Trading does not have to be complicated. For most traders, if they take time to look carefully at candle or bar charts, they will quickly discover that price action alone is all you need to observe to be successful. As a bar develops, consider the tone of the market, whether the bulls or bears are in control, and more importantly, who is trapped and who will have to get out. It can be that simple. This article discusses some strategies for day trading the 5 minute Emini chart.

While this approach works with all time frames and all markets, it is efficient on five-minute charts of the E-mini S&P 500. Typically, there are from 10 to 20 set ups per day on the five-minute time frame, which is far more than needed to do well. If you trade enough contracts, you only need to net one or two points a day to succeed.

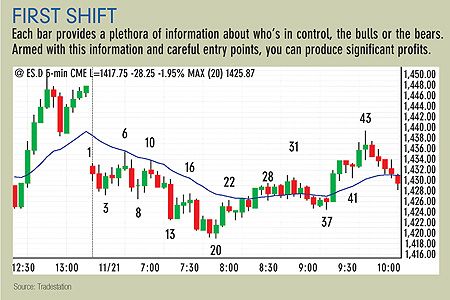

“It’s typical” is a five-minute chart depicting a normal day in the E-mini S&P 500, while “First shift” is a closer look at the first four hours of trading. For example, 37 is the 37th bar of the day. By reviewing the price action as this day unfolds, we can point out several opportunities as they occur. Along the way, we might refer to various formations, but general price action, not specific patterns, will be our primary guide.

As a rule, it is usually best to enter a trade on a stop one tick above or below the prior bar because you want the market to take you into the trade. Place your protective stop at one tick beyond the prior bar until you can scalp out of part or all of your trade. Alternatively, risk four to 12 ticks, depending on the size of the average bar.

If you’re letting some contracts swing, move the stop to breakeven after taking four ticks profit on the scalp portion. Often, it is more profitable to just scalp for four ticks, but when there is a strong reversal at a possible high or low of the day, or when there is a strong trend, it is far better to swing part or all of your position.

Set ups

One important concept is that of a High or Low 1 or 2. Here’s how it works. The first time in an upswing that there is a bar that has a low below the low of the prior bar, that bar is labeled L1 (Low 1). Examples are Bars 5 and 41 in “First shift.” The next occurrence is an L2, such as Bars 7, 28 and 45. Bar 38 is an H1 and Bar 15 is an H2. There are several nuances to this approach, and one or two will be seen as the day unfolds.

Another concept involves signal and entry bars. A signal bar is a set up but not yet an entry. If the next bar extends one tick beyond the high or low of the signal bar, then that bar becomes the entry bar. Often, it is wise to enter on a breakout of either side of a signal bar. For example, if there is a bull signal bar and if the next bar takes out the low instead of the high, then it’s usually a good idea to go short because the existing trapped longs will drive the market down as they cover. Bar 25 is such an example. It is a bear reversal bar at a new swing high that never triggered a short entry. It also demonstrates why it’s important to place an entry stop at one tick below the signal bar to go short and another to go long on a stop at one tick above the high of the signal bar.

The example day opens with a large gap down from the previous day’s strong close, leaving all traders who bought into the close with a substantial open loss. Whenever there is a large gap down, the bears are momentarily in control. Bar 1 has a down close but a five-tick downward tail, indicating that some buyers do come into the market.

At this point, two things are worth looking for over the next hour or so. First, there’s a bullish reversal bar after some additional selling (this occurs at Bar 3), and then a short entry on an L2 near the 20-bar exponential moving average, which forms at Bar 6, leading to a new low of the day. Because the bears are in control, an appropriate order would be a short entry on a stop one tick below the low of Bar 1, with a plan to scalp four ticks of profit. However, a good option might be to swing up to one-third of the position because some gap days form the high on the first bar; although it’s rare, the rewards sometimes warrant the risk. Considering the market is above the starting level of the previous day’s strong bull close and Bar 1 is attracting some buying pressure, it’s probably a good move to forego carrying any swing contracts until more bearish strength presents itself.

The four ticks of scalp profits we were after come on Bar 2. It was a strong bear bar with a large body and a close near its low.

Bar 3 is always critical because it determines the look of the first 15-minute bar of the day. Bar 3 is often a smaller bar and a reversal bar, and it often works well to enter on its breakout in either direction. Here, it forms a strong bull reversal bar with a low below the low of the prior bar and a close near its high —and well above the close of the prior bar. Whenever a strong reversal bar occurs in the first 15 minutes or so on a day with a large gap open, odds are high for at least a scalper’s profit on the trade (four ticks net, which requires a move that extends at least six ticks beyond the high of the signal bar).

An L1 within a bar or two of the long entry often also traps bears into shorts and traps longs out of a good long, so consider exiting the long on a three-point stop since the set up is particularly strong. Consider exiting prior to the stop being hit if there is a new swing low or a pullback that reaches about 75% of the move up (the low of Bar 3 to the top of Bar 4); however, neither could happen in the example case because the three-point stop would be hit first. If Bar 5 extends more than two or three ticks below the low of Bar 4, the bulls are likely in trouble, but one tick is usually safe.

