Emini and Forex Trading Update:

Tuesday October 8, 2019

I will update again at the end of the day.

Pre-Open market analysis

After 2 buy climax days, yesterday was likely to have a lot of trading range price action. The Emini rallied for a few hours and then reversed down below the open. Yesterday is therefore a sell signal bar for today. But after last week’s 2 strong bull days, there will probably be more buyers than sellers below yesterday’s low.

The Emini oscillated around the August ledge top today. That means it is still important. It might oscillate more around it for a few days. However, the odds favor at least a small 2nd leg up after last week’s bear trap and strong reversal up.

Overnight Emini Globex trading

The Emini is down 18 points in the Globex session. Today will probably gap down. Since Friday gapped up, there would then be a 2 day island top after last week’s 2 day island bottom. Island tops and bottoms are minor reversal patterns. This is especially true when they come in the middle of a trading range, like the one on the daily chart.

With all of the trading range price action on the daily chart, day traders expect continued trading range price action on the 5 minute chart. That means that there will likely be at least one swing up and one swing down today. Also, there is an increased chance of several swings and a trading range day.

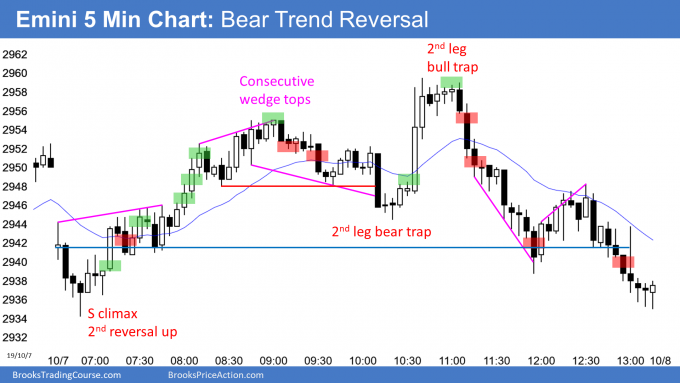

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

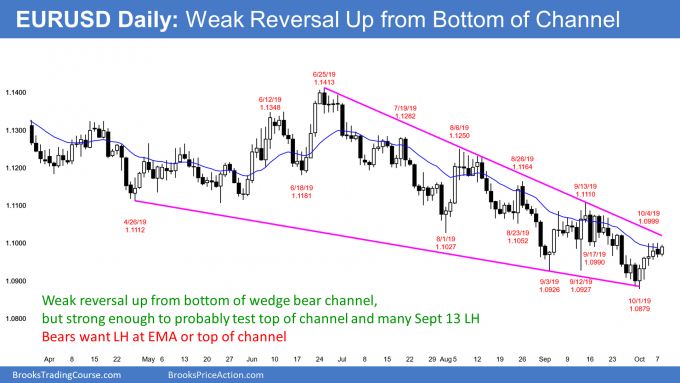

EURUSD Forex market trading strategies

The EURUSD daily Forex chart has reversed up for 6 days from the bottom of a wedge bear channel. The rally so far lacks consecutive big bull bars closing near their highs. Consequently, the reversal is weak.

The EURUSD is now testing the 20 day EMA. The bears expect the rally to be like all of the other rallies over the past 2 years and form a lower high and then lead to a new low.

While they are probably right, there is no top yet. Furthermore, the prior lower highs are magnets above. Also, sometimes a 200 – 300 pip rally begins slowly like this and suddenly accelerates up.

Finally, the rally is so close to the top of the channel that the EURUSD will probably get there. It can get there by going sideways or up. The next resistance is the September 13 lower high, which is only about 100 pips above. It is therefore within reach.

Unless the bears get a strong sell signal bar or a big reversal down, the odds favor at least a test of the top of the bear channel. But even if the rally continues up to the September or August highs, traders expect the pattern of lower highs and lows to continue.

Overnight EURUSD Forex trading

The EURUSD 5 minute chart has been in a 50 pip range for 4 days. Day traders are therefore looking for small reversals and scalping for 10 pips.

There is no sign that this is about to end. But 4 days is a long time for a tight trading range. Consequently, traders expect a breakout this week.

The bars on the daily chart are small and have prominent tails. Also, there have been many reversals over the past month. Therefore, a breakout on the 5 minute chart will probably not get very far. Until there is a strong breakout up or down, day traders will continue to scalp.

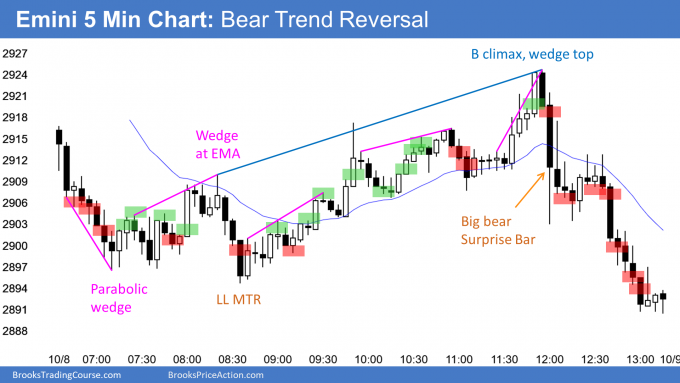

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

End of day summary

The Emini gapped down and created a 2 day island top. After a reversal up to a new high today, the Emini reversed down to a new low. It closed on its low, erasing much of last week’s rally.

The bulls need a reversal up and a buy signal bar tomorrow. If not, then the 2 day rally will have been simply a pullback from last week’s selloff.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

I find myself missing trades during some very reasonable setups because the market moves too quickly for me to place a trade. I’m usually waiting for the bar to close, then calculating my share size to make sure I’m risking the same on every trade and by that time it’s already gone. It comes back sometimes and takes me in but it’s a bummer to miss good setups than never pullback.

I know you recommend just hitting market orders to just get in it but I was wondering what your thoughts are about getting in the bar around the 10 second mark before it closes. For example if it’s a good buy signal bar, it won’t change much within the last 5-10 seconds so I’m getting in early anticipating the move in my direction.

Do think this is reasonable to not miss trades when the setups have a positive traders equation?

Thanks

I never worry about being perfect. It is more important to be reasonable and consistent.

Lots of bars dramatically change their appearance in the final few seconds. In general, I think most traders should enter with stops. Using a bull trend as an example, when a new bull trend is strong, buying at the market at the close of the bar or with a stop 1 tick above the high of the bar is a good choice. If the trend is very strong, buying at the market and using the appropriate stop is good.

I agree that deciding on position size at the time of placing a trade makes traders miss many trades. Most profitable traders do not trade that way. Instead, they have a default position size and a default stop. They trade small enough so that they will not be upset if a wide stop is hit.

It is better to just have a default size and not worry about finding the perfect size in the minutes before every entry. If the recent 10 bars are twice as big as normal, trade half size. If they are half of the normal size, I would recommend trading the default size and look to add on as the trade goes your way.

What happens if you miss the exact entry? No problem. If you think the market is always in long and you see where a reasonable protective stop is, use that stop and just buy the close of a bar, buy with a stop above any bull bar closing near its high, buy a small position at the market, or buy with a limit order below the low of the last bar. If you want to buy 5 – 10 seconds before the close, that is reasonable as well. The key is to rely on an appropriate stop, get long for any reason, and trade small. That includes buying at the market at any time.