Market Overview: Bitcoin Futures

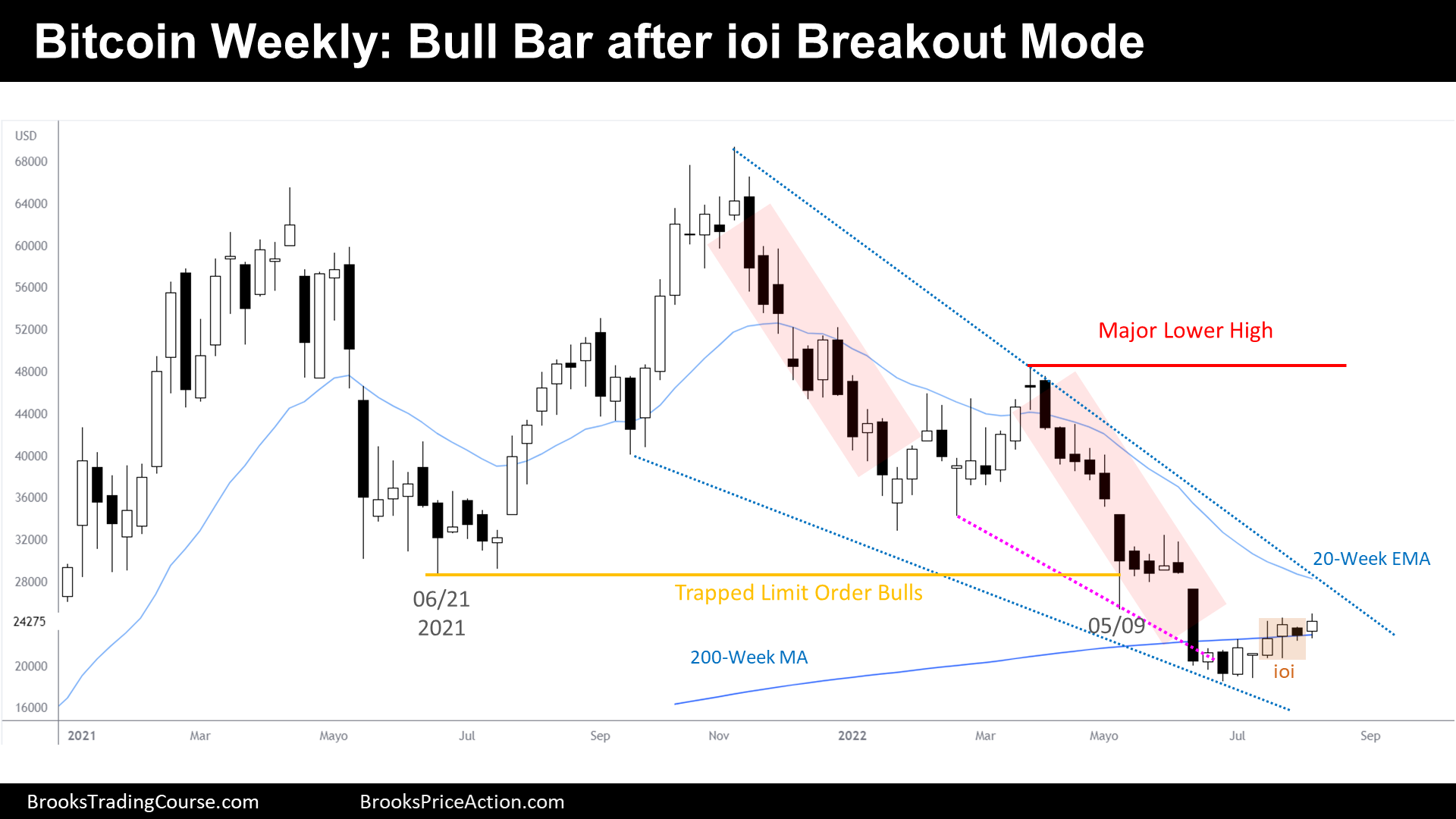

Bitcoin futures hold above 200-week moving average while the price is testing the May 9 low. During this week, the ioi breakout mode triggered to the upside, but the final result was not heavily bullish because the current weekly close is below the ioi high.

Bitcoin futures

The Weekly chart of Bitcoin futures

- This week’s Bitcoin candlestick triggered the ioi breakout mode pattern on the upside, and ended closing as a small bull bar with tails above and below. It closed below the ioi high.

- Last week, we said that odds slightly favor sideways to up because after a wedge bottom, we should expect two legs sideways to up.

- Price is testing the 5/9 low. There, many bears who sold around the last major lower high, took profits. If the price gets there, they will be proven right: the bear breakout that came right after is, more likely than not, failing.

