Market Overview: Bitcoin Futures

The Bitcoin futures are down 60% since the year has begun. Down 73% from the highs, traders are wondering if the price will continue to trend down until $11800, which represents a Bitcoin major drawdown (85%) from the highs. Traders look at this 85% number because it is the size of the prior major market downturn, occurred between 2017 and 2019. Since the 2020/2021 Bull Trend structure was constructive, the chances of Bitcoin holding above $11800 are good; However, traders do not expect any bull trend starting soon. Actually, traders expect lots of Trading Range Price Action between $14470 and $45000 during the next couple of years.

Bitcoin futures

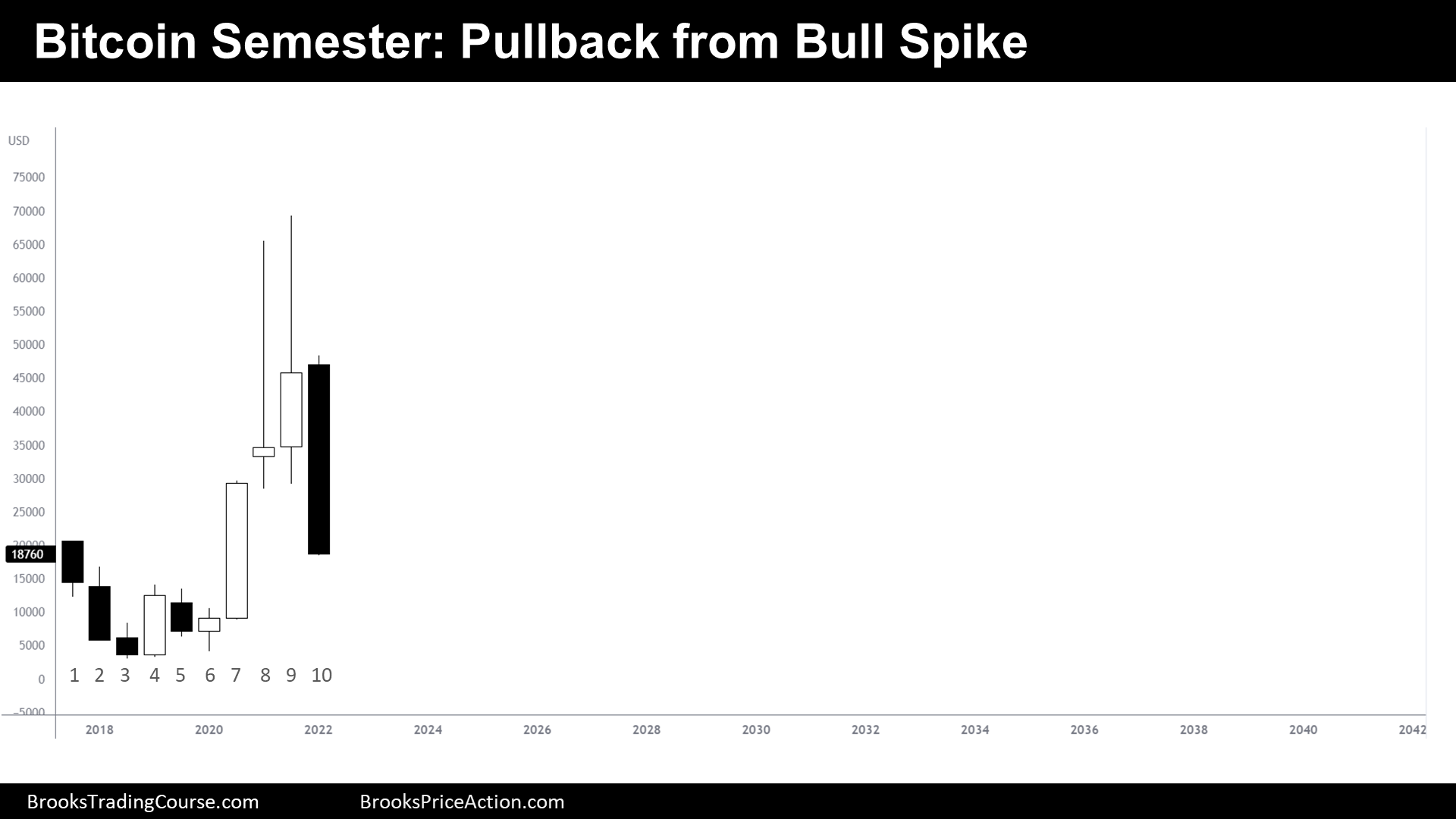

The Semester chart of Bitcoin futures

Context

- This is a Semester Chart. Every bar represents 6 months of trading. The 1st half of a year or the 2nd half of a year. Last week, we got the close of last Semester Bar.