Adding & reversing

Often, any move below the low of the bar after the entry bar (if the set-up is strong) is a stop run trap, making that a good place to increase any existing long position. In this case, because Bar 5 reaches 11 ticks below the entry of the long from Bar 4, the market probably will run up about 11 ticks or more above the entry. The market often moves the same distance as the risk it forces you to assume. Here, a good trade would be to take half of profits at four ticks, which happens on Bar 5, and to take another 25% off at 10 ticks (just shy of the 11-tick goal). This is reached on Bar 6. The stop now can go to breakeven on the remaining 25%, with a consideration of reversing to short on an L2 near the EMA. Countertrend moves often end after two legs and often around the EMA. Bar 6 has a large bear tail that tags the EMA, and it breaks above the prior high of the day (Bar 1), forming something of an awkward double top (Bars 1 and 6). We should look to reverse any longs under this bar’s low. Again, the price action calls for a scalp of four ticks on half or a third of the position, with the protective stop moving to breakeven for the remainder, and the rest coming off at any new low for the day (and possibly another reversal to long) if the market keeps dropping. In this case, with an order to reverse to long at one tick above the high of Bar 8, Bar 9 will get us long. Because the market has had several reversals this day, it is a signal to switch to scalp-only mode until a strong swing.

However, markets are fundamentally unpredictable, and we get that on the next bar. Bar 10 again tests the EMA and fails, forming a bear reversal bar. This is the second test of the EMA, and second tests usually lead to big moves. Also, it forms a downward-sloping double top with the high of Bar 7 (it could not go above this entry bar of an earlier short). So, it’s fair to expect a breakout of the range for a measured move down (a move that extends below the range for as many points that made up the range, here nine points from the high of Bar 6 to the low of Bar 8). Scalp out four ticks on Bar 11 and move the stop to breakeven. Plan to take more profit at just shy of nine points, which happens on bar 17.

Bar 13 is a large bear trend bar and a breakout to a new low of the day. Large trend bars that break out often fail on the following bar. However, there have been several signs of the bears controlling this market, so the move likely will extend for at least a second leg down. Bar 16 is also a test of earlier short entries (below Bar 8 and again below Bar 12). At the close of Bar 14, you should place an order to add to your shorts at one tick below its low. This is not filled. Bar 16 is the third up bar, but both it and the prior bar have small bull bodies and big tails, indicating that the bulls are not strong. Move your sell stop order up to one tick below the low of Bar 16. You are filled on Bar 17.

The turnaround

Bar 18 is a small inside bull bar (neither high nor low extend beyond the prior bar). Inside bars often proceed a reversal and usually indicate a higher low on a smaller time frame. A higher low is a necessary component of a bull swing, so place an order to reverse to long at one tick above the high of Bar 18 and an order to add to your shorts at one tick below its low. The result would be a new short on Bar 19 and a four-tick scalper’s profit during Bar 20.

Bar 20 is another small bull reversal bar. This second attempt at a bull reversal adds to the conviction that the bulls are taking control and that the bears are taking final profits. Having been stopped out of all remaining short positions, we would place an order to go long at one tick above Bar 20 and a second order to go short at one tick below its low. Bar 21 extends above the high of Bar 18, the first bull signal bar that wasn’t confirmed. Bar 18 appears to be a one-minute swing high, and now the market has a higher high. Though the first high was not part of the bull leg, going above it is a sign of strength. Bar 21 also breaks the bear trendline across the tops of Bars 10 and 16.

Bar 23 reaches down exactly to the high of the long signal bar (Bar 20), just far enough to run stops. If you exit, you would have to return to long at one tick above its high because you would now have a small higher low and a successful test of the breakout into a bull swing. Also, it is a test of the trendline breakout. Signs that the bulls are gaining strength is confirmed on Bars 24 and 26. Bar 24 reaches above the high of the minor prior high at Bar 22, so there is now a higher high after a higher low. Bar 26 extends above the Bar 16 high, forming a higher high. The market runs up to Bar 31 without a major pullback, which is a sign of sufficient bullish strength that traders will be looking for at least a second leg up after a pullback. Bars 26 to 33 all close above the EMA. At this point, you should expect at least one more leg up after an attempt by the bears to reassert themselves.

Bigger swings

The sell off down to Bar 37 also breaks the bull trendline from Bar 20 to 31. The bear trap is set and the new bears are worried by their inability to move the market down forcefully. Also, bulls are eagerly looking for any sign of strength to add to their longs near the EMA. Bars 35 and 37 have down closes, and they are two attempts by the bears to gain control and both fail. Bulls go long and bears exit at one tick above Bar 37. This results in a significant higher low. Bar 38 is a strong bull trend bar that broke above the EMA and broke above the bear trendline from Bar 32 to Bar 34.

Now, you should expect at least two legs up, which the market gives you: one ending at Bar 41, and the other at Bar 45. Bar 43 is a new high for the day and a huge second leg up (Bar 20 to Bar 31 was the first). This second leg up also had two legs (Bar 37 to Bar 39 and Bar 41 to Bar 43).When the day is not a clear and strong trend day, you should always be looking for set ups that allow you to fade new swing moves and new highs and lows for the day. Bar 43 gives you several and you would sell, expecting at least a scalper’s profit and likely two legs down.

This approach is difficult to quantify and requires practice to develop a feel for the market; however, once learned, it works consistently. For most of us, the five-minute chart is the best time frame, providing enough time to spot most set ups and enter the market. The five-minute chart offers an incredible opportunity to a day-trader if you remain patient, trade within your means and take time to understand what the price action is telling you.

This is based on an article in the May 01, 2008 issue of Futures magazine