Market Overview: Bitcoin Futures

Bitcoin futures surge from support. The price barely decreased -0.36% of its value this week, after gapping down after the prior weekly close. Moreover, bears were unable to close, again, below the Head and Shoulders Bottom (HSB) breakout point and the 20 Exponential Moving Average (20 EMA).

Bitcoin futures

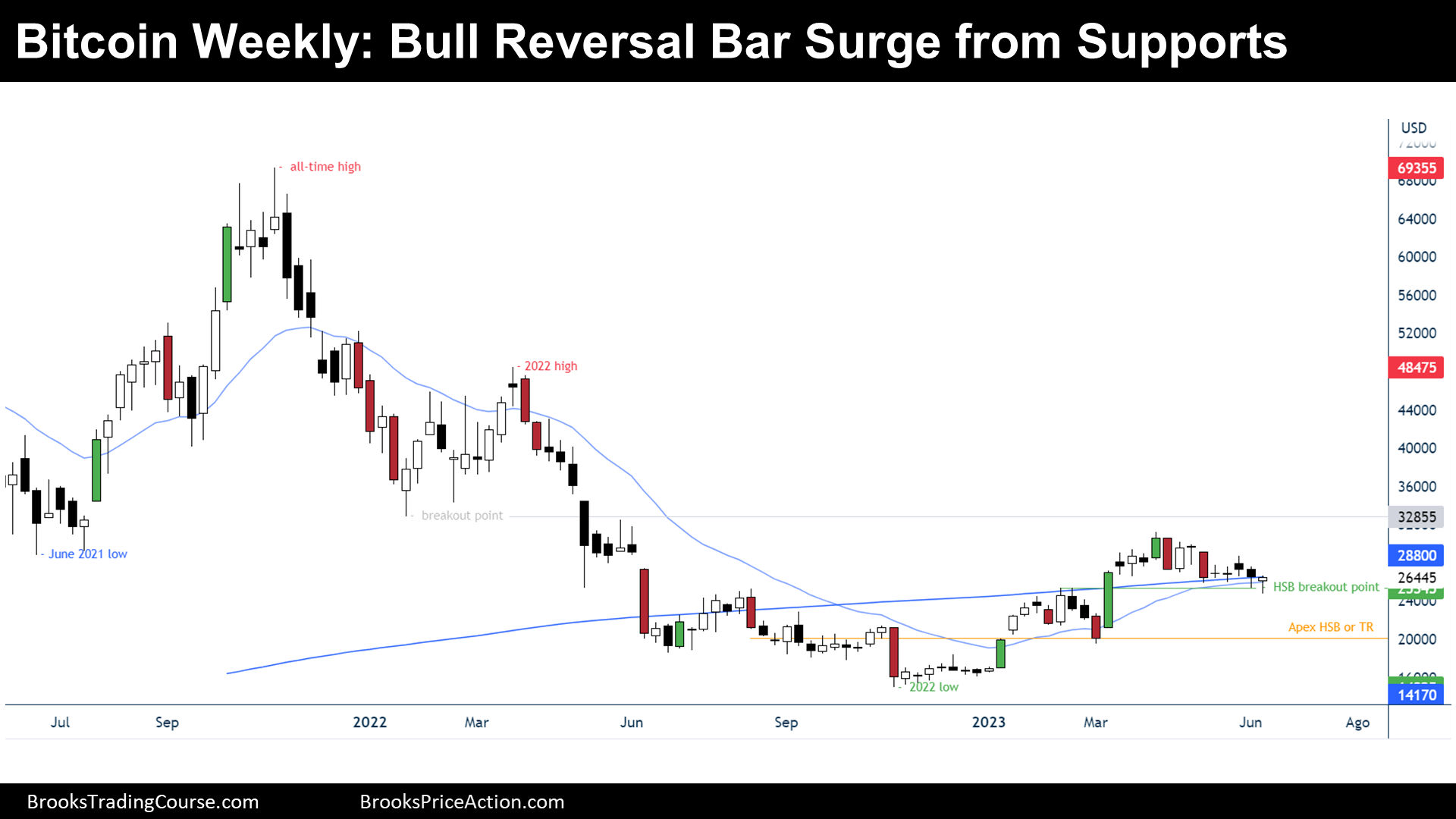

The Weekly chart of Bitcoin futures

*Green bars are bars with more than 70% of bull body. Red bars are bars with more than 70% of bear body.

Analysis

- This week’s candlestick is a bull reversal bar with a small bull body. The bar gapped down and then tested the low of the prior week and the HSB breakout point, and then it reversed up. The bar closed above the 20 EMA and slightly below the 200 Simple Moving Average (200 SMA).

- The past five bars have tails, which means that the price tends to reverse. The past 13 weeks, the price has been in a tight trading range, also sideways to down.

- A Tight Trading Range is Breakout Mode: 50% that it will break one side or the other.

- Currently, bears tried for a second consecutive week, a break below the Tight Range, but they are failing, and hence, bulls see this as a bull flag.

- Bulls:

- They see this surge from support as a reversal up that will break above the upper trend line of the bull flag.

- Then, they expect a continuation of the 2023’s bull trend and get, at least, to a Measured Move up based upon the size of the HSB (shown within the previous report).

- Ultimately, they want to reverse the whole 2022’s bear trend.

- Bears:

- They need a bear breakout below the bull flag.

- Then, what they will probably get is a test of the higher low or the Apex of the HSB.

- Ultimately, they aim to get back to the 2022’s low.

- We have said that there is about a 50% chance for either participant; However, I think that until there is not a breakout of the bull flag’s trend line, the price it is more likely to trade down until the Apex of the HSB.

Trading

- Swing Bulls:

- This week’s candlestick, is not a good bull signal bar since the body is small, and it closed below the 200 SMA.

