Market Overview: Nifty 50 Futures

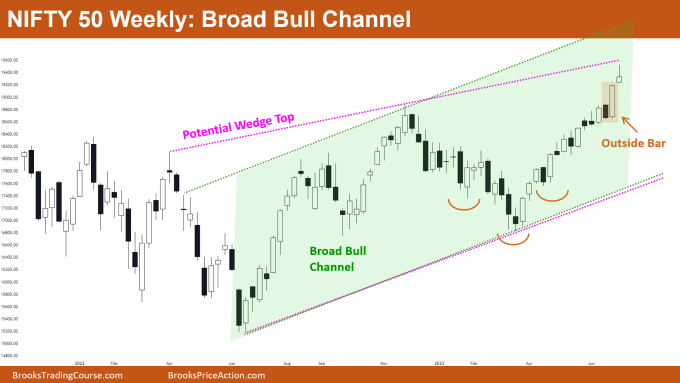

Nifty 50 Broad Bull Channel on the weekly chart. Following the large outside bar, the market this week produced a weak bull close with a long tail on the top. A few bears may sell because the market is trading near the top of a potential wedge top. On the daily chart, the market produced a bear outside bar following a strong bull micro channel. The market also produced gaps on the way up that are still open, and these gaps will serve as a price support.

Nifty 50 futures

The Weekly Nifty 50 chart

- General Discussion

- Bulls who are already long positions shouldn’t sell them until the market makes an attempt to reverse the trend.

- Bears shouldn’t be selling right now because the market is trading inside of a broad bull channel and a second leg up following the strong outside bar is likely.

- Given that the market is in a strong bull leg and that the reversal bar (shown as a bull inverted hammer on the chart) has a bull body, some bulls may place limit orders at the low of this bar in the expectation that the market will exhibit a second leg up.

- Deeper into the price action

- Bars have shorter tails at the bottom of bars during a strong bull trend (like in the chart above) because many traders place buy limit orders at the low of bars.

- In a strong bull trend there are several ways to enter a long position:

- Placing buy limit orders at the bottom of strong bull bars and weak bear bars

- You buy at the low of a weak bear bar because you think that a weak bear bar cannot reverse a strong bull trend, which implies that there would be more buyers than sellers at the low of this bear bar.

- Buying strong bull closes

- Placing buy stop order at the high of a bull bar

- Placing buy limit orders at the bottom of strong bull bars and weak bear bars

- You must choose an appropriate entry strategy based on price action because each method carries a different level of risk and probability.

- Patterns

- Because the market is trading inside of a broad bull channel, a second leg up to the channel’s top may be seen in the price.

- The potential wedge top, which could halt this bull trend, would be confirmed if bears are able to produce consecutive bear bars from this level.

- Because the market is also forming an outside bar, some bulls would buy at the low of this week’s bar and aim for a measured move upward based on the outside bar’s body.

The Daily Nifty 50 chart

- General Discussion

- The market gave a bear breakout of the bull micro channel; given the strength of the channel, there is a strong likelihood that the market will form a second leg up before reversing.

- In order to enter into a long position, bulls can wait for the market to form a high-1 buy signal bar.

- Because the channel is strong, selling at the outside bar’s low might not produce a reversal with a high degree of probability. Therefore, if bears are selling at the current level, their risk to reward should be favourable.

- Deeper into price action

- A wedge top overshoot to a channel has a 75% chance of failing and reversing within a few bars.

- As you can see, the overshoot succeeded and the wedge top failed and created a strong bull micro channel.

- However, this had only a 25% chance of happening, so the market typically displays a second leg in that direction when it does something less likely

- This is frequently referred to as surprise moves; surprise moves are less likely events that result in a second leg in an up/down movement. This also holds true for surprise bars.

- Patterns

- As a whole, the market is in a strong bull trend, so bears should hold off on selling until there is a clear attempt to reverse the trend.

- The market has developed some gaps, which could serve as a support and a magnet for the price.

- Bull micro channels typically represent a market cycle breakout phase, so an upward channel (wedge top/bull channel) is anticipated.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.