Market Overview: Bitcoin Futures

Bitcoin second bear leg in trading range developing within a bear channel, down 70% from the highs and currently testing a major support: the previous Breakout Point, which happens to be the prior all-time high. This week we have seen some bears buying below the biggest bear bar late in a bear channel.

Bitcoin futures

The Weekly chart of Bitcoin futures

Context

- After a strong Spike & Channel bull trend between 2020 and 2021, the price transitioned into a Trading Range. We could call it also an Expanding Triangle, which is just a type of Trading Range.

- Presently, we are developing a 2nd bear leg in a Trading Range.

- From the high of the 1st leg to the high of the 2nd leg, we can draw a bear trend line, representing a Bear Channel. Bear Channels break to the upside 70% of the time.

- During the Bear Channel, important gaps were closed, warning traders that this channel is contained within a Trading Range.

- 2nd legs within Trading Ranges are commonly bear traps.

- The current 2nd bear leg is attempting to break below the Trading Range, but this is more likely a sell vacuum test of support.

- The most emblematic price level of this chart it is, possibly, the prior all-time high, which is also the exact price of the open of the Bitcoin Futures when they launched late in 2017. A week ago, the bears achieved that level. Currently, we are watching carefully the price action around it.

- This week is the first bull bar closing above its midpoint, since 03/21. This should remind traders that bears have been forceful since then and therefore, expect selling pressure during hypothetical rallies.

Bear Goals

- We are still within a bear channel, and hence, we should keep looking to downside targets.

- Conquered goals:

- 2021’s low (prior bottom of the Trading Range).

- 200-week moving average.

- 2017’s high (prior all-time high).

- Measured Move based on Bear Flag (03/28 high & 02/22 low)

- Next supports:

- 2017’s close, which is also the 2019/2020’s Trading Range Top and therefore, is presently a Breakout Point at $14470. 40% chances to get there.

- 2nd leg measured move: If we measure the 1st bear leg between 11/08/2021 high and 01/24 low, and we consider that the 2nd leg starts on 03/23 high, this measure would project a 2nd bear leg to $12000.

- 85% correction is at $10400 (the previous and only major correction on Bitcoin futures was an 85% correction).

- Prior Higher Low Major Trend Reversal at $9905.

- Pandemic Low at $4210.

Bulls hope

- Bulls hope that bears are exhausted, and taking profits after testing last decade’s all-time high.

- They see the following signs of bear trend exhaustion:

- Gaps:

- The only important gap that remains open happened at an advanced stage of the trend, between 01/24 low and 05/31 high.

- We consider a trend sustainable when gaps are at the beginning or at an intermediate stage of the trend, not later.

- This enforces the idea that this second bear leg it is just a vacuum test of support and, therefore, a bear trap.

- A Nested Wedge Bottom:

- Between 09/20/2021, 01/24, 05/09 lows.

- Between 01/24 or 02/22 and 05/09, 06/13 lows.

- And a parabolic one between 04/11, 05/09, 06/13 lows.

- Measured Move price targets: Price just arrived at a Measured Move target based upon the prior bear flag: between 03/28 high and 02/22 low. If the price continues to fall, there is another projection that can be made from the bear flag: between 03/28 high and 01/24 low; this projects the price to $17000.

- Moreover, as we can see, one of the biggest bear bars of the trend was a week ago. When this happens at an advanced stage of the trend, could attract profit takers.

- Gaps:

- Bulls foresee a future with the price testing the 2021 close. This price, it is also around the middle of the Trading Range, and therefore it is an essential price level that could be considered as a price Magnet. For now, we are far from that scenario.

- Most likely, the best bulls can get during the next several months is a Trading Range between the final 2nd bear leg low and 01/24 low. That is a Trading Range embedded into a Trading Range.

- Why 01/24 low? After 05/31 attempted to close the gap between its high and 01/24 low. It failed. More important, price created a new lower low in the bear trend. That may imply that around 01/24 low there may be strong bulls trapped into longs. What would they do when price revisits their wrong entry? They will sell, believably.

- There are different types of Trading Ranges:

- Rectangular, Triangles, Expanding Triangles and Head and Shoulders.

- We should expect the price to draw one of those type of Trading Ranges during the next following months between the final 2nd bear leg low and 01/24 low.

