Emini and Forex Trading Update:

Thursday April 30, 2020

I will update again at the end of the day.

Pre-Open market analysis

I have been saying that the Emini probably had to test the weekly EMA before there would be a 2 – 3 week pullback. The 7 week bull micro channel is extreme and it is coming after a big bear trend. There is now a wedge rally on the 60 minute chart nested within the wedge rally on the daily chart. But, there is no reversal yet.

Traders should expect the rally to be just another leg in the 2 1/2 year trading range. That means there should soon be a bear leg. The context is good for the bear leg to begin within the next few weeks.

I said over the weekend that this week might rally and then reverse. That would create a doji bar on the weekly chart. A doji bar is common after a High 1 where the buy signal bar was also a doji. This increases the chance of a reversal down this week or next. However, there is no sign of a reversal at the moment. Furthermore, the open of the week is probably too far below for a selloff today to get there.

The bull channel has been tight. This is a strong bull trend. It will probably reach the March 3 lower high at some point this year. Traders currently think that there will be a pullback before the bulls get their target.

April erased the March crash

Today is the last day of April. April is currently a big bull bar on the monthly chart. Yesterday got back to the February close. April therefore totally erased March’s collapse.

The bulls would like the month to close on its high. It would then be a good buy signal bar for May. It would increase the chance of higher prices in May. That February close could be a magnet today, especially in the final hour.

However, April follows 2 big bear bars on the monthly chart. Therefore, there will probably be sellers above the April high and below the all-time high of February. The 2 1/2 year trading range will probably continue for the rest of the year.

Overnight Emini Globex trading

The Emini is down 13 points in the Globex session. Yesterday was sideways for 4 hours and today will open within that range. That increases the chance of more trading range price action today.

The most important price for today is the February close. It could be a magnet all day. If the Emini is within 20 points of it in the last hour, it might get drawn to it.

The Emini on the monthly chart currently has a big bull bar closing on its high. Most bars on the monthly chart have at least noticeable tails on top and bottom. That increases the chance that today will close at least 20 points below the high of the month.

The high currently is yesterday’s high. Today could make a new high. But even if it does, there is an increased chance of a late selloff and the month closing 20 or more points below the high.

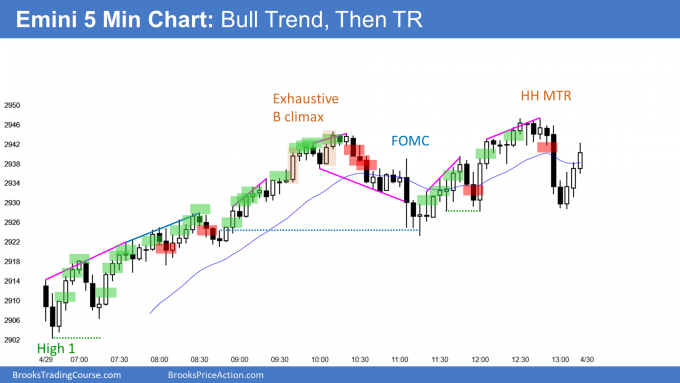

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

The EURUSD Forex market on the daily chart has been in a tight trading range for 2 weeks. That range is within a month-long range, which is nested in an 8 month trading range.

It has been in Breakout Mode for several weeks. There have been small breakouts and reversals, but no big or sustained move up or down.

Traders believe that there is currently a 50% chance that the breakout will test the March 27 high and a 50% chance of a move to below the March 23 low. Traders are waiting for the breakout.

Overnight EURUSD Forex trading

The 5 minute chart of the EURUSD Forex market has been sideways for 4 days. Day traders have been scalping.

Yesterday was a bull day closing near its high. It was an inside bar after last week’s reversal up. Even though it is a buy signal bar, there were more sellers than buyers above its high overnight.

