Trading Update: Thursday August 26, 2021

Emini pre-open market analysis

Emini daily chart

- Emini poked above top of bull channel drawn from May 7 high on daily chart (not shown), but closed below.

- It also got to within a couple points of, and thus testing 4500 Big Round Number.

- Probably will try again today to close above both levels. When a market gets near important resistance, it usually tests it at least twice before the bulls will give up and the market reverses.

- Bulls want big breakout above, and then an even stronger bull trend. That happens 25% of the time, and it happens because traders who have been selling for the past 20 – 30 bars (days) finally give up.

- 75% of the time, a breakout above the top of a bull channel fails by about the 5th bar. However, those 5 bars can still be still very big, and therefore there is a reasonable chance of a sharp rally over the next week.

- If the bears get a reversal down within a week, it will be from a higher high major trend reversal and from an expanding triangle that began with the July 26 high.

- Even though strong rally for 5 days, each day has had at least a couple hours in a trading range. Traders will expect at least some trading range trading today, whether or not there is a bull or bear trend.

Monthly chart

- The bears want a reversal down into the end of the month because they would like a bear bar on the monthly chart. The open of the month is about 100 points down and there are only 4 trading days left in August. At the moment, a bear close is not likely, but surprisingly big moves are more common at the end of a month.

- Not only do the bears want a bear bar on the monthly chart, they want it to have a big bear body. That means they want the month to close 50 or more points below the open, which is even less likely.

- August will probably be the 7th consecutive month with a bull body on the monthly chart. That has only happened twice before in the 25-year history of the Emini.

- If it does, then September should be a bear bar because there has never been a streak of 8 consecutive bull bars in the 25-year history of the Emini. Every streak eventually gets broken, but since that happens rarely, it is more likely that September will be a bear bar.

Emini 5-minute chart and what to expect today

- Emini is down 5 points in the overnight Globex session.

- After 5 days without a pullback, there will probably be a pullback within the next few days. A pullback is a day with a high below the high of the prior day.

- Most recent days were bull bars on the daily chart, but had a lot of trading range trading on the 5-minute chart. Traders should expect at least a couple hours of sideways to down trading at some point today.

- With only 4 trading days left in August and with the Emini overbought and at the top of its bull channel, traders should be ready for a surprisingly big move up or down before the end of the month. Will it happen? I said “surprisingly.” If it was likely, it would not be a surprise, but be ready just in case. A big day can go much further than what seems reasonable in the middle of the day.

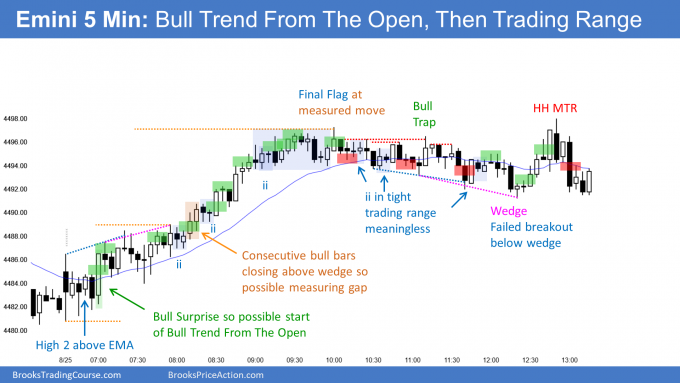

Yesterday’s Emini setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- Yesterday was outside up day that closed above Tuesday’s high, but small body and lower high in bear channel that began on June 25..

- Yesterday was 4th consecutive bull day.

- I said last week that this week should rally and that it could be the end of the 4-month bear trend.

- Traders are deciding if the low is in for the next month or two, or if the rally will form a double top with the August 13 high. If the EURUSD turns down from here, it would be a lower high double top with the August 13 high, and be another lower high in the bear channel.

- The more bull bars closing near their highs, the more likely the Emini will work up to the July 30 high and maybe the June 25 high over the next month.

- If the bears get consecutive bear bars closing near their lows over the next few days, there will probably be a test of this week’s low or the November low at the bottom of the yearlong trading range.

- At the moment, traders will buy the 1st 1- to 2-day pullback unless that pullback is a pair of big bear bars.

- Today so far is the 3rd consecutive day with a small body. That is a loss of momentum and it increases the chance of a 1- to 3-day pullback.

