DAX 40 bear surprise last week at the 20-week moving average (MA). The bears got a successful moving-average gap bar sell signal at a double-top. Now we are sitting at the 200-week moving average. It’s not as bearish as it could be because we didn’t create a new low and the bulls will look to buy below here for a wedge reversal. The bears want this to be a larger second leg down from January, but the bulls have been buying below bars so market might pause here to go sideways

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures weekly was a bear surprise at the 20-week moving average (MA). The bar closed on its low so we may gap down next week.

- The bulls see a breakout pullback of the bear trend line. They see we’re still on the buy from the double bottom, higher low major trend reversal.

- Who is selling? The bulls who went long might be closing here.

- Bulls see support at the 200-week MA and expect another bounce for a wedge bottom reversal and a measured move up.

- They want a reasonable-sized bull bar, hopefully, one that trades below the lows of this week and finishes up. Limit order bulls have been buying below bars at this level before and making money so it is likely they will do it again.

- For the bears it was a moving average gap bar sell signal and at the top of a 16-week trading range. They see it as the start of the second leg down like in February and March, but we might have already had it.

- It’s a bear surprise so traders expect a second leg, but the context is bad. If you were short, here is a good place to take profits and the bulls know it.

- It’s a double top breakout test of the trading range above, but the range is narrowing so on a higher time frame it’s breakout mode, 50/50 either way. Traders will continue to scalp until reasonable stop entries appear for swings.

- We said last week bears would sell above bars as they had done for several months now and this remained true.

- For stop order traders it has been a difficult environment with many reversals.

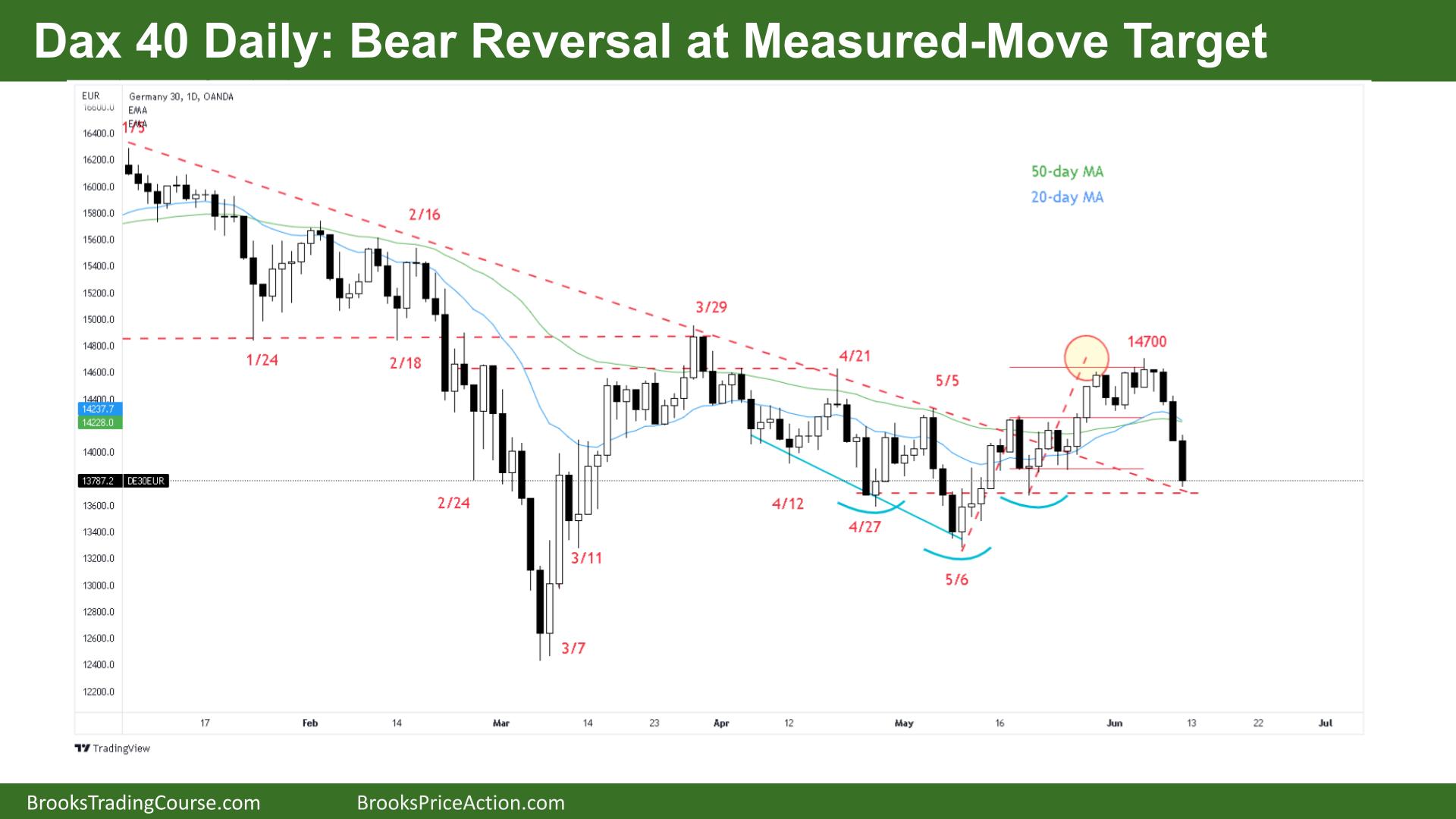

The Daily DAX chart

- The DAX 40 futures was a bear bar closing on its low so we might gap down on Monday.

- It was 3 big consecutive bear bars closing on their lows so we are always in short, but right in the middle of the March range. Traders will expect a second leg sideways to down.

- The bulls reached their measured move target from May 6th and then we sold off. They expected two legs sideways to up and got them.

- They see a higher low major trend reversal from March 7th and we are back at support near the right shoulder of the inverse head and shoulders buy setup.

- It’s a breakout test of the bear trendline right on the line, so that might cause bears to take profits before deciding on swinging lower.

- Bulls want a sideways pause bar next week and a High 1 buy setup to trade back up into the range, but the context is bad — 3 bear bars. The first reversal is likely to be minor.

- The bears see a bear surprise, failed breakout above the trend line, a failed inverse head and shoulders. They see a double top at the prior trading range and expect the first reversal to be minor so will sell above bars.

- Bears see we paused at the right shoulder and prior lows, if bears have exited we might need to go sideways before a second leg.

- Holding trades into the weekend is a good sign for bears next week, so a close below April 27th would be even worse for the bulls.

- We have been saying that the February 24th price has been a magnet for many months now and might be the middle of the range, or at least a magnet so if we do go down, it might not be far from here.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.