Emini strong August close likely today

I will update again at the end of the day.

Pre-Open market analysis

Today is the last day of the week and of the month. The bulls want both to close on the high. That would increase the chance of higher prices next week and next month.

The bears are unlikely to get a big enough selloff today to create a big bear bar on either chart. However, this week’s low is close enough for the bears to have a chance of creating at least a small bear body. When the monthly candlestick closes today, it will probably be a bull trend bar closing above its midpoint. That would be a reasonably strong bull bar on the monthly chart.

The bulls have already accomplished their goal of creating a good bull bar on both charts. They therefore do not need a big bull day today. Their minimum goal is a close above the January high of 2884.00. With yesterday’s late selloff, the bears have 40% chance of a close below the January high today.

Yesterday’s late selloff was strong. Therefore, if the Emini is within 5 points of that price in the final hour, there will probably be a test down to that level by the end of the day. Less likely, the week will close on its low and be a good sell signal bar for next week.

A gap down on any day over the next week will create an island top. If the gap stays open for a few days, it could lead to several weeks of lower prices.

Overnight Emini Globex trading

The Emini is down 7 points in the Globex market. Today might therefore gap down, which would create a 4 day island top. However, a small gap usually closes in the 1st hour. Also, there is support below at the January high and the top of the gap at Friday’s high. This selloff will more likely be a test of those breakout points than the start of a bear trend reversal.

The January high is the most important price today. If the Emini is within about 5 points of it after 11 a.m. PST today, it will probably get drawn to it. Traders should look for that reversal trade at the end of the day.

Since it is such an important price, the Emini might selloff early today to test it. If so, it might then enter a trading range around it for the rest of the day.

Can today be a huge bear trend day and begin a bear trend that can last for months? Any reversal down from important resistance can lead to a huge bear trend. However, the odds are always against a major trend reversal. Most trend reversal attempts fail. Traders want to see a series of big bear days before they will conclude that a bear trend is underway. But, if today starts to selloff strongly on the open, day traders will swing trade their shorts.

Most days are mostly trading range days, and the past week has been like that. Therefore, today will again probably be mostly sideways. However, yesterday’s huge reversal down was extremely unusual. It therefore increases the chance of several days of sideways to down trading.

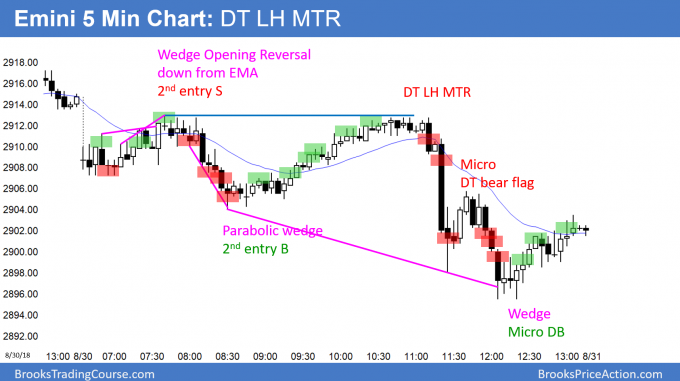

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not in a position at the moment, these entries would be logical times for him to enter.

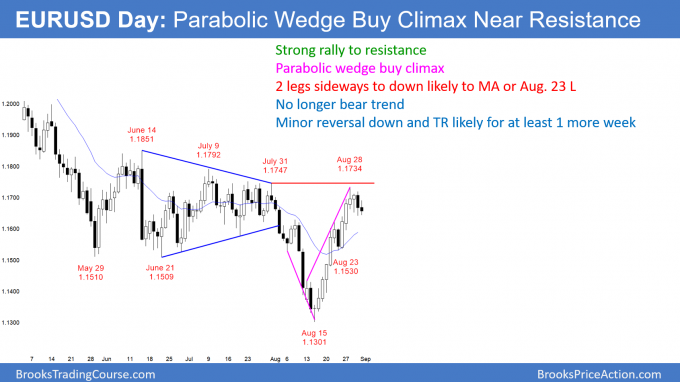

EURUSD Forex trading range after parabolic wedge buy climax

Today is the 4th sideways day after a parabolic wedge buy climax. The rally is a bull trend reversal and a buy vacuum test of resistance at the top of the 4 month trading range.