- The bulls require a strong breakout of the bull flag’s trend line before buying.

- The context is not bad because of the surge from support, but they need momentum and for now, there is not.

- Swing Bears:

- This week’s candlestick, it is not a good bear signal bar, since it is a bull body that and a surge from support.

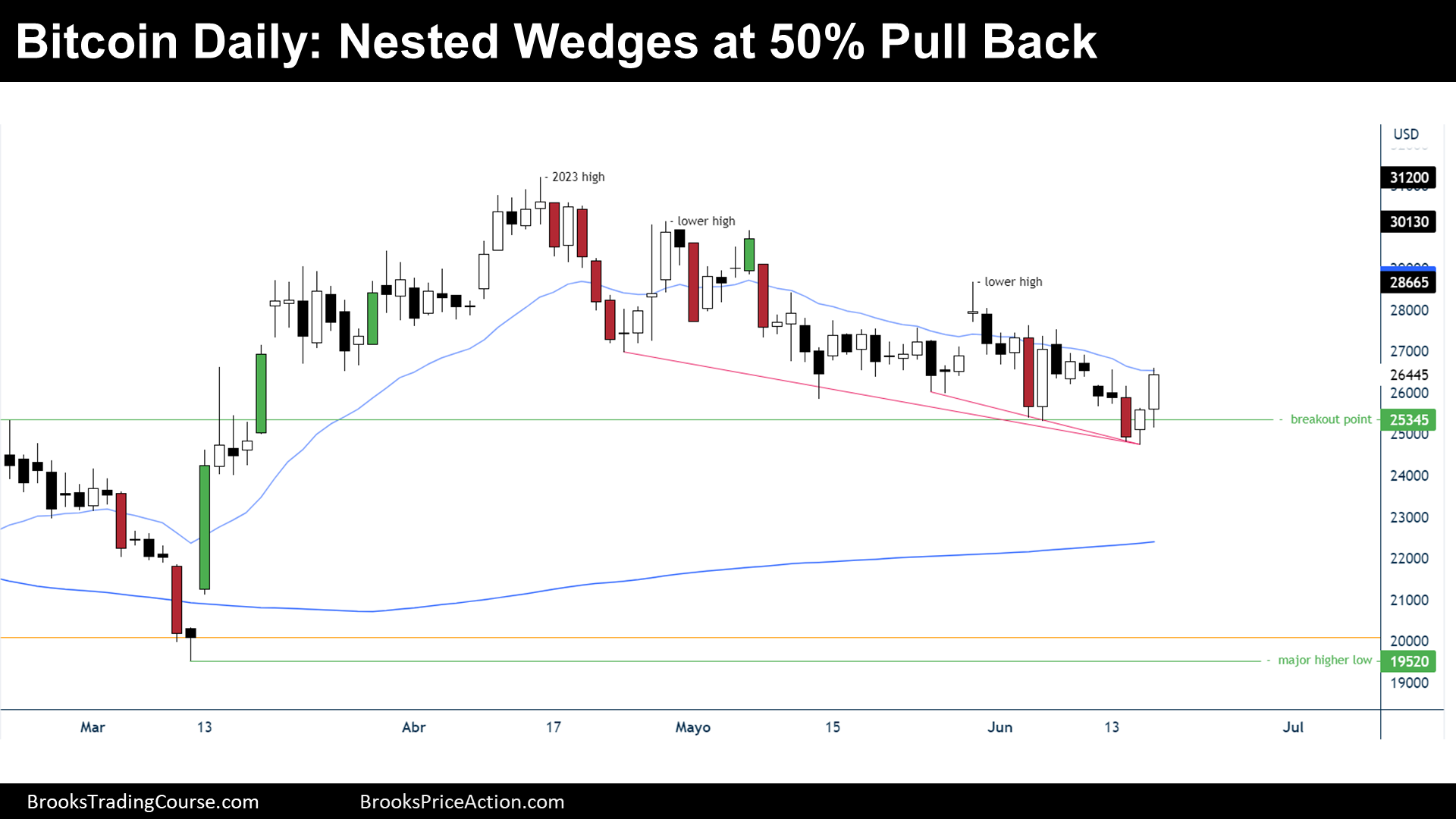

The Daily chart of Bitcoin futures

Analysis

- During the week, the price did a bear breakout of the HSB breakout point, and then it reversed up from a nested wedge bottom, creating two consecutive bull bars by the end of the week.

- The price, more than within a bear channel, it is within a Bear Trending Trading Range.

- The Bears want to sell double tops, scalp some and let some run.

- The Bulls intend to buy below lows and scalp.

- At some point, there might be a measured move down, since bears are accumulating shorts.

- Bulls:

- There is a price surge from supports, but they need a strong bull breakout, or a breakout of a double top, or a failed double top, before thinking that the bearish inertia is over.

- Bears:

- They want a reversal down from the 20 EMA, or a double top from prior lower highs.

- Moreover, they want a bear breakout below the nested wedge bottom.

- Ultimately, want to get to the 200 SMA or a measured move down based upon prior bear flags.

Trading

- Swing Bulls:

- Some might want to buy above Friday’s bull bar, but the price it is still below the 20 EMA and, more important, there are a lot of limit order trading on the left. Most 2-bar breakouts fail within trading ranges. Bulls scalps that are buying below lows will probably take profits here, adding selling pressure.

- The bulls probably need more consecutive bull bars, or a bull surprise before buying.

- Swing Bears:

- They can sell a bear breakout below the nested wedge, looking to catch a hypothetical bear momentum surged from retail swing bulls stop losses (sell stops at market) that bought the bullish surge from supports.

- Moreover, they can sell a reversal down after a double top.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.