What to expect the next few weeks

- Being at a major support, increases the odds for a bull bounce soon, at least to test the 05/09 low. The problem for the bulls is that this current bear leg has been so strong that traders expect another leg sideways to down.

- During the next week we will assist to the close of the monthly, quarterly and semester candles, therefore, the price of the close of this month will be supercritical for the rest of the year, especially for the upcoming weeks.

- Bulls want to close the month above $25800 because that means that we close above the midpoint of the monthly bar. It will be a sign of weaker bears. As we have not seen bulls buying (just some sellers buying), the price will likely close below $25800.

- Last week, we have said that this week should be a disappointing bar for bulls and bears, but more bullish than bearish as price was sitting on a major support.

- So far, this week, we had a small bull bar closing above last week’s close.

- During the week, price traded below last week’s bear bar, and there were buyers (bears buying back their shorts).

- Last week, we have said that bulls won’t be aggressive because bears were not taking profits at all. This week, we have seen some bears taking profits. The bulls want another bull bar as a follow through bar this week, that will mean that bears are still taking profits.

- There should be buyers below the current bar and especially around the close of the weekly bar a week ago. If we test that close, traders will watch carefully: buying pressure could mean that bears who sold that close are leaving and, hence, increases the potential for a future bounce.

- What if instead of a bounce, we continue the trend down? As we are in a Bear Channel, that won’t be surprising. When something it is not going to surprise us, we assign, at a minimum, a 40% chance of that happening. That means, there is a 40% chance at least that the price could reach the next support, at around $14500.

- That being said, what we expect is a test higher to 05/09 low the next following weeks.

