Emini weekly and daily sell signal bars after 3 month rally

I will update again at the end of the day.

Pre-Open market analysis

Since Monday was a weak buy signal bar, there were likely to be more sellers than buyers above Monday’s high. And there were. Although yesterday gapped up, it sold off for several hours and closed the gap.

In addition, it dipped below the open of the month before reversing up. The bulls want the March candlestick to have a bull body on the monthly chart when it closes on Friday.

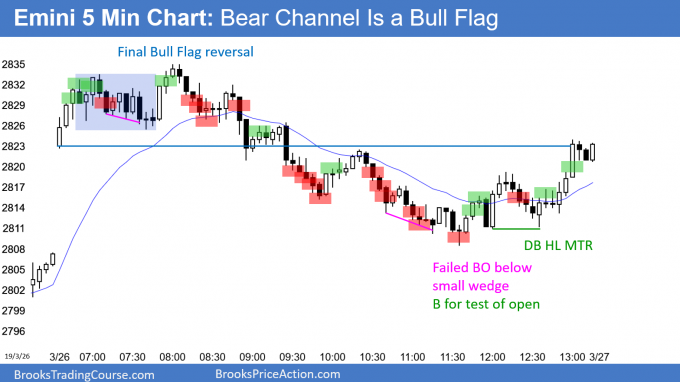

Yesterday spent most of the day in a bear channel. A bear channel is a bull flag. There was a late breakout above the channel. That makes today more likely to be sideways to up.

But, the bears still want a lower high major trend reversal on the 60 minute chart. This week is currently on a sell signal after falling below last week’s low. The bears want to trigger the sell signal again by trading back below last week’s low.

There are nested buy climaxes at resistance on the daily and weekly charts. Therefore, the Emini is probably beginning a 2 month sideways to down move. The bulls need 2 daily closes above last week’s high to shift the probability back in their favor.

Overnight Emini Globex trading

The Emini is down 3 points in the Globex session. Yesterday’s late reversal up was strong enough to have follow-through this morning. However, the odds are that the Emini has begun or will soon begin a 2 month correction. Consequently, traders will be looking to sell rallies.

For example, if today or tomorrow tests yesterday’s high and the bears get a reversal, the 60 minute chart will have a double top lower high major trend reversal sell setup. That could be a reasonable entry for put buyers, hoping for a 100 – 200 point selloff over the next 2 months.

Most days over the past 2 weeks have had at least one reversal. Day traders will therefore expect at least one swing up and one down again today.

Open of the Month is a magnet

There are only 3 trading days left in March. The bulls want a 3rd consecutive bull trend bar on the monthly chart. But, the bears want a bear body.

Yesterday dipped below the 2809.25 open of the month. That will probably be the most important magnet for the remainder of the week. The Emini might stay in a trading range near that price until the final hour on Friday. Then, traders will decide whether to close above or below it. A bear close would increase the chance of April trading below the March 2725.50 low.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

EURUSD Forex market trading strategies

On the daily chart, the EURUSD had 2 legs down from last week’s high. If today continues to have a bull body, it will be a buy signal bar for tomorrow.

After 10 bars without a pullback, this 5 day selloff is more likely a pullback than a bear trend. With a bull body, today would be a credible candidate for a buy signal. Traders would see the 5 day selloff as a buy setup for a higher low major trend reversal. They would consider the 5 days down as a test of the March low.

Will there be a major reversal up into a bull trend? Or, a strong break below the 4 month trading range? Yes, one will probably happen within a month once Brexit gets resolved. But, until there are consecutive closes above or below the 4 month range, traders will continue to bet on reversals every 2 – 3 weeks.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart had a small overnight range. It sold off to below yesterday’s low and reversed up. So far, it is a bull trend reversal day. But, the day is small. With the rally being less than 40 pips, day traders so far have been only scalping for 10 – 20 pips.