- When we look at a chart, we try to understand the forces behind price moves. This is, we try to understand actual market participants behavior. If we identify properly how they are behaving, we can get an idea of which context will drive the price during around the next 20 bars of the chart. On a Semester Chart, this is, next 10 years.

- Every tick provides new information. This is why, Al prepare us for a dynamic environment, where we should be permanently judging if our premises are still valid.

- Today, this chart is Pulling Back from a Bull Spike (bar 7) that broke up the prior higher high.

- The current Pullback, it is forceful, as it has closed the gap between the high of the Open (bar 1) which was the prior higher high.

- Bulls hope that this is a just the Pullback of a Spike & Channel Bull Trend, that this pullback it is just the start of a Bull Channel. Bears hope that this Spike is a failed Breakout and therefore, the price will fully reverse all prior upside gains.

- Until price do not reverse the Bull Spike, or until it goes sideways for many bars, we should think that this might be simply a Pullback of a future Bull Channel.

- Bull trends that close gaps (as here) and have big Pullbacks are likely Broad Bull Channels.

- Broad Bull Channels can spend a lot of time behaving like a Trading Range, and then do some Bull Spikes.

- With current information (price holds above bar 6, Major Higher Low/ Higher Low Major Trend Reversal), we should expect lots of Trading Range Price Action and another Bull Spike happening within the next 10 years.

- Regarding next bars, after a Big Bear Bar like this past bar, we should see Big Risk. The chances are that Bitcoin will trade at least a bit lower, but this is not an ideal context for selling below this bar, as it occurs after a couple of Trading Range Bars.

- Trading Range Traders usually fade good trend bars within bad context. At the end of the year, we will probably see a doji with a bull body or a bear bar with a big tail below.

Critical Price Levels

- On prior reports, we have said that the prior major high (high of bar 1) was the most important price of the entire Bitcoin Futures Chart since the Bitcoin futures were launched at the Chicago Mercantile Exchange (CME). However, considering that the most critical price of any year, it is the close of the year (it represents the final sentence, the verdict), the most influential price on this chart might be the close of the 1st year of Bitcoin Futures Trading. This is $14470.

- The 2nd most essential price of any year, is the close of June: it is not only the close of a month, or a quarter (March close and September close are the 3rd most important) but the close of a semester.

- $19134 was the final price of this past semester, and will presumably play some kind of important role during the rest of the year, or the next years to come.

What are market participants doing?

- Generally, we can say that there are 4 types of market participants: Trend Bulls, Trend Bears, Trading Range Bulls, Trading Range Bears.

- When Trend Traders dominate a chart, we can spot on the chart how good Stop Entry Setups and good Trend Bars end up achieving Swing Targets (risking 1 portion of their capital, they end up earning 2 portions or more). Another feature of Trend Traders is that they usually start risking a lot regarding their position size, so they need to scale out their position if the price moves in their favor. They do this to balance properly a dynamic trader’s equation. Typically, they scale out a total of 3 portions:

- 1st one at 1:1, 2nd one at 2:1 and a 3rd one at 3:1.

- When Trading Range Traders dominate a chart, we can spot on the chart how good Stop Entry Setups and good Trend Bars end up reversing, at least, a move of the size of the average bar on that chart. Another feature of Trading Range Traders is that they usually Risk a little regarding their position size, so they need to scale in their position if the price goes against them. They do this to balance properly a dynamic trader’s equation. Typically, they scale in a total of 3 portions.

- 1st one is their entry price, 2nd one is at a distance of the average bar on the chart and 3rd one is at a distance of the average bar from the 2nd entry.

- Opposite Trading Styles require opposite Risk Management Strategies.

- When Trend Traders dominate a chart, we can spot on the chart how good Stop Entry Setups and good Trend Bars end up achieving Swing Targets (risking 1 portion of their capital, they end up earning 2 portions or more). Another feature of Trend Traders is that they usually start risking a lot regarding their position size, so they need to scale out their position if the price moves in their favor. They do this to balance properly a dynamic trader’s equation. Typically, they scale out a total of 3 portions:

- It looks like the dominant participants on this chart are Trend Bulls as they have been successful recently.

- They bought above bar 6 (High 2), during bar 7 (Breakout) or above it, and achieved their targets somewhere around bar 8.