- The price holds above the 200-week moving average. This moving average is particularly useful after strong bull trends, as it is a common reference that traders use to determine where the low of a future trading range might be: after strong trends, the most likely outcome is a trading range and not an opposite trend.

- While the price keep holding above the 200-week moving average, traders wonder if the price is constructing the bottom of the major trading range: this is probably the prevailing market cycle of this chart.

- Within trading ranges, after a bear leg, the most likely outcome is a bull leg; however, the last bear leg has been extremely tight, strong enough to expect at least a test to the lows of the year.

- The best the bulls can get is sideways trading. If bulls maintain the price about 20 bars sideways, the odds of another bear leg will be lower than the odds for a bull leg, because if we go sideways for 20 bars, the price will keep sitting within a buy zone. 20 weeks sideways mean until the end of October.

- More likely, the price will test the June 2021 low and then will attempt to test the 2022’s low.

- Bulls might hesitate to buy because, as stated on prior reports, numerous participants will sell around the June 2021 low. This activity clearly does not favor bulls interests.

- Bears hesitate to sell, the last bear breakout is failing, they think that the math is better higher.

- The lack of participants willing to take serious positioning, around current prices, favors the price being driven by the path of the least resistance. The dominating market cycle is probably a trading range. The 200-week moving average might suggest a bottom. We are at a buy zone. The price, more likely than not, will not attempt to trade below the 2022 low seriously until first, it finds sellers: at the June 2021 low.

- Odds favor sideways to up trading over the next weeks.

The Daily chart of Bitcoin futures

- The Bitcoin Futures traded sideways to up, respecting the support of the lower bull trend line, mentioned in last report.

- We have said that the odds favor a continuation of the bull channel; hence, higher prices this week.

- This week, the price accomplished a new high staying within the bull channel, continuing the higher and lower highs series.

- But now, the price will face a confluence of price resistances:

- 50% pullback of prior bear leg.

- 100-day moving average on the daily chart of bitcoin spot.

- Stop Order Bulls profit taking (2:1/reward:risk ratio).

- Bulls think that the price is contained within a Bull Channel. A bull channel is a trend. 80% attempts to reverse a trend fail; Therefore, they expect the price to test the upper bull trend line at some point during the following 20 days.

- If bulls take profits, how can the price continue up?: because weak bears are buying. They sold at the bear trend line top after a higher low major trend reversal. They sold at the 20-day exponential moving average. They sold every double top. They will buy (being stopped out) right where strong bulls are selling.

- Strong bears do not plan to sell until:

- Bullish inertia stops: break below the bull channel trend line.

- Around the Major Lower High and the 100-day moving average. Bears know that weak bulls will come back around that point, expecting a major bull trend. Weak participants always ignore what is on the left: a bull channel contained within a trading range and thus, it will probably become just a bull leg in a trading range, followed by a bear leg in a trading range.

- We have been saying, since early July, that a bull reversal after a strong bear trend it is more likely to be weak on early stages, and strong on late stages. This is because after a strong bear trend, traders expect a trading range. And when they consider that we could be at a buy zone, they tend to be much more inclined to buy below things instead of above things. That is what traders do in trading ranges, they buy low.

- Weak traders, after a strong bear trend, instead of identifying a transition from one cycle to another, sell below things at the buy zone. With more opportunities they have to sell, more positions and leverage they add. If the price goes against them (80% of the time), their stop losses are being hit: buying market orders.

- Hence, there is a 60% chance of a strong leg starting within the next 1-3 weeks, attempting to test the prior Major Lower Highs.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hey Josep, thanks for another detailed report.

2 things, unlike S&P future current Bitcoin week is still up and running thus wondering why you have chosen bitcoin future as reference and not the crypto exchange information? I assume Bitcoin’s future PA will be impacted by the regular crypto exchange behavior no?

There is a resistance level at the high of 07/24 wherbuy if bulls close the current week above it, we may get a MM based on the June low with the 07/24 high. This will drive the price to May LH and slightly above June 2021 low. How likely is this scenario to occur?

Hola Eli!

Thank you for making interesting questions.

— The most important price of the day it is the close of the day. The most important price of the week it is the close of the week, and so on. By choosing the Bitcoin Futures on the CME, traders find consensus, they can agree on which prices are more relevant for US traders. On Bitcoin spot there is no price consensus, just like the Forex markets. Thus, I select the Bitcoin futures because everyone agrees on price, exact closes, highs, or lows. Whatever the Bitcoin spot does during the weekend, it only has a 20% chance of changing the context of Friday’s close. I would even say less % because the volume during the weekend it is not as relevant as the volume traded in the week.

— I think that the scenario that you mention should have near 60% of chances for the bulls. If the price trades sideways or down and break the bull trend line of the daily chart bull channel, I would change my mind. While the price respects the bull channel, 60% chances.

Thanks Josep for clearing this.