Emini and Forex Trading Update:

Wednesday June 26, 2019

I will update again at the end of the day.

Pre-Open market analysis

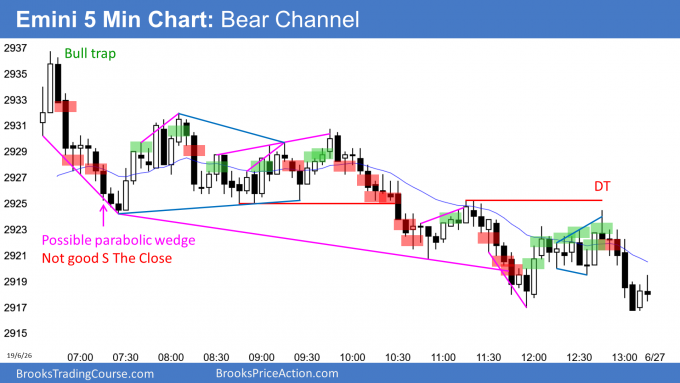

Yesterday was a Bear Trend From The Open day. It was also a bear channel. A bear channel typically has a bull breakout. Consequently, there is a 75% chance of at least a couple hours of sideways to up trading at some point today.

The 3 day selloff did not have a lot of panic selling. For example, despite yesterday’s bear trend, bulls could make money all day buying new lows. It is therefore more likely going to be a pullback than the start of a bear trend. However, the tight trading range below 2900 from 2 weeks ago is a potential Final Bull Flag. Traders know that this 3 day pullback might test it over the next week.

Overnight Emini Globex trading

The Emini is up 10 points in the Globex session. It will therefore probably gap above yesterday’s bear trend line. A breakout above a bear channel usually leads to a trading range. The top of the range is often around the start of the channel. That is the top of the 1st lower high yesterday around 2945.

The bears would like a continuation of the 3 day pullback. But traders know that a pullback in an strong trend usually ends after a few days. Since this selloff is more likely a pullback than the start of a bear trend, today will probably not be a strong bear trend day.

Although the bulls want a bull trend day, Friday’s Big Up and yesterday’s Big Down create Big Confusion. That usually results in a trading range. Traders expect at least one swing up and one swing down today.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

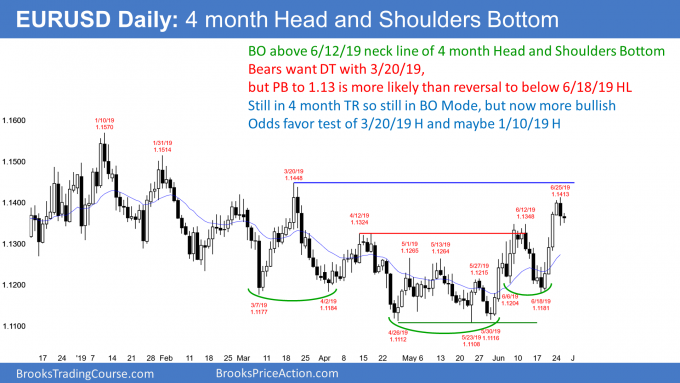

EURUSD Forex market trading strategies

The EURUSD daily Forex chart has been sideways for 3 days after breaking above the April/June double top. That is the neck line of a 4 month head and shoulders bottom.

There is room to the March major lower high above. Since that is an important magnet and it is nearby, the rally probably cannot escape its magnetic pull. Consequently, the odds favor higher prices within 2 weeks. This is true even if yesterday’s pullback continues down to below 1.13 and the neck line of the head and shoulders bottom.

The bears need a surprising strong reversal down to make traders believe that the rally is turning down from a double top with the March high. A pullback and another leg up are more likely.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has been in a 25 pip range overnight. Furthermore, it is within yesterday’s range. If today remains an inside day and closes above its midpoint, it will be a buy signal bar for tomorrow. It would be stronger if today closes near its high. The bulls will therefore buy selloffs to try to get a bull body on the daily chart.

An inside day can also be a sell signal bar for a failed breakout on the daily chart. Consequently, the bears will sell rallies to try to get today to close near its low. However, even if they are successful, traders believe that a pullback will only last a few days. There will probably be strong buyers around 1.13.

Traders expect that the overnight trading range will continue all day. Both the bulls and bears will look for 10 pip scalps from reversals.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

End of day summary

The Emini gapped above yesterday’s bear channel, but then sold off in a Bear Trending Trading Range Day. Today was the 4th consecutive bear on the daily chart and it closed on its low. The 20 day EMA is a magnet below, as is the tight trading range just below 2900. Since the past 2 days have big bear bodies and closed on their lows, the momentum down is strong. The Emini should test below 2900 this week.

It is important to realize that this weekend’s China trade talks could lead to a big move up or down. In addition, that move can even happen this week before the talks begin.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

Would you consider selling below 72 as a double top at the ema with a big bear body closing on its low? I did, got out above 73 and sold again beneath 75.

Thanks

I did sell below 72 and immediately realized that I sold at the bottom of a TTR (67-72) which is a low PRB trade though 72 is a good bear. I usually will cut after 73 bad FT, but today, I was thinking the price will have to break out the bear channel line and reclaim the H of 56 – closing above it to persuade me the bulls are taking over. Also, I noticed the MM height of that TTR is about the same price of H of 56, so I risked more to move my stop above H of 56 and eventually made out. I am not sure if I was managing this trade correctly. How do you think, Al?

and honestly, I do not think by managing this trade like what I mentioned is a good RRR trade. I risked about 6 points to avoid a loss only……I did not add of course..and basically, BE out…..

Thanks for your response, glad to know I wasn’t alone! I agree with pretty much everything you did and if it were another day, I might’ve done the same. The only thing I might’ve done differently is to add on higher, either closer to the channel trend line, or below 75. In my opinion, selling below 72 was reasonable so I expected the prices to at least reach that price again, especially considering the bear trending trading range day.

I think one reason Al might not have placed a stop below 72 is because there was a fairly strong push up with bars 64-66 I believe. Even though it was a bear trend day, it was a strong enough push that I felt another push was likely. This made 72 feel like a trap to me.

I talked about that in the chat room today. I said that it was a double top bear flag at the EMA in a bear trend, but I would not sell it. My thought was that 66 67 was strong enough to have a clear 2nd leg up, and the 72 high was probably not enough.

I further made the point that there were 6 sideways bars in a tight trading range. In general, selling at the bottom or buying at the top, like above 71, is a low probability bet. Most tight trading range breakouts fail, and I said that there would probably be more buyers than sellers below 72, especially since a clearer and bigger 2nd leg up was likely after the wedge bottom at the Leg 1= Leg 2 measured move and the measured move based on the 11 19 trading range.

Finally, I said that big signal bars mean the stop is far away, which means that the risk is big. If the risk is big and the probability is low for a stop entry, there would likely be more limit orders to buy the 72 low than stop orders to sell below it.

Al, Thank you so much for responding. You’ve been encouraging us all the way.

Yes Al, thank you. I’ve learned so much from you over the last 10 years and you’ve changed my life.