- If the pullback does not have consecutive bear bodies closing below their midpoints, there should be a higher low and a 2nd leg up. If it does, there will probably be a new low and a test of the November low.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

End of day summary

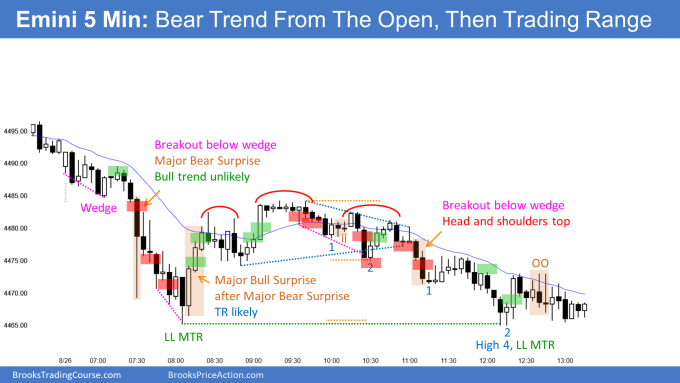

- Wedge bottom on the open, then major bear Surprise Bar and breakout to far below yesterday’s low.

- After micro wedge bottom and lower low major trend reversal, bulls got strong reversal back up to above yesterday’s low (not shown).

- Big Down, Big Up made trading range likely.

- There was a midday reversal down from a 2nd leg up, and the bear trend resumed down to a small new low.

- After another lower low major trend reversal and a High 4 bottom, the Emini entered a tight trading range in the final hour.

- Today closed near its low, but it was a bear channel. A bear channel is a bull flag since 75% chance of a break above the bear channel tomorrow.

- Now only 40 points above open of month with 3 trading days remaining in August. Bears want bear body on monthly chart so Emini might get drawn down there by end of month.

- The bulls want the month to close on its high, which would increase the chance of higher prices in September.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

al, thank you for your always insightful analysis. i’m curious how you view the current monetary regime that operates as THE singular force underpinning asset prices now. since covid, but really even long before, market corrections have become fewer and fewer. the current price action is akin to something like an ever present short squeeze, where prices just go higher and higher with shallower and shallower pullbacks. you have said that most trade probabilities range anywhere from 60/40 – there is essentially an evenness required that allows both long/short to take trades and each to make money.

this market, and again, for some time now seems like its skewed more like 90/10 to the bulls. essentially any bull trade will work almost every time. i am miffed by the duration of the uneveness now. by so many measures it is totally extreme and unabating – 8 months of consecutive bull bars, time from a visit to the 200 dma, time without a 5% correction etc. outside an exogenous “event,” it doesnt seem possible for the market to pullback, even by a small amount for days/weeks on end. have you seen the s&p500 correlation to the fed balance sheet? its like 1:1. can there be a pullback in this environment in the absence of the fed changing its policy? how could the market ever go down with them printing so much money (120bil/month)? i respect your market knowledge more than anyone and would be curious to understand how you view all of this. thank you

I have talked about this occasionally. What the Fed and market are doing is unsustainable. However, it can sustain much longer than a short can sustain his account as he bets it will end soon. That is why I have been saying during every selloff that the odds continue to favor higher prices.

While the Treasury is in charged of printing the actual money in your wallet, the Fed is creating money by buying government debt with money that it fabricates.

As long as this does not create an obvious problem (meaning significant inflation), they can continue to do it. If they continue forever, at some point, you will need a wheelbarrow full of dollars to buy a hamburger at McDonald’s.

That isn’t going to happen, but there are consequences to everything. The consequence of doing too much of something is that it eventually creates problems that are too big to control. Only time can fix them.

I see 2 ways for this to end. The obvious one is inflation.

There is another one that I have not heard anyone mention. The Baby Boomers. Let’s say the market goes down 20% and the Fed pumps money into the system so that institutions will be able to buy stock. That has been the “put under the market” that you sometimes hear mentioned by economists. But what happens if the institutions buy stock and the Fed buys ETFs, but the market continues to work lower, despite the Fed creating hundreds of billions of dollars and then trillions of dollars in new money? How could that possibly happen? If the public loses confidence in the Fed and the economy, they might use rallies to dump stock and then not buy dips. They might conclude that no price is low enough for them to safely buy.