- Trading Range Bears knew that Trend Bulls that bought above 7 and did not quite reach their 2:1 target, would happily exit above bar 8; Therefore, Trading Range bears sold above 8.

- For Trend Bulls, it would not make sense to buy right after taking profits. They want to buy lower, probably around where they bought previously, where it worked good for them. That is: Above 6, 7 or somewhere in the middle of 7, during the bull BO (Breakout).

- They will wait to re-enter until there is a good reversal Stop Entry Setup around the mentioned price areas: a Double Bottom or a Wedge Bull Flag. A construction of a setup like this can take a couple of years or more.

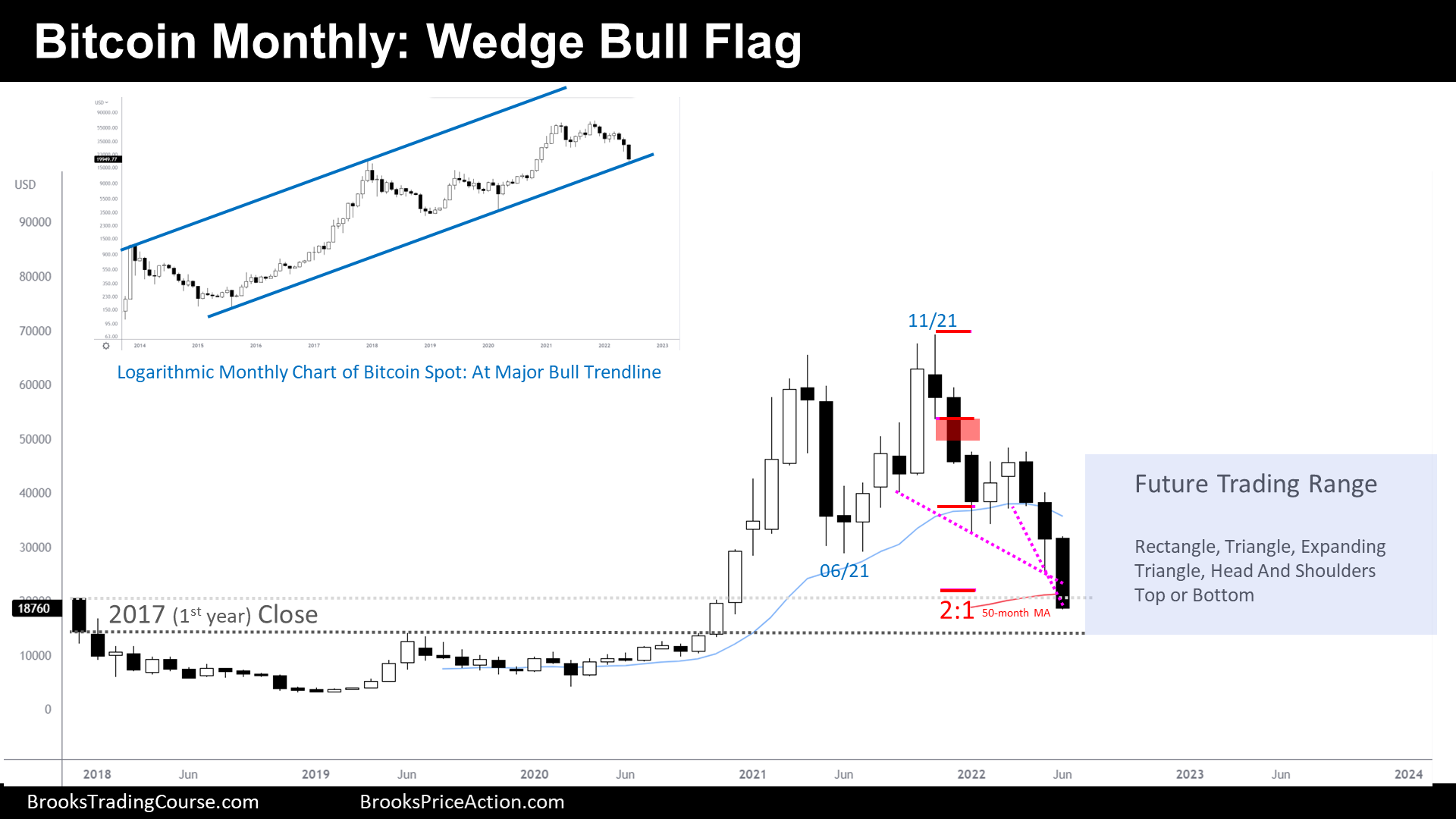

The Monthly chart of Bitcoin futures

Context

- We are trying to break below a Wedge Bull Flag while we are at and near major supports.