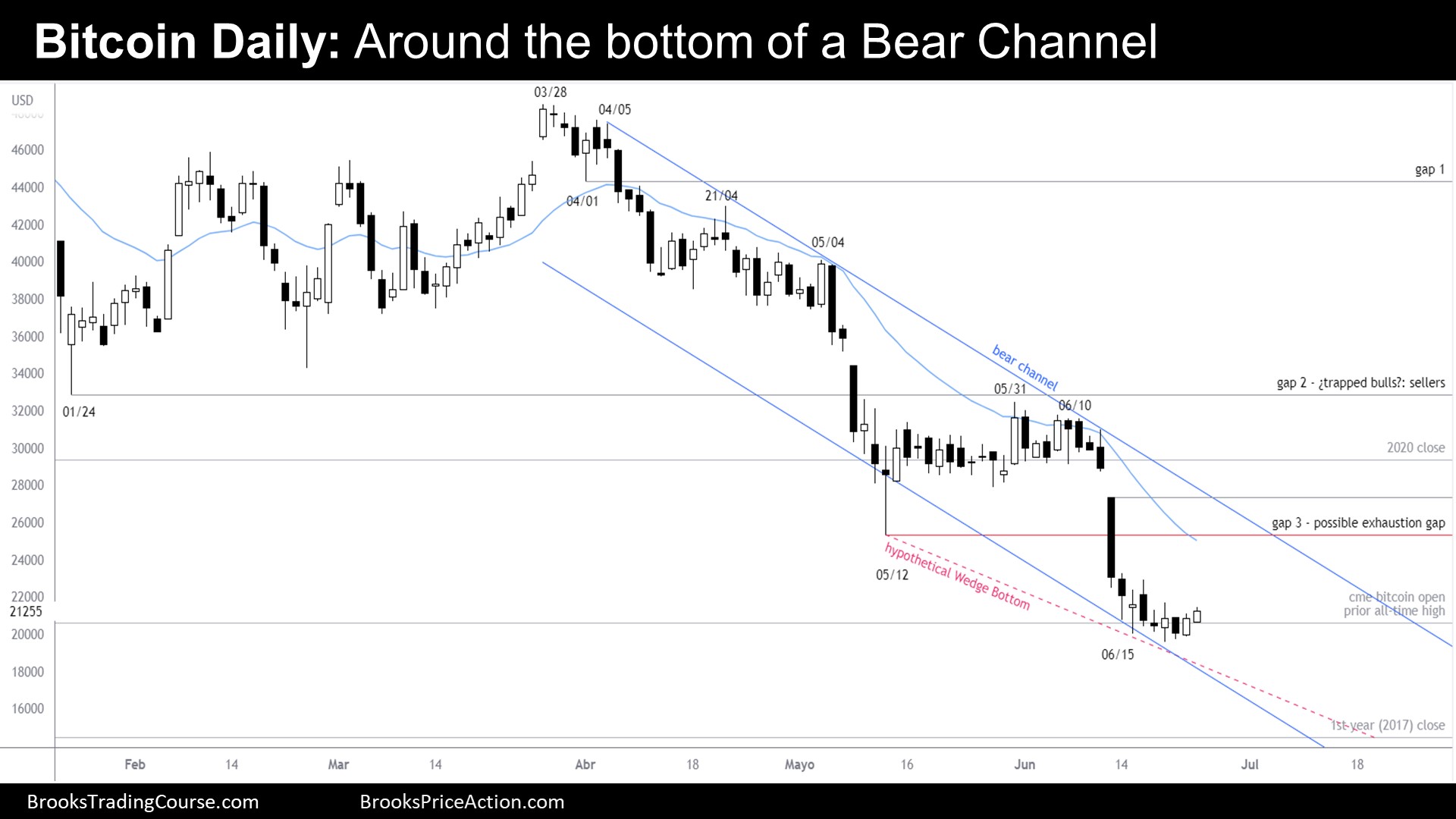

The Daily chart of Bitcoin futures

Context

- Price is in a strong bear trend, contained into a Bear Channel.

- We are around at the inferior side of the Bear Channel, where it is harder to sell good bear setups.

- The trend has been strong: maintains open gaps around the beginning and middle stages of the trend (gap 1 and gap 2 on the chart).

- A strong trend like this, has a great probability (even greater than usual) of transitioning into a Trading Range instead of a Major Trend Reversal.

- However, the price just reached a major support on higher time frames. This is a candidate end of the trend.

- Nevertheless, the price keeps a 3rd gap (gap 3) open, which happened late in the trend. While this gap is open, bears still have chances of continuing down.

- At current prices, it is hard to believe that strong bears will sell. Most likely, they will first “test the waters”, that means, testing gap 3. Tests occur normally when sellers stop selling, a test is just a check to see if there are buyers around (bearish case).

- If gap 3 does not close after the test, there will probably be more downside to come. In this scenario, bears foresee a Wedge Bottom between 05/12, 06/15 lows and a hypothetical one at around $14000.

- If gap 3 closes, bulls and bears will look ways to buy. That means, the bottom of a future Trading Range is forming.

- During the whole Bear Channel, there was not any complete bar above the 20 EMA. When that happens, we expect sellers.

- There are likely trapped bulls around gap 2, we expect them to sell around there. Bears know that and will also look to sell around gap 2.

What should we expect over the next few days

- Last week, we said that we should expect a pullback starting this week, and this is what has happened.

- Tuesday was the first bar of the week (Monday was a holiday), an outside bar, that closed above its midpoint, but had a prominent tail above.

- Wednesday was an inside bar; Therefore, we had a breakout mode pattern: an “ioi” at a major support.

- Thursday, by trading above Wednesday, triggered the pattern on the upside.

- Friday, we had a bull bar.

- If there is a good bear bar on Monday, that could be a failed ioi, and therefore, a Low 2 bear flag. The problem for the bears is that we are at the inferior side of a bear channel, and as we have seen on the previous report, good bear setups are do not respond well around here.

- This leaves traders thinking that there are buyers below the last few bars. Are there buyers above bars? More likely, there are no sellers.

- What are the odds of a bear breakout? That would be a bit of a surprise, as Bear Channels only break on the downside 30% of the time. There is a 70% chance that of sideways to up trading during next bars.

- We should expect a test of gap 3 within next 20 bars.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

If you watch Video 26B – The slides on “Bad looking patterns” and Video 16A the section on “Bad Symmetry”. I would doubt the lower trend line on the expanding triangle on the Weekly chart is likely to be respected.

Hi Kevin, thank you for your comment and for the reference. I agree with your observation. I draw that line just as when we draw a parallel on a channel where there is no reference yet on the other side (in this case inverting the direction).

