Market Overview: Crude Oil Futures

The Crude oil futures is forming a crude oil second leg sideways to up from a higher low major trend reversal (Oct 18) on the weekly chart. It is the second leg up re-testing October 10 high. Bulls want a follow-through bull bar after breaking above the 20-week exponential moving average and bear trend line. The bears want a reversal lower from a double top bear flag with the October 10 or August 30 high or around the 20-week exponential moving average.

Crude oil futures

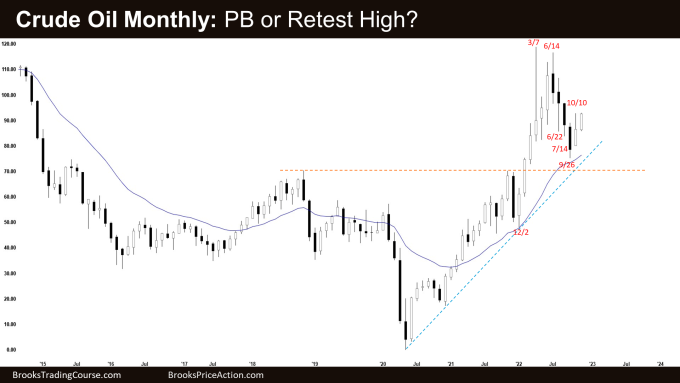

The Monthly crude oil chart

- The October monthly Crude Oil candlestick was a bull bar with a long tail above.

- Last month, we said that the odds slightly favor sideways to down.

- October gapped up and did not trade below the September low. It traded above September high but closed below it.

- The move down since June is in a tight bear channel. That means strong bears.

- The bears want at least a second leg sideways to down retesting the September low after the current pullback.

- The target for the bears is the 20-month exponential moving average.

- The prominent tails below the bear bars indicate the bears are not yet as strong as they would like to be.

- The bulls want a reversal higher from a wedge bull flag (June 22, July 14 and Sept 26) and a micro trend channel line overshoot in September.

- They see the current move down since June simply as a deep pullback following the buy climax and want at least a retest of the June high.

- Since October is a bull bar, it is a buy signal bar for November. However, the long tail above makes it a weaker buy signal bar.

- November has traded slightly above October. The bulls need to create a follow-through bar to increase the odds that the deep pullback has ended.

- For now, odds slightly favor sideways to up in the first half of November.

- Traders will see if the bulls get a consecutive bull bar, or if Crude Oil trades higher first, but reverses to close with a bear body or has a prominent tail above.

- If November closes as a big bull bar near its high, the odds of the deep pullback ending and a retest of June high increases.

- The US Government plans to refill the SPR (Strategic Petroleum Reserve) at some point around $67-72 which will likely provide a floor on price and prevent a sharp crash. (Source: US to complete 180 million barrel drawdown…)

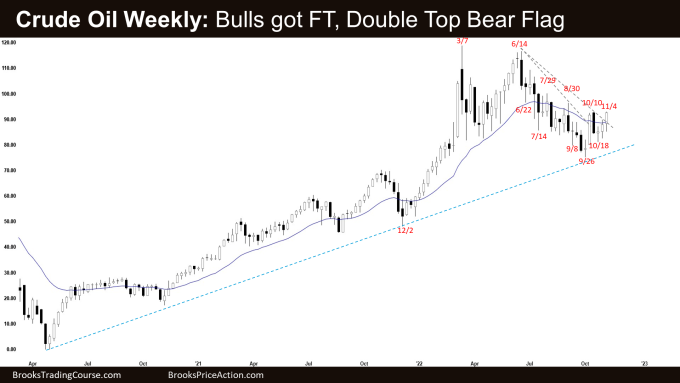

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a bull bar closing near its high.

- Last week, we said that odds slightly favor sideways to up and traders will see if the bulls get follow-through buying.

- The bulls triggered the High 2 buy signal and got strong follow-through buying this week closing above the 20-week exponential moving average and bear trend line.

- Bulls want a reversal higher from a wedge bull flag (June 22, July 14 and Sept 26) and a lower low major trend reversal.

- They then got the second leg sideways to up from a higher low major trend reversal (October 18) re-testing October 10.

- The bulls will need to create consecutive bull bars closing near their highs breaking far above the bear trend line, and the 20-week exponential moving average, to convince traders that the correction may be over.

- Next week, they need to create a follow-through bull bar to confirm the breakout above the bear trend line and the 20-week exponential moving average.

- While the move down since June was in a tight bear channel, the candlesticks had a lot of overlapping price action. The bears are not yet as strong as they could have been.

- The bears hope that the current move is simply a 2-legged sideways to up pullback and want a retest of the September low.

- They want a reversal lower from a double top bear flag with the October 10 or August 30 high or around the 20-week exponential moving average.

- They want next week to close with a bear body even though Crude Oil may trade slightly higher first.

- Since this week’s candlestick is a bull bar closing near the high, it is a weak sell signal bar for next week.

- Odds slightly favor Crude Oil to trade at least a little higher next week. Traders will see if the bulls get a follow-through bull bar or fails to do so.

- If next week trades higher but reverses to a bear bar closing near its low from a double top bear flag, the bears may attempt to retest the September low.

- The US Government plans to refill the SPR (Strategic Petroleum Reserve) at some point around $67-72 which will likely provide a floor on price and prevent a sharp crash. (Source: US to complete 180 million barrel drawdown…)

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.