Emini and Forex Trading Update:

Wednesday January 6, 2021

I will update again at the end of the day.

Pre-Open market analysis

Yesterday was a bull inside day after Monday was a huge outside down day. It is therefore an ioi buy signal bar for today (inside-outside-inside).

But, remember, Thursday and Monday were consecutive outside bars. That is an OO Breakout Mode pattern (outside-outside), which is a more important setup. Monday is therefore both a buy signal bar, and a sell signal bar.

Also, there is a Spike and Channel Bull Trend on the daily chart. Traders should expect a break below the bottom of the channel at some point in January, and then a test down to the start of the channel. That is the November 10 low at around 3500. Monday may be the start of a couple weeks down to 3500. We need to see follow-through selling over the next few days.

With both buy and sell signals, there is confusion. That typically results in some sideways trading. Traders might be waiting for the results of the Georgia elections, which will probably come by the end of the week.

It is important to understand that sometimes when a market triggers a higher time frame buy signal, it immediately reverses down sharply. That happened this week on the yearly, monthly, and weekly charts. However, when that happens, the market often resumes up and triggers the signal again before deciding if the signal will fail or succeed.

This might be happening with the Emini. Traders should know that there is a 50% chance that the Emini will go back above last year’s high, before there is a 2nd leg down. The odds still favor a move down to 3500 before the Emini goes much above last year’s high, if it does go above last year’s high.

Overnight Emini Globex trading

The Emini is down 11 points in the Globex session. Yesterday was an inside day. Today will open in the middle of yesterday’s range. Markets sometimes form consecutive inside days. Traders will therefore watch for reversals today on tests of yesterday’s high and low.

With the Emini in the middle of a 2-week trading range and with reversals every couple days, there is an increased chance of more trading range trading today. However, because it will probably begin to test down to 3500 this month, there is an increased chance of some bear trend days, like Monday.

That also increases the chance of bears being squeezed, which can lead to a series of strong bull trend days. Most likely, the Emini will have another quiet day. But, traders should be ready for several bear trend days coming at any time.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

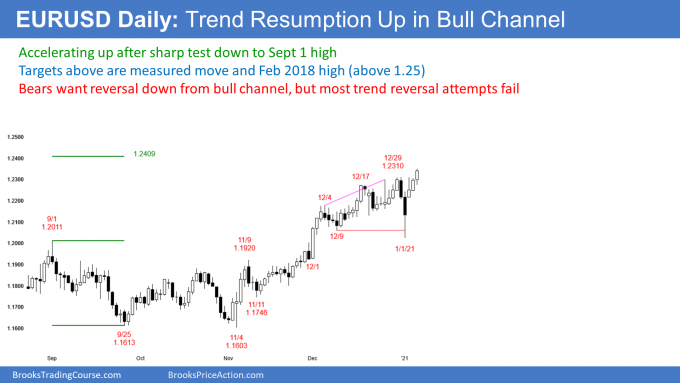

EURUSD Forex market trading strategies

The EURUSD Forex market on the daily chart has been rallying from the November low. It sold off sharply for 2 days last week, but reversed back up to a new high. This is a reminder that a bull channel can quickly become a bear trend at any time. However, the selloff turned out to be a breakout test of the September 1, and it became a bear trap.

It is important to note that trends constantly try to reverse, but most reversal attempts fail. Markets have inertia. That means they resist change and they tend to continue to do what they have been doing.

The next targets for the bulls are a measured move projection just above 1.24 and, more importantly, the February 2018 major lower high, just above 1.25.

