Market Overview: DAX 40 Futures

DAX futures were in a tight bull channel last week. Traders are deciding if it is a possible bull leg in a trading range. The bulls are at one measured move target and want the swing target above. The bears want to sell to keep the price in the range below. We are in a tight bull channel so most traders should be long or flat. Traders will likely buy below the low of a prior bar.

DAX 40 Futures

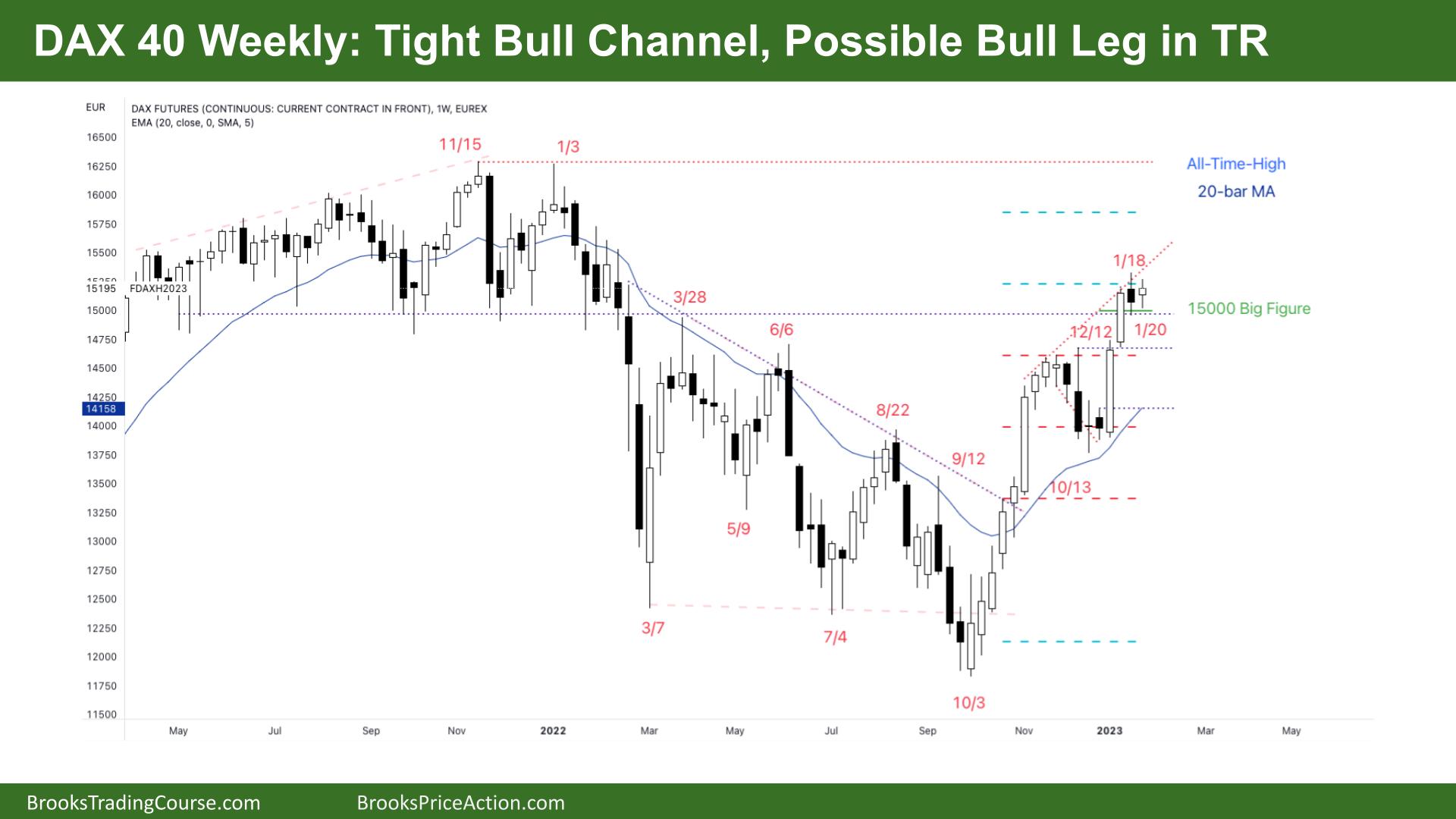

The Weekly DAX chart

- The DAX 40 futures was small bull doji last week that did not go below the low of the prior bar, a bear doji.

- It is a pair of dojis in a DAX 40 tight bull channel after consecutive big bull bars closing on their highs.

- We are likely always in long, so traders should be long or flat. Some traders will exit below the low of a reasonable bear bar, closing below its midpoint.

- Other traders will look to buy for a scalp long below the low.

- If the price falls below the last fortnight, we might move down quickly as bulls exit.

- The bulls see a tight bull channel. We broke strongly above a bear trend line from a wedge bottom, and traders expected two legs sideways to up.

- Both sides see we did not reach the moving average before a surprise bull bar indicated urgency.

- Leg one was so strong traders expected a second leg and possibly a third.

- The bears see a deep pullback to test the breakout point from 12 months ago.

- They see this as a test of that range and will look for a second entry sell signal. Selling a Low 2 high in a trading range is a reasonable strategy.

- The bears want to break below the prior swing high on Dec 12th. But where are the consecutive strong bear bars? Most bears will scalp on this time frame until they see them.

