Trading Update: Monday February 7, 2022

Emini pre-open market analysis

Emini daily chart

- The Emini had a strong reversal up to the December low and the 4500 round number last week. However, once the market reached the two targets, the bull bodies became smaller. This is a sign of trading range price action, with the Emini January rally beginning to stall

- It is important to notice that the bears made money selling the January 26 bull breakout point. This is another sign of trading range price action.

- Last Friday formed a weak High 1 buy signal bar with a big tail. This further lowers the probability of the bulls and increases the odds of sellers above the bar.

- The bulls are hopeful this rally is strong enough to reach all-time highs, even if the market has to test the January lows first.

- The bears see this rally as a 50% pullback and are hoping for a 2nd leg down that breaks below the January lows.

- Last week, the four consecutive bull bars were strong enough that traders would expect at least a small second leg up. The second leg up does not have to go far and may test the February 2 high and stall. This would form a wedge top on January 26, February 4.

- At a minimum, the bears will need a credible top such as a micro double top before looking to sell for a swing down to the January lows.

- Currently, the probability for both the bulls and the bears is around 50%.

- Last week, the bulls had four consecutive bull bars; however, the market formed a week High 1 buy signal bar at resistance (December Low, 4500 round number).

- While the odds favor the 2nd leg down, the bears have the problem of 4 consecutive bull bars last week and no credible short.

- The market is also around the middle range from the December low to the January high. Since the market is in a trading range, this is a poor location to initiate long or short positions.

- When you look at the daily chart right now, you should be confused about which side is in control. Confusion is the hallmark of a trading range.

- One thing to mention that Al has said a few times: If Russia invades Ukraine, that would likely create a big move on the daily chart. However, since the Winter Olympics are going on, it is possible Russia waits until the end of the Olympics (February 20) before invading. This means the Emini might go sideways for the next two weeks.

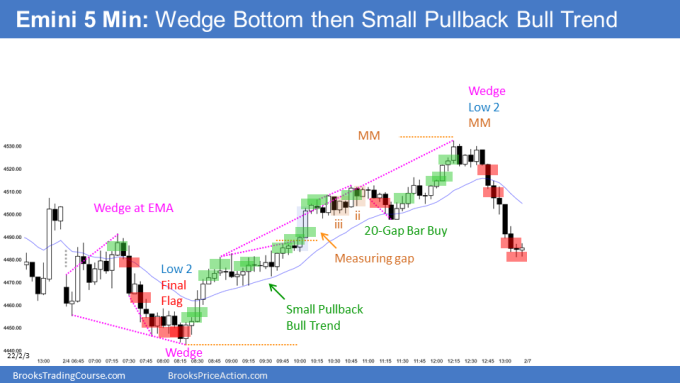

Emini 5-minute chart and what to expect today

- Emini is up 10 points in the overnight Globex session.

- The Emini has been mostly sideways during the Globex session.

- Traders will expect a trading range open, and most should wait for a credible stop entry setup or a strong breakout up or down.

- The selloff into Friday’s close was strong enough that there will probably be sellers above Friday’s high if the market gets above it.

- Last Friday is also a week High 1 buy setup increasing the odds of sellers above if the market gets to it.

Friday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

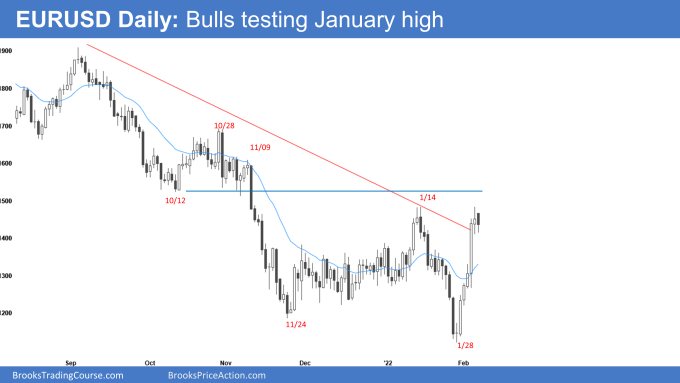

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The EURUSD had a strong breakout last Thursday, breaking above the top of the bear channel. This increased the odds that the market will reach the January 14 high, which it did on Friday.

