Market Overview: Bitcoin Futures

Bitcoin right below 40000’s sell zone. During the week the price decreased it is value but still, it closed above the mid-point of the weekly range. The prior 3-week’s low are all nearby, trading below that might change the inertia in favor of the bears. Moreover, the price is near a confluence of resistances: A Measured Move based upon a Rectangle, the $40000 big round number, a prior Range fair price, and a 50% pullback based upon the all-time high and the 2022 low at $42000. If the market cycle is a Trading Range, the price will probably create a bear leg after reaching resistances, then, Traders should look to buy low (below $30000) and sell high (above $40000).

Bitcoin futures

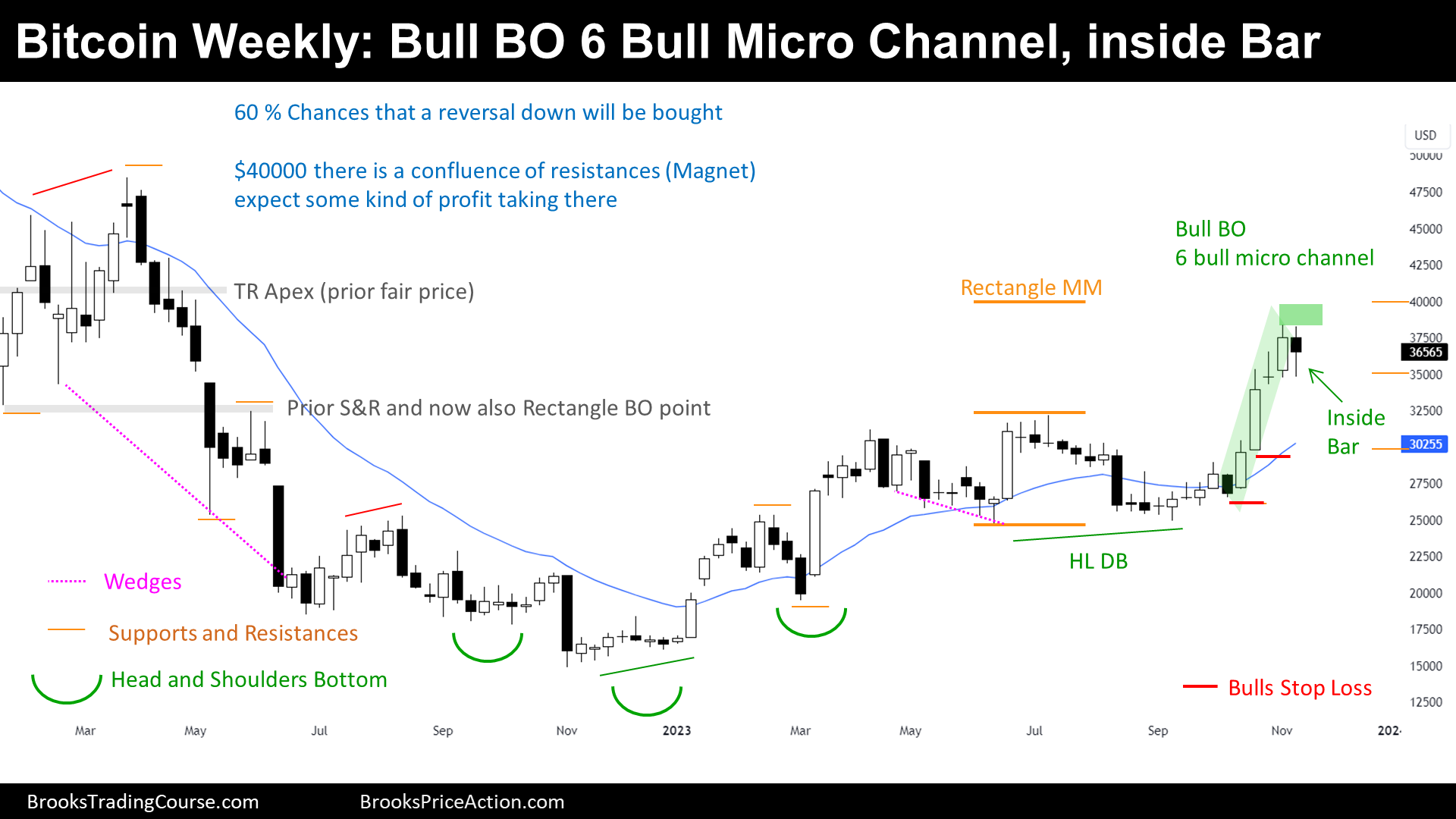

The Weekly chart of Bitcoin futures

Past: Support and Resistances

- The price started a Strong Bear Channel:

- Bear Flag’s Breakout Point (now rectangle’s Breakout Point).

- Major Lower High.

- Trading Range Apex (prior fair price).

- Then, failed a Breakout Below a Bear Flag and Reversed up, forming a HSB (Head and Shoulder Bottom) pattern, that broke up:

- 2022 Low.

- 2022s Major Higher Low.

- 2023 Major Higher Low.

- HSB Breakout Point

- HSB Measured Move around $35750 already reached.

- 50% Pull Back at around $42000, from all-time high to 2022 low.