- After a 10 bar Wedge Bottom, we should expect 2 legs sideways to up within the next 10 bars.

- July’s bar will likely trade lower, however, as the context it is not good for Bear Trend Traders to sell below June, we should expect to see a tail below the bar.

- Currently, the price sits between the two most relevant prices of this chart: The prior all-time high at $20650 (above) and the 2017’s close at $14470 (below).

- Because the Bear momentum it is so strong and, on this chart, there are no signs yet of Trend Bears taking profits, the price may have to get to 2017’s Close before Bears buy back their shorts.

About Market Participants

- We should start thinking that Trend Bears are the dominant participants of this chart.

- They made a lot of money recently by selling below 11/21 Low 2. They reached their target during this last month.

- A dominant participant drives the price structure.

- If we were those Bear Trend Traders What would we do right after taking profits? Wait until we see attractive prices where to sell, and those prices won’t be far from our recent successful entry. Trend Bears want to sell again somewhere above $45000.

- What are the other participants doing?

- Trend Bulls are disappointed, they were the dominant participants until this month. They will not buy again until they understand that Trend Bears lose control. That and that won’t happen unless we go sideways below $50000 during 20 months or more.

- Trading Range Bulls: They are probably the most active traders in the market right now. They should have seen 06/21 Low as an opportunity to buy below (remember that Trend Bears were not dominant yet at that time). Trading Range Bulls structure their trades, generally, with 3 positions. If the price goes against them, they will scale in lower.

- They will probably add a 2nd position $10000 lower (average size bar), and a 3rd position $20000 lower.

- When they came in, they knew that if the price were to go against them, they could benefit from Trend Bears taking profits around where they were willing to buy with their 2nd position. Good buying pressure in their favor. Math is good for them.

- They currently hold 2/3 position, as the price recently reached their 2nd limit order around $18800. Therefore, their minimum target is $28800, where they could make money on their 2nd entry and exit breakeven their 1st entry. For now, their best target would be $38800, exiting profitably on both positions.

- We should remark that Trading Range Bulls are not good for Trade Bulls, as they add selling pressure (profit taking) during up swings. Trend Bulls are very far from the scene right now.

- Other Trading Range Bulls, instead of buying below significant price lows, will just fade good-looking Bear Stop Entries and Setups around Trading Range lows.

- Trading Range Bears: They are not within their active zone right now; they want to sell higher.

- Probably, they will become active when the price comes back to $28800. They know the following: Trading Range Bulls might start selling, if they do not sell there, good for them as they would sell more around $38800. What if the price continues up? Excellent for them either, as they know that Trend Bears will be active higher, the price pressure will be on their side. Math will work for them from $28800.

The important take here

- Best math will probably work best for Trading Range Traders.

- We started this exercise thinking that the Dominant participants were the Trend Bears, but when we add to the equation that the prior Dominant participants were clearly the Trend Bulls after a Strong Bull Trend (2020/2021), we end up with Trading Range Bulls finding good reasons to support a price fall before Trend Bears become clearly dominants.

- So, we end up thinking that Trading Range Traders will likely control the price structure during the next 20 months or more.

- We should expect a Trading Range between $14470 and $45000 until at least 2024. We should see a lot of price action around $33000.

The Weekly chart of Bitcoin futures

Context

- On prior reports, we have said that we were doing a Sell Vacuum Test of Major Support, a behavior that it is typical of 2nd Legs in Trading Ranges.

- We have said that the test was likely to happen around the prior all-time high; however, we were expecting to reverse soon and close the gap between 05/09 low and the actual price, but instead we continued down and created a new low. Trend Bears (Monthly Chart) are not yet taking significant profits.

- By creating a new low of the 2nd leg while 05/09 low gap remains open, we should think that the bear leg might not be done yet. It is true that we were anticipating at least a small leg sideways to down, this week we might have seen that.

- Still, we are below major supports and seeing passivity towards closing the mentioned gap.

- As we have seen on Higher Timeframes, there are many forces around the current prices that will pressure the price to the upside, and therefore can reverse up the price heavily at any time.

- Trend Bears took profits before 05/09 low, they won’t enter the market until the price retraces around their entry price. We should not expect them to be active below $35000.

