Market Overview: DAX 40 Futures

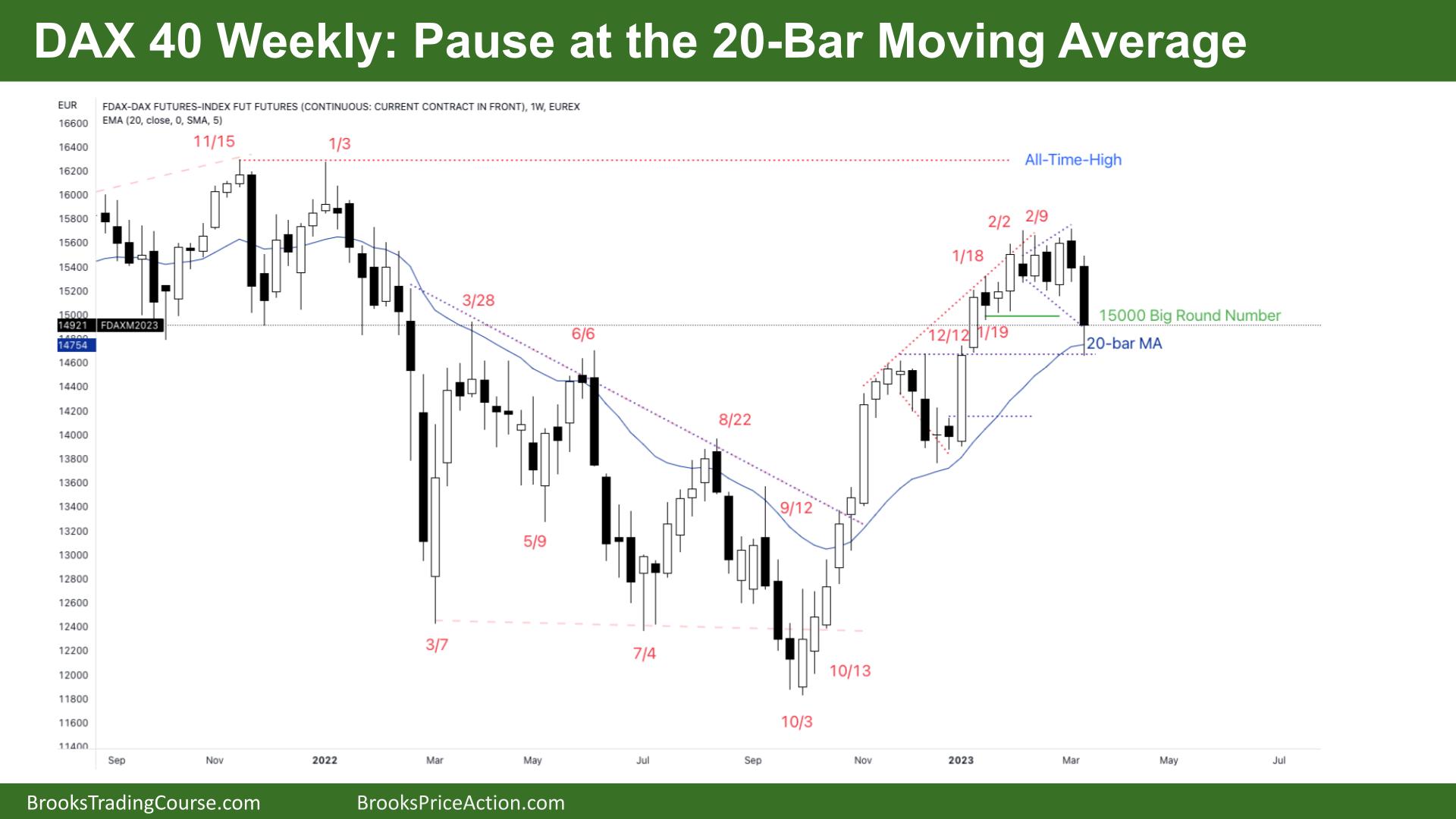

DAX futures moved down to the 15000 Big Round Number last week. We closed as a pause at 20-bar Moving Average. It is a test of the breakout point, and judging by the tail on the bar, there were many bulls happy to buy here and lower for one more leg up. The bears want this to be the end of the bull trend and looking to sell higher, betting on a trading range.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a bear bar closing near its low with a small tail and a pause at the 20-bar moving average (MA.)

- It is consecutive bear bars after a tight trading range and possible final flag.

- The bulls had a bull channel, and it was tight because it never went always in short. There were buyers at the MA on both legs. So what is next?

- The bears see a failed breakout above into the higher trading range above. It is a deep pullback from the bear spike before. They are looking for continuation with a small bull barn next week and a second leg sideways to down.

- But the bears have only just made money in 3 months – stop entry bears were losing constantly. So we might be transitioning into a trading range.

- The bulls know the best the bears can get here is a trading range – so they will look to fade any weak legs.

- The bulls need a small bar for a reversal. A small gap is still below, so we might need to go down first before going sideways. Other legs spent about 4 weeks before reversing.

- The bears want a followthrough bar or a doji – something they can sell above to reduce risk.

- The big bar was likely many bulls taking profits. There might be a better sell signal above the high of this last sell climax bar rather than a stop entry below.

- Selling at the MA in a bull trend is a low-probability trade.

- Better to short or flat – bears could take some profits on Monday.

- Because it is a pause at the 20-bar MA – it might be better to see what is below it before placing a trade.

The Daily DAX chart

- The DAX 40 futures was a bear bar closing near its low, so we might gap down on Monday.

- Thursday was. High 1 buy setup, but it had a small tail. It was a reasonable but low-probability swing. It is a higher probability of waiting for a High 2 and a better bull close.

- The bulls see a pullback to the breakout point – the bears closed the gap, and we are reversing here. The bulls might expect another leg up and test of the high.

- But we have been going sideways here for many weeks, which could end the bull trend.

- The bears see a higher high double top and strong bear surprise with follow-through. They see the wedge, but the bars are so big they want another leg down.

- The best the bears can get is to the tight trading range below. So they will probably scalp.

- Remember, the bears have not been making money for many months. So this is the first strong move, but not enough to change the trend.

- Better to be short or flat. Next week may have a decent buy signal for the bulls so that bears can get out above it.

- On the weekly chart, we have a pause at the 20-bar MA, so let’s see whether we get a continuation or a reversal here.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.