- The bulls will likely buy a pullback to 50%, to the prior swing high and the moving average so at best the bears can get is a trading range from here.

- The bears know this and might look to sell higher. The two consecutive bull bars are late accelerations in a bull trend, which can lead to profit-taking.

- Selling above those possible bull climax bars will get a better risk to reward even though low probability.

- We are at 15000 Big Figure, so we might need to go sideways here for a few weeks as traders reposition for the move back up into the high range or for a lower retracement. Expect sideways to up next week.

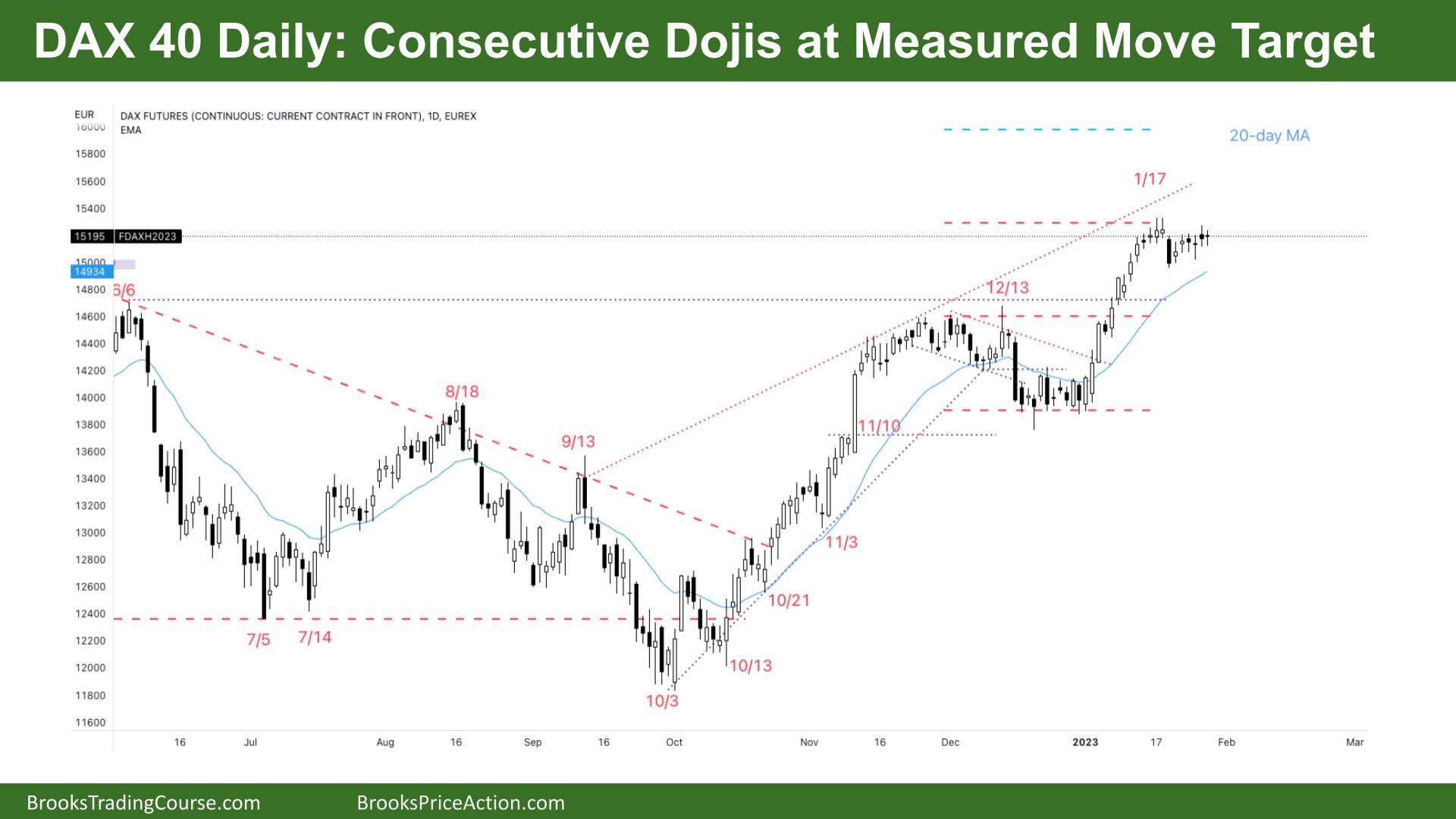

The Daily DAX chart

- The DAX 40 futures was a pair of bear dojis on Thursday and Friday. A weak close into the weekend.

- Both traders see the tight bull channel up, and probability is a spike and channel bull trend.

- The bulls want a pullback, an ABCD correction, two legs sideways to down, to the moving average and a trend resumption of another leg. They might get it.

- The bear surprise on the 18th was big but lacked follow-through. Some bears will wait to see a break below that to get short.

- We are always in long, even though some bulls exited during last Thursday’s bear trend day. We did not trade below it. That is important. Bulls are buying below.

- If limit bulls are making money, we can expect limit bears to try and sell above the highs.

- The bears see a possible final flag and want a double top to get short back to the moving average. Most traders should not be short until there is a stronger daily signal.

- The bulls are at a measured move target of 1:1 and are hoping to get the swing up again.

- However, strength should decrease in later legs, and this leg is stronger. That could be climactic. It might attract profit-taking at the highs.

- Expect sideways to down at the start of next week as the bears complete a second leg.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.