Market Overview: NASDAQ 100 Emini Futures

The NASDAQ Emini futures market had a big bear outside down bar this week – it went above the high of last week, reversed at the monthly exponential moving average (EMA) and with first close below weekly EMA since February.

The market will likely test lower in the next couple of weeks. Bulls could create a bull reversal signal next week at the weekly EMA, but it will likely be sold for another leg down.

NASDAQ 100 Emini futures

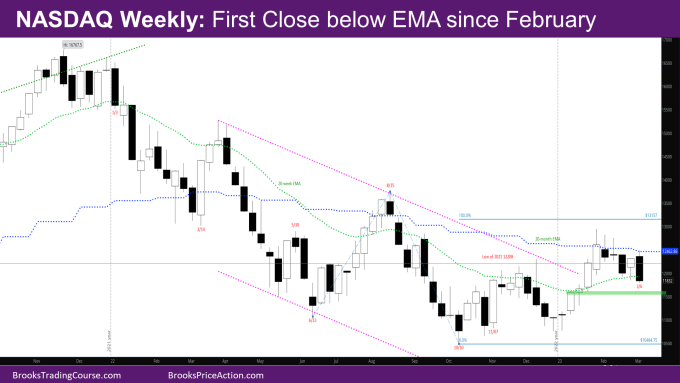

The Weekly NASDAQ chart

- This week’s candlestick is a bear outside down bar with close below weekly EMA.

- As mentioned last week, the question coming into this week was – Would the bulls who bought at the EMA 2 weeks back scalp out around the monthly EMA. Based on this week, it’s clear they did, as did the bulls who were trapped from the big bear breakout 2 weeks ago. Bears also sold the monthly EMA.

- There will likely be a leg down now based on the strong bear bars in the past 3 weeks.

- The market should find temporary support at the high of 1/9 around 11600. It was a sell at the weekly EMA for a possible 2nd leg down back, so a test target.

- Since bulls did not have a good signal bar in January or October, the reversal up in January is still likely a minor reversal, and bulls will need a good signal bar around the bar from the week of 1/2.

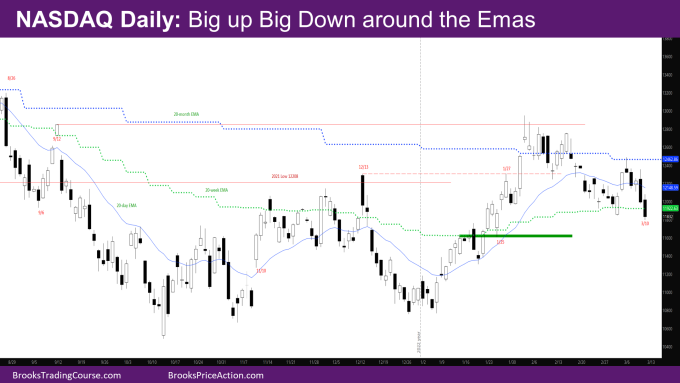

The Daily NASDAQ chart

- Friday’s NQ candlestick is a big bear bar with small tails.

- Four of the five days this week were strong bear bars closing on their low.

- This is the first time since early February, when the sideways to down move started, that the market has had consecutive strong bear bars.

- The bear bars in the move down this week are like the bear bars in the leg down in December.

- The market is likely to make the bottom of the 2nd leg in the move up – the low of 1/25 shaded in green in chart. It is also around the weekly EMA when the market was going sideways for a few days.

- As mentioned before, the market is in a trading range between the monthly and weekly EMA till they get close enough.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.