The Baby Boomers own a huge share of stocks, and they are now in their 70’s. If the market goes down, they start selling, and they may never buy again out of fear of losing all of their retirement savings in a bear trend lasting many years.

As the market falls 20% or so, institutions will initially use the Fed’s money to keep their employees and maybe buy equipment. But if the Baby Boomers keep selling and the market continues to fall, everything will fall with it. The public will conclude that the economy is in serious trouble. They will stop buying cars, houses, cloths, and tennis balls. All of the money being spent by the institutions is then not generating earnings. Investors will see stocks as overpriced, even when they are down 20%.

The transition out the endless bull market into an endless trading range will probably take at least a couple years. It might begin soon. As you know the Fed is talking about tapering and eventually ending what it is doing. The September FOMC meeting could be a catalyst for a selloff, but every prior catalyst was only a blip.

However, this bull trend is not going to go on forever. Whenever something is easy, it is usually wrong. It is easy to make money buying stocks right now. Investors will do it until it no longer works. Once it stops working, it will take a decade before it works again. That means this bull market is going to end with a decades-long trading range with the low being about 50% below the high, like in the 1970’s and the 2000’s.

al thank you sincerely for taking the time to respond. words can not adequately express the gratitude.

Was the major bear surprise because of Afghanistan bombing or other news related or was it pure price action because of the failed wedge? It went down in just 2 minutes I think. Thank you.

I never care. All I care about is whether the institutions think the price is too high or low, and they show me on the chart. Their opinion changes constantly since there is a never-ending inflow of information of every type imaginable.

Every big move happens at a time when news comes out because news comes out every second of every day. It is often the catalyst for the move. The move always is a test of something that was eventually going to get tested anyway, but the timing is often news related.

sometime after hitting our stops the market moves in the direction we thought.In those situations you said if our premise is still valid we can enter again.But when we loose on our first entry we are already at a loss of 1% of our capital.

How to handle this can we loose up to 2% on a day or we have to reduce our position size?

Traders need to trade the “I don’t care” size, which is different for everyone. If a trader is thinking back at the last trade, he cares and is trading too big.

Dr. Brooks, if the question is sensible, could you please indulge a couple doubts of a beginner?

I am currently watching the MTR section of your course, and I am a bit confused about 2 things.

First, relating to the question of Kamala, you said that one needs to trade the “I don’t care” size. Is that applicable for someone who is starting out or is it applicable even during the increasing volume stage when a trader in consistently successful? If you could elaborate a little more, that would be incredible.

Second, in the MTR section, you often speak about closing the trade at the end of the session. I am a bit confused there. Does that mean, the MTR setup is applicable only on a discrete day and one should consider the setup has lost significance after that particular trading day is over?

Please consider the questions at your convenience and if you have discussed the matter in your videos, I would be glad if you didn’t exert yourself answering them here. I realize that we ask you a lot of questions and sometimes the questions are probably even repetitive and you take precious time out of your life to answer them patiently and carefully. It’s just that, as I am seeing more and more videos, I am realizing how blessed I am to have found you. Truly grateful!

Thank you for all your hard work.

All traders, even institutions, must trade the “I don’t care size.” A beginner’s 1st goal should not be to get rich. It is to learn how to trade consistently profitably. His next goal is to gradually grow his account to the point that the “I don’t care size” has become big enough for him to make enough income to change his lifestyle and become his main source of income. At that point, he can work on getting rich.

For a day trader, he exits at the end of the day. However, an MTR on the 5-minute chart often leads to a trend that can last several days. If he exits at the end of the day, as always, he looks for a setup in either direction early the next day. If yesterday ended with a strong trend reversal, he will hope for a setup in that direction because there would be an increased chance of a trend day today.

Thank you very much!

Hello Kamala/Al, I just finished the complete course, purchased 2 months ago. Really helpful. About the 1 tick stop above/below: I see a lot of stop runs in which they screw the retailers. I’m more inclined to place my stop at the major swing levels, and not just 1 tick. And just for calamities. Exit a trade on PA alone. Today I came across a very interesting video about stops, a presentation by Linda Raschke, a legend so it seems. Perhaps Al finds it interesting to comment on it as well?

How to Use Stops, Why Trade with Stops, How to Determine Stops

Stop runs NQ today: Trading View Stop Runs on NQ

Thank you very much Al, for your work in guiding us. It is indeed a great pleasure and blessing to be able to learn so much from you.