- Trend Bulls will become active if they see a reversal from a Nested Wedge at support (prior all-time high, 200-week MA or 2017’s close).

- Trading Range bulls are trapped into their longs. They bought below 01/24 their first position at $32850. They scaled in around $6000 lower a 2nd position (approximate average size bar) and around $12000 lower a 3rd position. Furthermore, they are trapped at $32850, $26850 and $20850 ($20650 is the prior all-time high major price level).

- At $26850 they can Breakeven their entire position, but knowing that Trend Bears (with today’s price structure) won’t sell below their 1st entry, they will probably try to sell with profits around $32850.

- Because of this, we should not expect to trade above $32850 during the next 20 bars. This is the next semester.

- When we spot trapped traders, we must identify where it would be their maximum pain, this is, where or when they will accept the loss. I think that if they are trading this timeframe, they would have entered with a position size that allows them to accept the loss if the price goes to zero; This is how Trading Range Bitcoin Bulls take advantage of this massive volatility. Position size is all.

- Trading Range Bears are not active. They will probably start to be active around the Breakeven price of Trapped Bulls. The math will work perfect for them there as their 3rd position will be around prices where Trend Bears will pressure the price lower.

Important takes here

- Nobody is selling (but irrational/weak bulls & bears), but the price will continue to trend down until Monthly Trend Bears finally take profits.

- When that happens, Trend Bulls will have the opportunity to re-gain control, but they will face numerous resistances along the way as Trading Range Traders will add selling pressure. Therefore, they will likely end up disappointed before reaching their target.

- Trading Range Traders will probably dominate the price structure during the next 6 months; We should expect good trend setups to fail constantly.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Amazing analysis, thanks Josep!

It is our pleasure, we are glad you enjoy them! Another one to come next days.

Thanks Josep for another amazing and detailed report!

Hi Eli! We are pleased to see that you find these reports interesting. Feedbacks are the only way to know if our colleagues find this useful. Thank you very much.

As you can see, I did not forget to show the bull trend line of the Bitcoin Spot monthly chart as you suggested a few weeks ago…, however, I forgot to mention it through the report.

To be consistent with what has been said during the report, I’ll say that this trend line will probably be broken by going sideways during the following couple of years. This idea is consistent with the 70% probability of this trend line being broken to the downside at some point.

Have a productive week ahead, Eli! We hope to find you around here next week.

Thanks Josep, Saw this and much appreciate your efforts. I would have drawn the lines on the monthly chart bit differently. 07/2017 low is the first pullback following the breakout spike whereby this low have started 6 bars tight bull channel that lead to 2017 ATH. 12/18 is a DB with 03/20 that is also a Major HL that raced to 04/21 high that is also weak L1 I think.

Chart is enclosed here

Great analysis Josep. Can I send you a pm? ñ 🙂

Momentum remains down. Lower prices are expected. Strong bulls are selling. Long-term hodlers sold 178k btc. Miners are selling to meet debt obligations and operating costs.

You led with the most important metric of 84-86% pullback. Probably all that matters. Its when buyers will return.

Please see glassnode and txmc youtube for info on who is selling. Whales are selling. Small fish are stacking which is bearish.

Hi Erik,

Thank you for sharing this insights!

Have a great week ahead!

Wouldn’t the strong bulls have sold a long time ago near the top if they were indeed strong and experienced traders?

I believe only the weak inexperienced bulls would be selling out of their positions down here as they attempted to hold through a pullback and hoped for higher prices. What they had hoped to be a pullback turned into a sell-off and they are now exiting after discovering their premise for a pullback was wrong.

Hi Jorden!

Thank your for your comment.

I fully agree with you word by word. Strong Stop Order Bulls cannot be selling because they sold high. So, the only strong Bulls who can sell here are the Limit Order Bulls who started buying around 30k during the recent price drop. I suspect that those Limit Order Bulls have numerous reasons to hold their positions and that the math still works good for them to end up making money; I do not see any reason to change my mind yet. But certainly, it can happen, therefore, Strong Bulls (Limit Order Bulls) can sell here. Your point about inexperienced traders is, in my opinion, very accurate. As Al say: When weak bulls are selling, strong bears will start to buy. This reinforces the exercise of our report.

I absolutely respect and appreciate Erik’s fundamental insights and perspective here, maybe he has a better view or experience on the ecosystem, or possibly, we are analyzing different time horizons.

Thank you for your valuable insight, Josep! Hope to read more from you in the future

Thank you for your kind words, Jorden! I wish you have a great week ahead!