Stock market sell climax reversal after senate nuclear option

Updated 6:58 a.m.

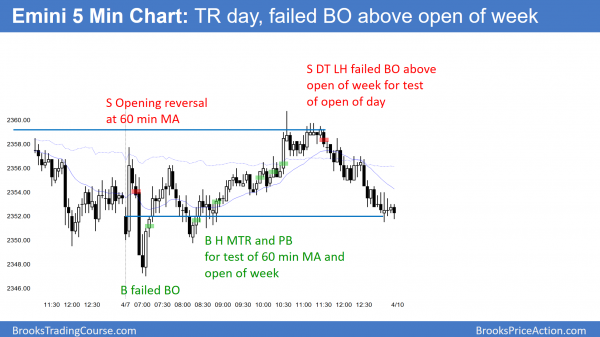

The Emini opened in the middle of yesterday’s range, but rallied on the open. Yet limit order bears made money and the Emini reversed down from the 60 minute moving average. While there are weekly magnets above, the bulls need another reversal up if they are to get a bull trend day. Because the reversal down was very strong, the odds are against a bull trend day.

The bears hope that the Emini reversal down from the 60 minute moving average is creating an early high. However, the Emini reversed up strongly many times over the past 2 days at around Wednesday’s sell climax low. Hence the bears need a strong break below that low to create a bear trend day. While the Emini is Always In Short, the bears need follow-through selling to create a bear trend day. The odds are that today will either be a bear trend day or a trading range day.

Since yesterday was an ioi day on the daily chart, it is both a buy and sell signal bar. Yet, it is in the middle of a 2 month tight trading range. Therefore, it is a low probability bar on the daily chart for stop entry traders.

Pre-Open market analysis

The Emini formed an inside day after Wednesday big bear outside day. Yesterday is therefore a buy signal bar on the daily chart. Yet, it is in the middle of a 3 week tight trading range. Consequently, continued sideways trading is more likely than a resumption of the bull trend.

Since Wednesday was a strong bear trend day, the odds are that the Emini will test its low within a few days. Hence, yesterday’s rally is probably just another leg in the 3 week range. The bulls need a strong break above the March 15 major lower high for traders to believe that the bull trend has resumed.

The bears need a follow-through strong leg down before traders will believe that the 5% correction has begun. In the meantime, the odds favor more bad follow-through up and down. As a result, the trading range will probably continue.

Overnight Emini Globex trading

The Emini is down only 6 points in the Globex session after initially falling 20 points following Trump’s bombing of Syria. Today is the last day of the week. Last week reversed the selloff of two weeks ago. In addition, this week is a doji bar on the weekly chart. Hence, the Emini is still neutral, despite the FOMC and Syrian news.

Because it is failing to selloff, it probably will test the March 15 major lower high. While it is in a bull trend on the weekly chart, the odds still favor a test down to the December 31 close. Hence, if the Emini rallies to the March 15 lower high, it will probably form a double top lower high major trend reversal. Yet, until it breaks strongly below last week’s low, traders will not believe that the correction in underway.

Since the Emini is ignoring important news, it will likely remain in its 2 month range again today. Because it is in a neutral environment, there is an increased probability of neutral days. Consequently, there is a greater probability of trading range days.

Because today is Friday, weekly support and resistance is important, especially in the final hour. Since the week is a doji bar on the weekly chart, the week’s open is an important magic. In addition, last week was a buy signal bar on the weekly chart. Its high is therefore also a magnet.

EURUSD Forex market trading strategies

The 2 week bear trend is weakening on the 240 minute EURUSD Forex chart. The selloff is close to the March 14 major higher low. The EURUSD will therefore probably test it before reversing up in a 150 pip bear rally.

While the momentum down has been less for 6 days, the EURUSD 240 min Forex chart is still in its 2 week bear trend. Since it is close to the support of the March 14 major higher low, it will probably fall another 25 pips to 1.0600 to test it before beginning a 150 pip bear rally. Since it is close to that support, however, it could begin its bear rally at any time. Yet, it is in a 5 month trading range. Therefore when it is close to support, it is likely to fall below that support before reversing up.

Overnight EURUSD Forex trading

The EURUSD Forex market is still in its flat, tight bear channel of the past 5 days. Consequently, bulls are buying new lows for scalps. In addition, bears are losing confidence. They therefore are waiting for 20 – 30 pip bounces before selling. In addition, instead of selling breakouts to new lows, they are buying to take profits. They are therefore switching from swing trading to scalping. This is typical of a trend that is evolving into a trading range.

In addition, the 2 week selloff on the 240 minute chart had several sell climaxes. Furthermore, the rallies have been small. These are signs of unsustainable selling and increase the odds of a two legged rally that will last several days.

Yet, there is no strong reversal up yet. Also, the EURUSD continues to make lower highs. The bulls need a strong breakout above the lower highs of the past several days. Furthermore, they need a strong close above the 5 day range. Until then, the bears are still in control.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini pulled back on the open to a new low of the day. It then rallied in a Spike and Channel bull trend to above the open of the week and the 60 minute moving average. It reversed down to the open of the day, creating a doji trading range day.

The Emini had a doji day today. It is still in the middle of its 2 month trading range, and therefore in breakout mode. Because of the weekly buy climax, the odds are that it is in an early bear trend. Since the open of the year has not been tested, the odds are that the selloff will give back all of the 2017 gains.

…

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.