The EURUSD has been in a 30 pip range for 6 hours. Day traders have been looking for 10 pip scalps as they wait for a strong breakout in either direction.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

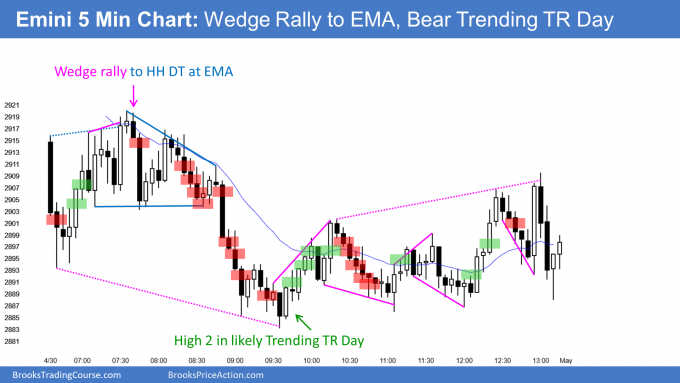

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

After a gap down, there was a trading range open. A brief bear breakout led to a lower trading range. Today was a Bear Trending Trading Range Day.

Today was also the end of the month. April was a big bull inside bar in a 12 year bull trend. It is therefore a High 1 bull flag buy signal bar for May.

May might have to get above the April high to see what’s there. That would trigger the buy signal, but it comes after 2 huge bear bars on the monthly chart. There probably will be more sellers than buyers above its high. Traders expect the 2 1/2 year trading range to continue all year.

There is a nested wedge on the 60 minute and daily charts. However, about half of wedges in strong trends have at least a small new high before there is a reversal down.

A new high above the daily wedge would trigger the monthly buy signal. But, traders expect a 2 – 3 week pullback to begin within a couple weeks. As strong as the rally has been, there is probably not much left to it.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Hi Al,

I sold at bar 18 close, think it’s a good sell signal bar below EMA20 for a PB S, with bar 14 and bar 15 are 2 cc bear bars closed at Low, I think it will go lower. But next bar (8PST bar) immediately strongly against me and I was stopped out.

Can you explain the price action for bar 19?

Thanks.

Hi Zhao, I know I’m not Al (nor am I as experienced as him) and I believe he is taking Tuesday and Thursday off this week (so not sure if he will reply). For what it’s worth, to the sell the close of 18 was a bit aggressive as the sell below 18 never triggered which signaled that the bulls were strong enough to not allow that to happen. Your thought process was correct of the market going lower after the bear spike however the correct stop would have been above the high of the day. Bar 19 was simply a vacuum test of the sell below 14 (running the breakeven stops, the market is very efficient). As you can see bar 19 buy stop was never triggered and the better sell was the 2nd entry inside bar below 21 (as Al has pointed out). I too used to get eager and liked to sell the close but so many times the market never triggers the stop order which shows strength in the opposing direction. Al has said to me in the past that there is an old adage in trading “if you’re early you’re wrong” and this took me years to understand but you’re not alone in your thought process. Just my 2 cents, hope if can be of some help.

Hi James,

It’s so true that it take years to understand PA. I still make mistakes everyday.

Very appreciated for your thoughts.

Hi Jin, just wanted to add my perspective to the already great response from James. For me, bar 17 was the trigger of a high 1 buy signal for the bulls and it closed a bull bar. If I’m bearish I’m waiting for at least a low 1 sell signal which didn’t trigger until bar 22. At the time it happened it ended up coming after several factors that made it more attractive such as an ii, the moving average, and re-load sellers coming in right at the first sell signal before the bar 15 bear surprise bar. If you look for it you’ll see that a lot of times pullbacks go all the way to the first signal of the first leg and then bounce

Hi Corey, thanks for the kind response. That makes a lot of sense. The PB after 1st leg down from top usually is very strong. I should be patiently waiting for a good setup as you and James described, bar 22.

Great analysis from y`all, thanks! Quite helpful! Seems some students might become better than the master one day lol 🙂

I think there was an interesting battle today to win the close above or below the Monthly EMA. At ETH chart the EMA were at 2889,50.

Hi Al,

I’m just curious, what are your thoughts about Tesla’s price action?

Thanks

The stock obviously has had exceptionally big swings. That means traders are not close to being certain what the price should be. Most traders cannot trade it because the big swings mean wide stops and too much risk. It is better to watch it for entertainment value than to trade it.

Thanks