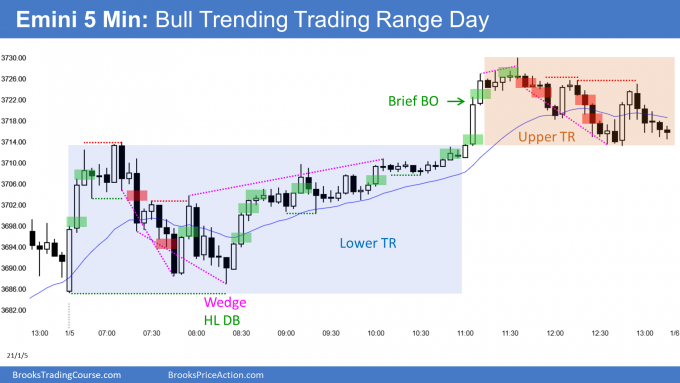

Overnight EURUSD Forex trading

The 5-minute chart of the EURUSD Forex market formed a trading range early in the session, rallied to a new high, and then has been sideways again for several hours. This is a Bull Trending Trading Range Day. While it is a bull trend, it is a weak bull trend because most of the trading is within trading ranges. Day traders are willing to sell for scalps, but because it is a bull trend, it is still easier to make money as a bull. There is a 25% chance that there will be a reversal down. More likely, it will stay sideways or go a little higher.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

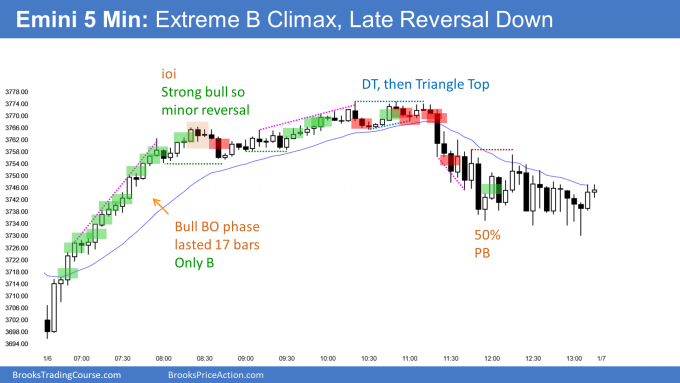

End of day summary

The Emini rallied in a buy climax to above last year’s high, again triggering the yearly buy signal. It also made a new all-time high. However, after a truncated wedge bull channel and triangle top, the Emini quickly sold off 50%. It closed just above the midpoint and above yesterday’s high, which is good for the bulls. But the big tail on top and the failure at the top of the 6-day tight range increase the chance of a reversal down beginning soon.

Remember, I said that Monday triggered a buy signal on the yearly chart by going above last year’s high. Last year was an outside up bar. I also said that when a higher time frame signal triggers, there is often an immediate reversal down, like on Monday. Finally, I mentioned that the Emini will rally back to trigger the buy signal a second time within a week or two. That happened today.

Today also triggered the OO buy signal on the daily chart. Traders will now decide if this is a double top with Monday’s high or the start of a new leg up. The 2nd leg up in a double top is often a buy climax, like the Emini had today. Traders expect a test of 3500. However, the Emini could rally a little more before the reversal down begins

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Emini – yearly time frame. Is there any additional explanation (technical or other) you can provide regarding why a higher time frame signal bar, when the signal is triggered, often results in an immediate reversal? Do these types of reversals under the same conditions (caused by the event on the higher time frame) result in similar substantial ranges like Monday’s range? Or the immediacy of the reversal is the point to emphasize?

Thank you very much for the time you take to teach and explain.

This happens with all markets on all time frames. Most buyers buy 1 tick above the signal bar. If there is not a lot of other buyers 2, 3, 4, 5 ticks higher, the market will immediately pullback in search of a price where buyers will buy again. If a buy signal bar is unusually big, the stop is far below. Many traders do not want that much risk. They wait for a pullback and then buy.

The pullback is usually proportional to the size of the bar and the time frame. It makes sense that the monthly (and the theoretically yearly) buyers are not going to buy again 2 ticks down, the way someone trading a 5 minute chart might do. I believe this accounts for the size of Monday’s selloff.

The Russell 2000 had the price action most like a buy climax today.