Emini and Forex Trading Update:

Tuesday September 17, 2019

I will update again at the end of the day.

Pre-Open market analysis

Yesterday triggered a sell signal on the daily chart by going below Friday’s low. There has been a wedge rally over the past 3 weeks. The bears also hope for a reversal down from a double top with the July all-time high.

But the wedge bull channel was tight. Therefore this reversal down will probably be minor. Also, yesterday was a bull day. It is therefore a High 1 buy signal bar for today.

The big tail on top make it a weak buy setup. Also, a reversal from a wedge rally typically has at least a small 2nd leg sideways to down. Consequently, there will probably be more to this pullback. The ledge top around 2940 is a magnet below.

It is important to remember that tomorrow’s 11 am PST FOMC announcement will overwhelm everything else. This is true for at least for the final 2 hours of tomorrow.

After the report, traders should be open to anything. There will be an increased chance of a big move up or down for those final 2 hours.

Many traders will be unwilling to hold positions ahead of that announcement. Consequently, the Emini might stay mostly sideways today and early tomorrow into the report.

Overnight Emini Globex trading

The Emini is down 6 points in the Globex session. It is struggling to hold above 3,000. Also, the wedge top on the daily chart increases the chance of lower prices over the next week. Since most of the days over the past 2 weeks had swings up and down, today will probably continue that trading range price action.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

EURUSD Forex market trading strategies

The EURUSD daily Forex chart reversed up from a double bottom this week. It then reversed down from a double top bear flag at the EMA yesterday. It is in the middle of the 3 week range and it is therefore in Breakout Mode. Traders are probably waiting for tomorrow’s 11 am PST FOMC announcement to decide on the direction of the breakout.

If today closes near its high, today will be a buy signal bar for tomorrow. The 2 day selloff would then be a pullback from the reversal up from the double bottom. This would then be a double bottom pullback buy signal. The odds would shift in favor of a breakout above the double top and a likely rally up to the August 26 high over the next few weeks.

Since the bears know this, they will try to prevent today from closing near its high. If they are able to close today near the low, today would be a follow-through bar after yesterday’s strong reversal down. Today would then increase the chance of a break below the September double bottom within the next week.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart traded slightly below yesterday’s low and then reversed up. This means that the bears were unwilling to sell at the low. In addition, it is a sign that the bulls see yesterday as a test down after a double bottom.

Neither the bulls nor the bears need a big day today. Tomorrow’s FOMC report is another reason why today will likely be small and sideways. Markets typically become neutral ahead of major catalysts.

Both the bulls and the bears are very interested in today’s close. The bulls will buy 20 pip selloffs and try to get the day to close near its high. However, the bears will sell rallies to near the high of the day. At a minimum, they want the day to have a bear body on the daily chart. That would require today to close near its low.

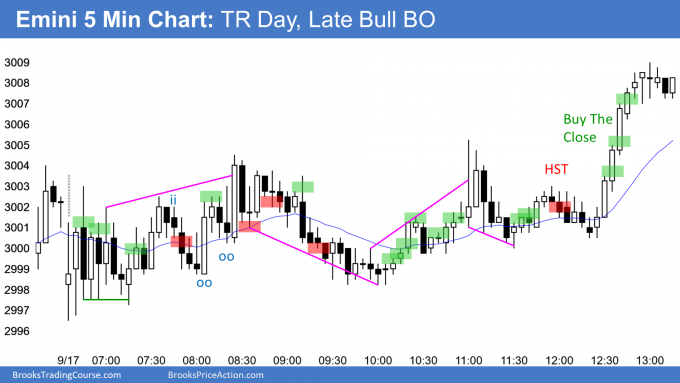

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

End of day summary

The Emini was in another small trading range day today until the final hour. There was a Buy The Close rally at the end of the day. It triggered the High 1 bull flag buy signal on the daily chart.

Traders are waiting for tomorrow’s 11 am PST September FOMC interest rate announcement. They will then decide whether the rally will continue up to a new all-time high or first pull back to below the 2940 ledge top.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al,

On such an overlapping trading range open, why would a stop buy above 4 be reasonable but below 7 not a sell? For me I was only thinking limit order market at the time and not stop order in any direction.

Thank you,

Josh

The first two bars made the market AIL making a buy above 2 or 4 reasonable. It was still AIL on bar 7 which was also selling at the bottom of a TTR and thus a bad trade. The first stop sale marked on the chart was an ii setup close to the top of the TTR and a L2 from the bar 3 & 9 DB.

Thanks for the feedback…my question wasn’t worded very clearly. My main intent was to address the trading range from bars 1-4 and the previous day, not the stop sell below 7. The entire previous day was a trading range between 2993.25 and 3005, and even more so, the final 2 hours was a trading range with a high at 3003. With the previous day’s and current day’s low not far below, plus all the tails and bar 3 a huge bear bar closing near its low (hallmark trading range confusion), I saw buying a stop above bar 4 @ 3001 as buying in the upper half of a trading range. The AIL point makes sense but still, I would’ve thought limit order only.

Reasonable is just that, not “good”. Taking the trade above 2 or 4 was betting on a breakout of the TR. The best action was to wait for the breakout with follow through and buy then.

Hi Joshua,

On previous day, market created Expanding Triangle after previous day’s Bar 60, so the Micro Double Bottom (Bar 1 and Bar 2) is a test of ET bottom (Al mentions this in his report on BrooksPriceAction.com). So when Bar 2 (or Bar 4) created (nested) MDBs, they were also setups for reversal from failed breakout below ET bottom.

Considering bulls made higher lows with Bar 1, Bar 2 and Bar 4, it seems that bulls intend to keep price above the low of Bar 1. So if bulls are strong enough Bar 1 might possibly be Low Of the Day. And if the low of Bar 1 stays LOD, you can expect enough reward that compensates for low probability of success.

I think buy above Bar 2 (or Bar 4) is worth taking if a trader plans to catch one of major swings of the day.