I think of it as a concept, not as a strict support. Let me go deeper into the concept of this Expanding Triangle (ET):

This ET comes from a bull trend and formed an upper line. This means that all the strong bulls, who bought during all the bull leg, even at the very top of it, made money or certainly avoided the loss. Those strong bulls won’t add any selling pressure during a fall in the price, they never got trapped. Instead, what would they do? Wait until the trader’s equation presents them an opportunity within this new current environment they are in: a Trading Range.

The area where they will look to reenter the market, is the bottom third of the Bull Trend. First, in the upper zone of that bottom third (current prices) and, if it fails, around where the bull trend started. Hence, all this area between current prices and around 10k is where strong bulls are waiting to buy. However, they will not buy until they see strong bears buying, and strong bears won’t buy until they see weak bears selling. And here we are, around where weak bears want to sell.

Finally, I would love to remark that your observation, in my opinion, is absolutely correct; Above I have just tried to justify why I will keep that line on the chart.

I wish you a great week ahead, Kevin!

Kr,

Josep.

I don’t think negating an upward-facing channel line into a downward facing trend line to make an expanding triangle is something Al Brooks teaches or advocates…. But understand I why you feel there’s some bigger range playing out here and are looking for a theoretical bottom – or at least some form of intermediate support before a move lower, it feels like that’s the case, like there should be something here. I’m glad you agree about the trendline, I don’t think that’s the support that traders are watching.

I’d suggest looking at a logarithmic chart if you want a real idea of price action on Bitcoin. It’s a spike and channel and a possible wedge. And the bottom of the channel is $300. there’s a significant gap between the first and second pushes in the wedge which isn’t ideal for the bear case. Bears made money buying at the Jan ’18 swing high, but its the first time they’ve made money since the Nov ’13 swing high hasn’t been retested – that’s technically not a wedge yet – according to Al’s rules. There’s definitely reasons for the bears to be encouraged (for the first time ever), but the bulls aren’t done yet.

See Trading View Chart

I think logarithmic charts are important with things like bitcoin. Because these days a $1000 dollar move happens in just one day and is just a 2-4 percent change. But just a few years ago a $1000 move would have doubled the price of the asset for a 100% gain and would have taken weeks/months to play out. A normal chart cannot capture such massive changes like a logarithmic chart can. 100 point today is nothing, but years ago a 100 point move was massive. That’s what a log chart helps to capture.

I will watch your updates with interest. Bitcoin started my trading journey 7 years ago. I’m a crypto sceptic now but I think that anything that gets a new generation of traders interested in trading is brilliant and bitcoin certainly does that.

Wow! Great insights, this is a very constructive comment. Thank you again, Kevin.

Next week I will talk about higher timeframes charts and I must use a logarithmic chart for sure; otherwise much information is missing, as you pointed out. However, I will keep observing the CME Futures chart, not only because it is useful to have a price consensus, but also because I feel that the information since then is more relevant. As we see, almost 5 years later we are around the price of the CME open. Still, I must admit that this might be just a vague opinion. In case the price fall below the CME futures historical low, definitely I’ll need to check past references.

I’ll be delighted if such a good analyst keeps reading the Bitcoin report updates. I’ll expect to learn more from you, as I see that you are a purist, and this is something that surely helps me and other disciples to understand better and deeper the concepts taught by Al.

Thanks Josep for another great and comprehensive report. In view of higher time frame assuming price is a round where we are: monthly we get first complete bar below 20ema and quarterly first touch of 20ema after consecutive 8 bars above. In both TF prominent tail bottom and price is above 2017 ATH close. What weight do you give this to the bullish scenario?

Hi Eli! Thank you for commenting again with such great insights, which I should definitely include on the upcoming report, as I will include the bull trend line you mentioned last week.

I will think deeper about higher timeframes charts after the monthly bar gives us the verdict…

But vaguely speaking, I think that the bull trend or spike was constructive, since there are gaps during early stages.

That means that there are areas, like the one we sit on, or the prior higher low (below 10k) where bulls can objectively build positions.

With current information, it won’t surprise us a price around 45k at some point within next 5-10 monthly candles. I am not convinced that a price above that levels, or below current levels, can be sustainable.

Anyway, once I work with the corresponding charts, I’m sure I will get a better sense of what is going on there.

Wishing you a great week ahead.