- Lately, the price has been sideways creating a Double Top and a Double Bottom, which is a Trading Range, and because the Trading Range was not wide, was also a Rectangle and Breakout Mode Pattern.

- Trading Range High (Rectangle’s Breakout Point).

- Trading Range Low.

- Measured Move at $39500.

Present: Market Cycle

- The price is probably in a broad Trading Range instead of a strong bull trend, this is because on the left of the chart there were sellers and hence, exist sell zones.

Future: Inertia

- The price will probably reverse soon, maybe after reaching the $40000 area.

- Then, it will incite weak bears to sell by pulling back, but the first reversal down will likely be bought, even if it reaches the major higher low.

- If it keeps trading higher, might reach the 2022 high, but if this is a Trading Range, it will struggle to break up resistances like $40000 and $42000 (50% Pull Back from all-time high to 2022 low).

Trading

Looking to buy below $30000 and sell above $40000 it remains the plan.

- This week is an inside bar.

- Bulls see a high 1:

- For Bulls that bought during the Bull Breakout, will probably exit below $34000.

- Weak bulls stop loss marked on chart (strong bulls will look to buy there).

- Bears want next week a bear bar for a micro double top:

- For now, they do not have any available setup (but selling with limit orders around $40000 targeting $24000 area, stop loss at 2022 high).