The EURUSD daily Forex chart rallied for 3 weeks in a parabolic wedge buy climax. While the rally is a bull trend reversal, it is also a buy vacuum test of resistance. A buy climax to resistance usually makes bulls take at least partial profits. This stops the rally and often leads to a pullback. The sideways to down move typically has at least a couple legs and often lasts about 10 bars. Therefore, the daily chart will probably be mostly sideways for at least another week.

The bulls might get one more small leg up to around 1.1750 and the July 31 high before there are a couple legs sideways to down. However, the rally stalled in the middle of a 4 month trading range. That is a sign that traders still believe that the trading range is the appropriate price.

Can the chart reverse back down from a lower high and continue a broad bear channel on the daily chart? Probably not because the reversal up was surprisingly strong and the weekly chart is still in a bull trend.

Can the 3 day pullback form a High 2 bull flag and lead to a strong breakout above the range over the next week? That, too, is unlikely. A parabolic buy climax reversal is usually an attempt to fix a price that was clearly too low. The price is now back to what has been normal for 4 months. Traders will probably need to trade in this range for at least a couple of weeks before they can conclude that the price is still too low.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart sold off about 50 pips overnight after yesterday’s outside down day. Since the daily chart is now probably in a tight range, day traders will look to buy reversals up from below the prior day’s low and sell reversals down from the prior day’s high. Support is at the 20 day EMA and the August 23 pullback low.

That means that the pullback will probably continue down to around 1.1550 over the next week. Day traders will sell rallies and bulls buy new lows on the 5 minute and daily charts, looking for 10 – 30 pip scalps. Some legs might last 4 or more hours, but day traders will probably have a hard time making more than 30 pips on a trade over the next week.

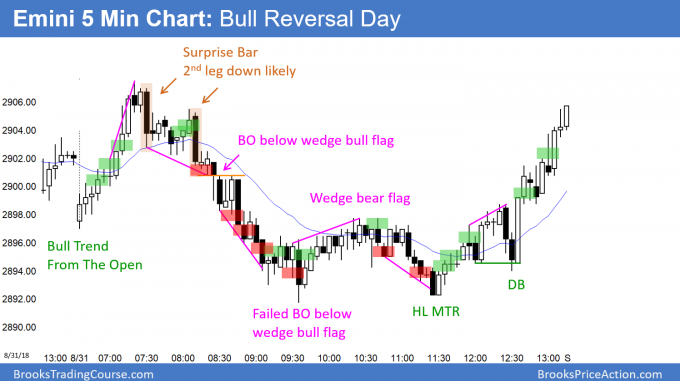

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I sometimes also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not in a position at the moment, these entries would be logical times for him to enter.

After a strong rally on the open, the Emini reversed down in an endless pullback to a new low of the day. However, the bulls then got a bull trend reversal. The week and month closed above the January high, which is good for the bulls. The odds favor higher prices.

There is a 6 week micro wedge on the weekly chart. Since this week was a bull bar that closed above the middle of its range, it is a bad sell signal for next week. Also, the weekly bull channel is tight. Therefore, any reversal down will probably be minor and last only 1 – 3 weeks.

However, a gap down on Tuesday (Monday is a holiday) would create a 1 bar island top on the weekly chart. That would increase the chance of a swing down to the bottom of the channel on the daily chart at around 2850.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

If you look carefully at a lot of Emini charts, you will conclude that lots of traders and computers take profits at 1, 2, 3, 4, and 10 points. A 1 point stop is too small, and about 2 points can be good. If a swing trader wants 2x risk, he exits at 4 points.

If you study a lot of charts, you will see that 90% of the days have a 4 point swing trade, with a good signal bar for a stop entry, beginning in the 60 – 90 minutes. It usually stalls or stops at 17 or 18 ticks, which means 4 points for a stop entry trader. I could write much more about this, but most traders will have their best chance of being consistently profitable if they take profits at 4 points or more.

Thanks for answering my question after the close (8/31). In your reply you gave me several possible swings based on today’s action, and you recommended a 4 point profit taking limit order. Why 4 points? Was it a function of average daily range or that 4 points is generally a good target for a swing? I am also assuming that your would recommend closing the prior to the 4 point limit order if price action indicates a possible trend reversal, like below a bear bar closing near its low? Thanks for you help.