- The market is always in long, and traders will expect a 2nd leg up following any pullback.

- January 14 was a major lower high for the bears. Since the bulls were above to get above it, this increases the odds that that market is now in a bull trend or a trading range.

- The bulls are hopeful this will be the start of the rally up to the October lows, the August 2021 lows, and ultimately the High of October 29.

- Traders will probably expect profit-taking today or tomorrow. The bulls have five consecutive bars on the daily chart, which is climactic, so the market will likely need to pause.

- The odds are there will be buyers below any pullback.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

- Today had a trading range open that rallied and a wedge top leading to the high for most of the day.

- The bears had a credible short at 7:40 (Bar 14), leading to a new low below bar 1.

- The first 2 hours of the day was a trading range, which increased the odds that any breakout would soon be followed by more trading range price action and a likely trending trading range day.

- The bears were disappointed by 9:40 (bar 38), and most bears gave up above the bar leading to a swing up for two hours.

- The bulls broke above 7:40 (bar 14) and quickly failed during 12:20 (Bar 68). Most bulls gave up here, and the bears got a sell the close market for the next up until 1:00 P.M.

- Today formed a bear trend bar that closed slightly below its midpoint. While this is a bear trend bar, most traders will see today’s close as more trading range price action on the daily chart than a trend bar.

- Tomorrow is a High 1 buy signal bar for the bulls, but the signal bar is a bear body, and it is in a 4 bar bear microchannel. This increases the odds of more sideways.

Al created the SP500 Emini charts.

End of day summary

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com on trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Will there be any spotlight on housing market price action?

Wondering why bar 55 wasn’t a credible short? It was after wedge 3 pushes up that have created DT with the previous leg where bears took control?

Bar 77 is a wedge. However, the minimum one should expect two ledges sideways to down after a wedge. In this case, the market went sideways for 5 bars.

Bar 77 is within a small pullback bull trend, and notice how the most significant pullback in the past 12 bars has only been 2 bars. This is a sign the channel is tight, so traders will be cautious of selling below anything that does not look strong.

77 follows a big bull bar, and bar 77 has a big tail.

Was the low of bar 77 not a stop entry as well? It had a large bear body closing near its low. Was the large tail above that broke the high of the prior bar enough to disqualify the stop sell? It was also extremely climactic.

Bar 77 is a wedge. However, the minimum one should expect two ledges sideways to down after a wedge. In this case, the market went sideways for 5 bars.

Bar 77 is within a small pullback bull trend, and notice how the most significant pullback in the past 12 bars has only been 2 bars. This is a sign the channel is tight, so traders will be cautious of selling below anything that does not look strong.

77 follows a big bull bar, and bar 77 has a big tail.

Ignore the other comment about bar 55*

There are a few problems with bar 77. The first is the time of day. There are only 20 minutes left in the day, so time works against you.

The other problem is the trader’s equation. It is late in the day, so you have to ask yourself what is your goal?

The minimum risk on the trade is 20 points, so ask yourself what is the probability you will make 20 points shorting below bar 77 before you lose 20 points is? (see trader’s equations videos about 40%-60% rule).

The odds are there is a around 40% chance you will make 20 points which is your risk selling below bar 77. Could it be closer to 50% sure, but either way, you will find that you will likely need to target two times your initial risk, and that is 40 points. It is not realistic to expect 40 points more to the downside before you get a bounce up into the close.

The bulls understand the math behind shorting below bar 77, so they will buy the low of the bar or, as it starts to turn up, understanding the poor math behind selling below 77.

77 is also a climactic bar, so profit-taking will occur, and traders will see it as a gift.

Could someone please check why the Emini charts are not expanding to full screen when you click on them for the past week. The EUR chart expands properly. Thanks.

Hi James,

I guess you are referring to EOD chart which Al adds to report several hours before I check. Al will sometimes forget to set the image to expand.

I check the post later in the day and fix if needed. But as I am in different time zone to Al, this it will be late evening US time.

Brad or Al,

I really like the dot point summary after the marked chart, the way it relates market mood at particular bars. It adds much to understanding the swings.

Graeme,

I will try to add more to the end-of-day summary if that helps. Glad to know it is helpful.