The chart has been in a 20 pip range for the past 3 hours. The bulls have already achieved their goal. They got a reversal up. They would like to have a bull body on the daily chart. Consequently, they will buy dips below today’s open.

Since the bears always want the opposite, they will sell reversals down from near the day’s high. However, the rally in the European session was strong enough to be a Dominant Feature. That means that it will probably dominate the remainder of the day. Traders will expect either a bull trend, or, more likely, a continuation of the 3 hour trading range. The reversal was strong enough to make a bear trend unlikely.

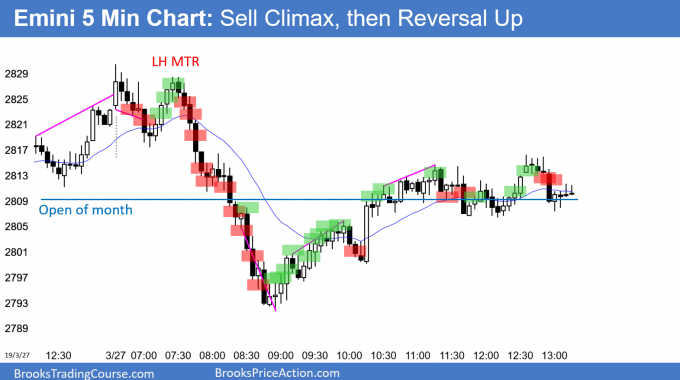

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

End of day summary

I wrote before the open that yesterday was a bad sell signal bar on the daily chart. I said that there would be buyers below its low. Although today crashed, the bulls bought the selloff. The Emini reversed up from below yesterday’s low and just above the low of the week.

The Emini has been trading around the open of the month and last week’s low for 3 days. Both are important, especially when the week and month close on Friday. Consequently, the Emini will probably trade sideways into Friday’s close. Then, in the final hour, we will know if the Emini closes the week and month below that support.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Morning Al.

I’m actively posting in the EURUSD channel on slack now and I think Derek is going to contribute today as well. Would you mind mentioning this on the EURUSD section on your blog when you post each day?

As you know we are undergoing a protracted period of very difficult trading on EURUSD right now. Its absolute hell for EURUSD traders – lots of trading ranges and small days. I’m hoping we can assist and advise each other though the chat room.

The invitation link they need is:

https://join.slack.com/t/brookspriceaction/shared_invite/enQtNDYwNzI4MDAwNzIyLTRlY2JkZjM2MWI2NDAyMDdmYTYxNWU4NDg5ZDZiNjQzNDdkOTVlZjczYjExZjNkYjNhNzliNDhiYzM2YmY5Yjk

Hope you don’t mind

Thanks

Hi Al or seasoned student,

Out of curiosity, are there Universities that teach trading at this level of detail? Or teach price action in general?

One of my daughters graduated from the Harvard Business School. I asked her if she knew of any elective comparable to what I teach and she said that she did not.

I know that some schools have courses on algorithmic trading. I suspect they teach more programming than actual price action. My belief, based on 7 years at the University of Chicago and my girls graduating from Harvard, Yale, and Stanford, is that even the best universities avoid directly teaching people how to make a living. You learn that after you graduate.

Very interesting. Thanks for the reply!

If anybody is trading EURUSD, I’m posting stuff in the slack group. Its very tricky trading on EURUSD so I’m hoping we can get the EURUSD channel active and help each other.

https://brookspriceaction.slack.com/messages/CHC0XPLTY

I trade the EURUSD and would be interested in this channel. How do I request access?

Hey Derek, you can sign up at brookspriceaction.slack.com

You might need to use this link to sign up:

https://join.slack.com/t/brookspriceaction/shared_invite/enQtNDYwNzI4MDAwNzIyLTRlY2JkZjM2MWI2NDAyMDdmYTYxNWU4NDg5ZDZiNjQzNDdkOTVlZjczYjExZjNkYjNhNzliNDhiYzM2YmY5Yjk

That worked, thank you Kevin