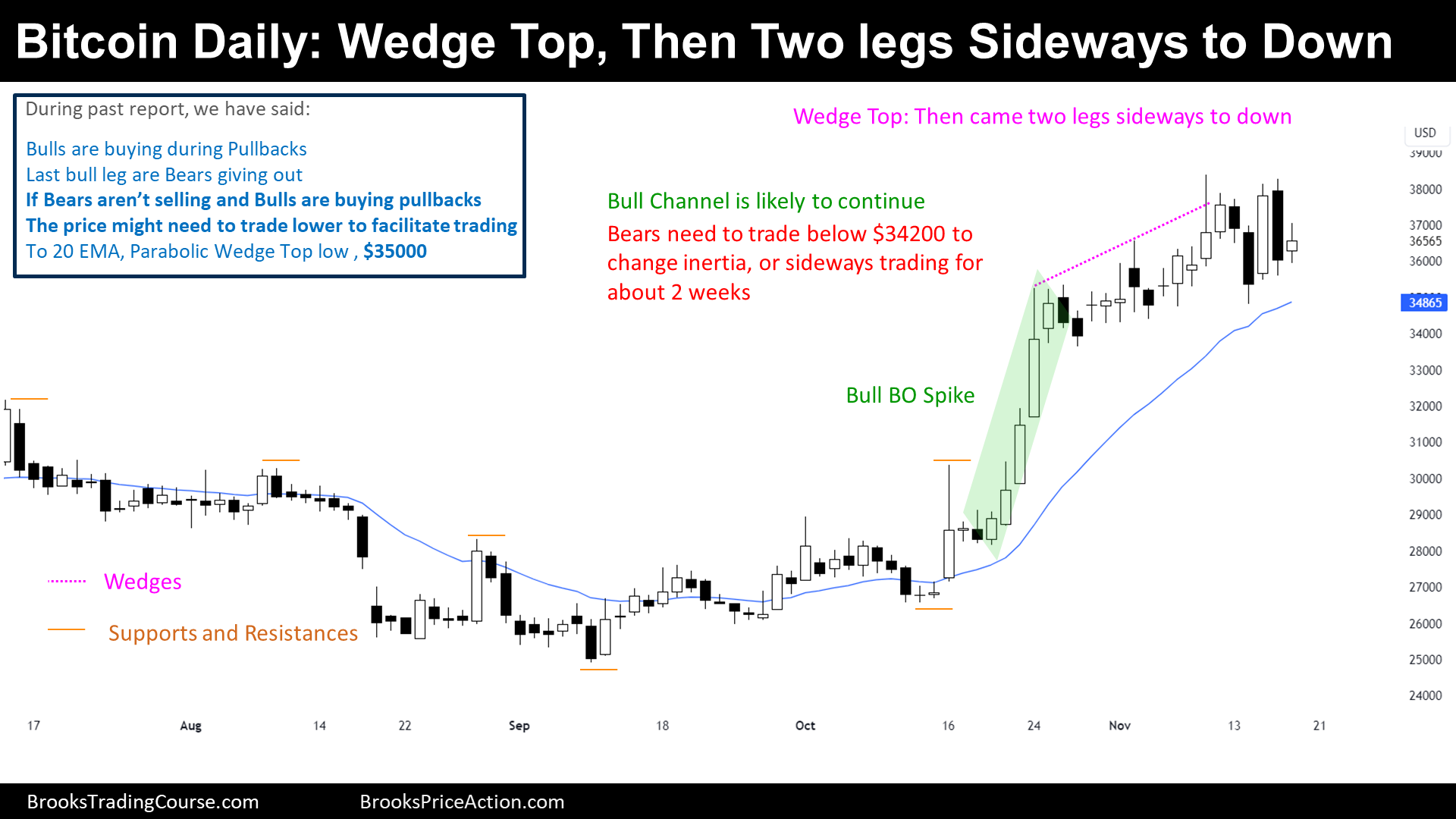

The Daily chart of Bitcoin futures

Past: Support and Resistances

- The price did a Bull Spike (Breakout) and Bull Channel.

- Breakout Points are now support.

- Bull Spike Low.

- Parabolic Wedge Top Low.

- 20-day Exponential Moving Average (EMA).

- After a Wedge Top the price did a couple of legs sideways to down.

- Wedge Top high.

Present: Market Cycle

- The current Market Cycle is a Tight Bull Channel, you can also call it a Bull Spike and Channel.

Future: Inertia

- 80% of attempts to reverse a Tight Bull Channel are going to fail; moreover, the price should Trade higher towards resistances.

- The price will probably trade back above the Wedge Top high.

- If there will be a bear reversal, the price will likely transition into a Trading Range first, that means, going sideways for at least 20 days.

- Or the price might reverse after reaching the targets.

Trading

The past week, we have said that the price should not trade much higher since bulls were not buying high. Now, there are weak bulls that want to buy above the wedge top high, where there are strong resistances. Exactly there, there are the stop losses of the weak bears that are entering short during a tight bull channel.

- Bulls:

- Most bulls buying here are looking to scalp.

- Swing Bulls are willing to buy a deep pullback, a failed bear breakout below the past week’s low.

- Bears:

- Bears scalping are making money, but swing bears should wait until there is a major trend reversal setup.

Market analysis reports archive

You can access all the weekend reports on the Market Analysis page.