Emini at magnets of March open and low of last week

I will update again at the end of the day.

Pre-Open market analysis

As I wrote before yesterday’s open, yesterday was a bad sell signal bar on the daily chart. Although the Emini triggered the sell, it reversed up. The Emini is waiting for the final hour on Friday.

Friday is the last day of the week and this week is the entry bar in a good sell setup on the weekly chart. The bears want the week to close near its low. At a minimum, they want the candlestick to have a bear body and close below last week’s low.

Friday is also the last day of the month, and the Emini is near the open of the month. Traders want to see if the month will have a bull body. If it does not, then April will probably test the March low. That means a 100 point selloff over the next month.

Furthermore, 80% of years have at least a 2 month move up and a 2 month move down. Therefore, the selloff could last a couple of months before the bulls will buy again.

The past several days have oscillated around the open of the week, the open of the month, and last week’s low. These are clearly important prices. Therefore, the odds are that this trading range will continue again today. However, there is an increased chance of either a rally to the high of the week or a selloff to the low of the week starting today or tomorrow.

Overnight Emini Globex trading

The Emini is up 1 point in the Globex session. It therefore will probably open within yesterday’s 3 hour trading range. In addition, it increases the chance of trading range trading again today. However, most days over the past 2 weeks have had at least one swing up and one swing down.

There might be significant Brexit news tonight. That could result in a big gap up or down tomorrow and a big trend up or down tomorrow. The move would be especially important because it would affect both the weekly and monthly charts.

Yesterday’s setups

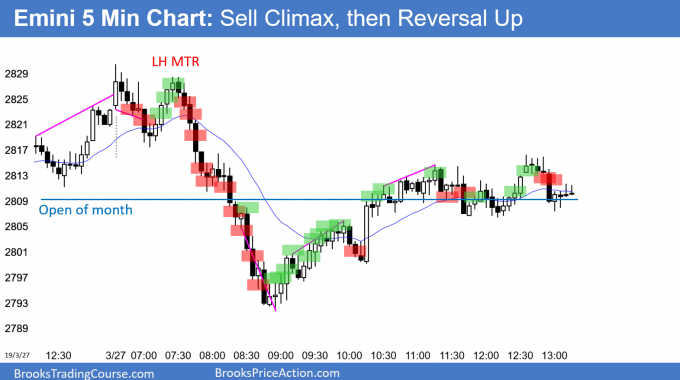

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

EURUSD Forex market trading strategies

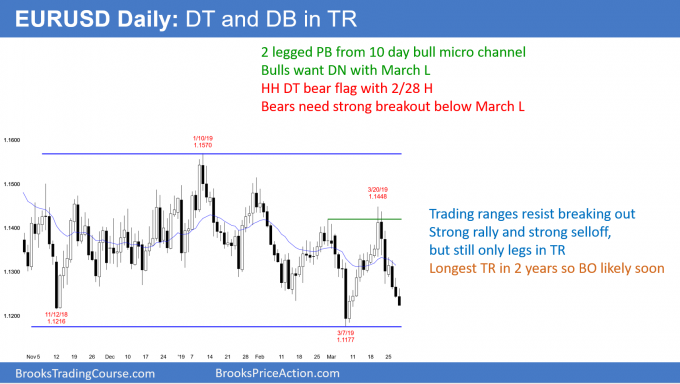

The EURUSD daily Forex chart sold off again overnight. It is now in its 7 day of a bear micro channel after a 10 day bull micro channel. The volatility is increasing, and this increases the chance of a breakout soon.

While the momentum down over the past 6 days favors the bears, there have been many strong legs up and down. Therefore, the probability is only slightly higher for the bears. They need consecutive closes below the range or one close far below the range to convince traders that the 4 month trading range has ended and a bear trend has begun.

How does a double top work?

The EURUSD had sold off strongly from its breakout above the February 28 high. There is a very important point about the strong rally to the March 20 high. It might be forming a possible double top with the February 28 high.

One of the reasons why a double top can lead to a strong bear trend is that there is often a very strong 2nd leg up. The March 20 rally was a 10 bar bull micro channel and it broke above the February 28 high. It qualifies as a strong rally. It therefore was likely to have a 2nd leg up after a pullback.

Because traders know that the probability favored a higher low this week, traders can find themselves trapped. For example, a bull who bought at any point during the 10 day rally theoretically has a stop below the March 7 low. Consequently, his risk is big and he is now trapped into a disappointing long trade. If the selloff drops below that low, he will sell out of his longs for a big loss.

Also, the bears know that a higher low has been likely. Many bears did not sell over the past 6 days. If the selloff breaks below that low, it would be an early sign of a possible strong bear trend. Those who are not short will be eager to sell.

Therefore, that strong rally will have trapped bulls into a bad long and trapped bears out of a good short. If there is a breakout, both will have an urgent need to sell. That heavy selling can lead to a fast and big move down. The first target is a 200 pip measured move, based on the height of the double top.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has sold off 40 pips overnight. While the selling this week has not been strong, it has been relentless. Day traders therefore are only scalping for 10 – 20 pips.

Because the selloff is now near the bottom of the 4 month range, there is an increased chance of either a strong bear breakout or a strong reversal up. The Brexit news is becoming increasingly important, and an announcement can come very soon that will lead to a trend up or down.

It might come out sometime early Friday morning during the European session. Once it comes out, day traders will probably have many days with big swing trades. Until the intraday ranges increase, day traders will continue to scalp.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

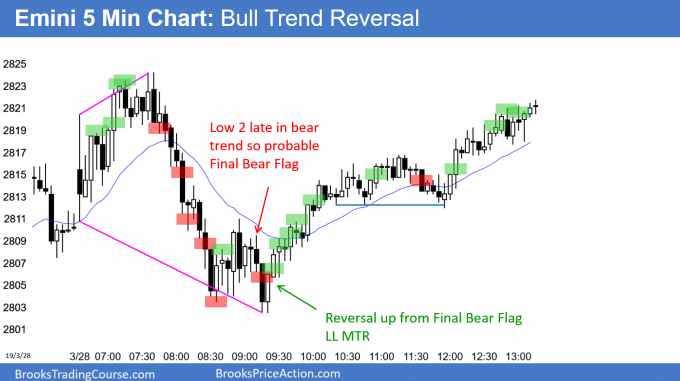

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

End of day summary

The Emini formed an inside day today. It is neutral going into tomorrow, which is the last day of the week and month. If the month closes around the open, it would increase the chance of a test of the March low. That low is about 100 points down.

This week is the entry bar for the bears on the weekly chart. The bulls instead want it to become a High 1 bull flag for next week. They therefore will try to get the week to close near its high.

There are several weekly and monthly magnets nearby. Each will be a magnet tomorrow, especially in the final hour.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

For anyone trading EURUSD – feel free to join the chat group at the following link, we are posting charts and trying to help each other.

https://join.slack.com/t/brookspriceaction/shared_invite/enQtNDYwNzI4MDAwNzIyLTRlY2JkZjM2MWI2NDAyMDdmYTYxNWU4NDg5ZDZiNjQzNDdkOTVlZjczYjExZjNkYjNhNzliNDhiYzM2YmY5Yjk