Market Overview: DAX 40 Futures

DAX futures moved higher last month in tight bull channel but back in tight trading range with large tail above on monthly chart. Bears are looking to sell high in the prior range, betting we will not break far above the All-time High. Bulls are in a tight channel and expect all reversal attempts to fail. There are measured moves above, so more likely sideways to up next month. A lack of stop-entry sell signals on the monthly chart means it is better to be either long or flat.

DAX 40 Futures

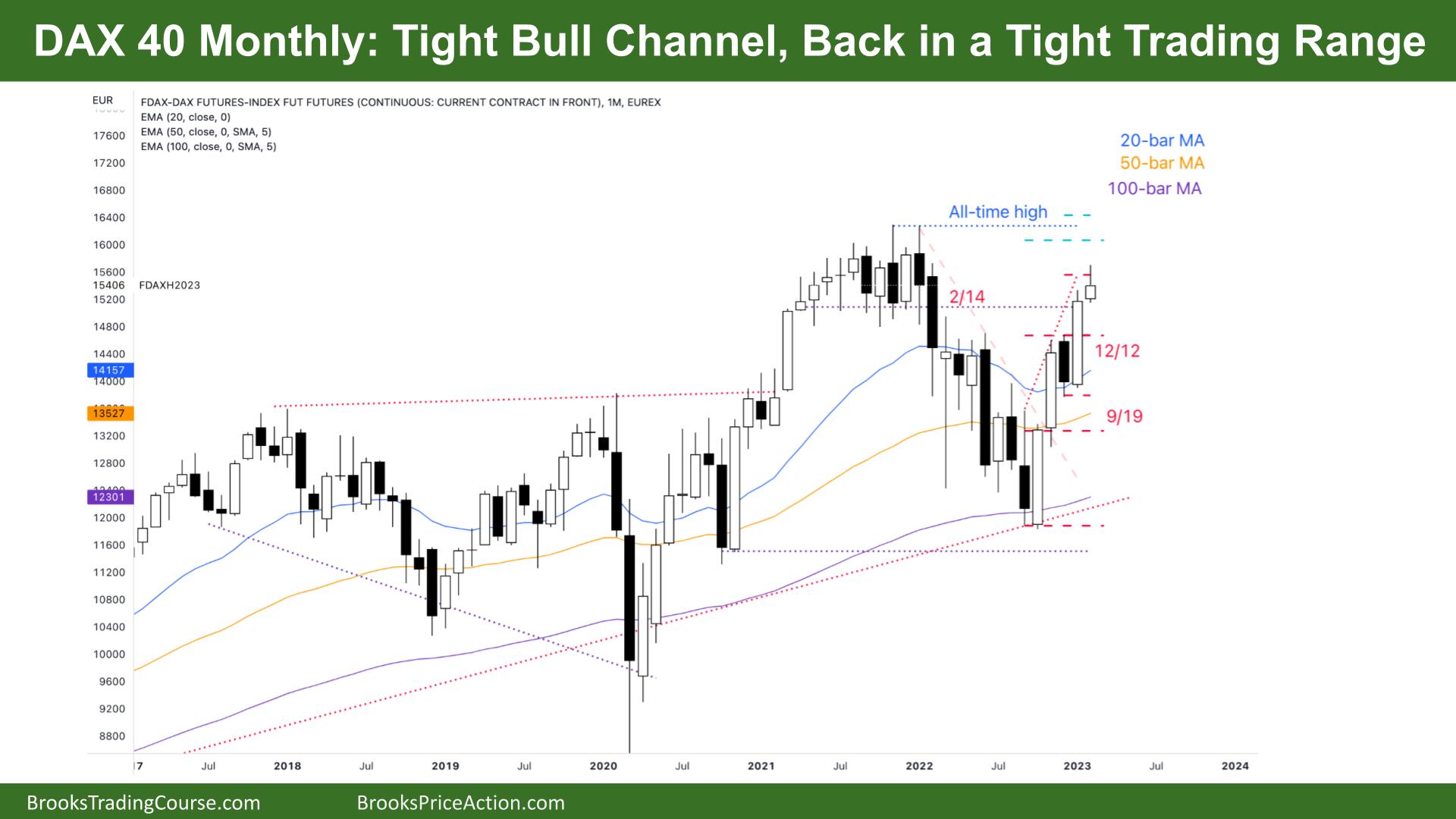

The Monthly DAX chart

- The DAX 40 futures was a small bull bar with a large tail above and closing below its midpoint.

- Both traders see a 5-bar bull micro channel.

- The bulls see a tight bull channel, it is the second leg, and we are back in tight trading range from the All-time high.

- A tight trading range is a magnet and pulls prices back towards it. We might need to go sideways here as traders decide which way we need to go.

- The bears see a possible double top and lower high, but it’s a bad sell signal – a bull bar.

- Some limit bears will look to sell a micro DT with February’s high, but most traders should enter on stops and wait for a better buy or sell signal.

- We never triggered the sell below December, so a Low 1 in a tight bull channel is not a great sell signal.

- The bears want a strong sell signal in March to attract sellers below the bar. The best they might get is a minor reversal.

- Bulls see the swing targets from the High 2 buy above October, and they end above this month near the All-time High. This is no coincidence, as computers are playing chess many moves ahead.

- Likely limit-order bulls buying below the low of a prior bar in a micro channel.

- We are still always in long, in a tight bull channel, so it is better to be long or flat.

- Expect sideways to up next month.

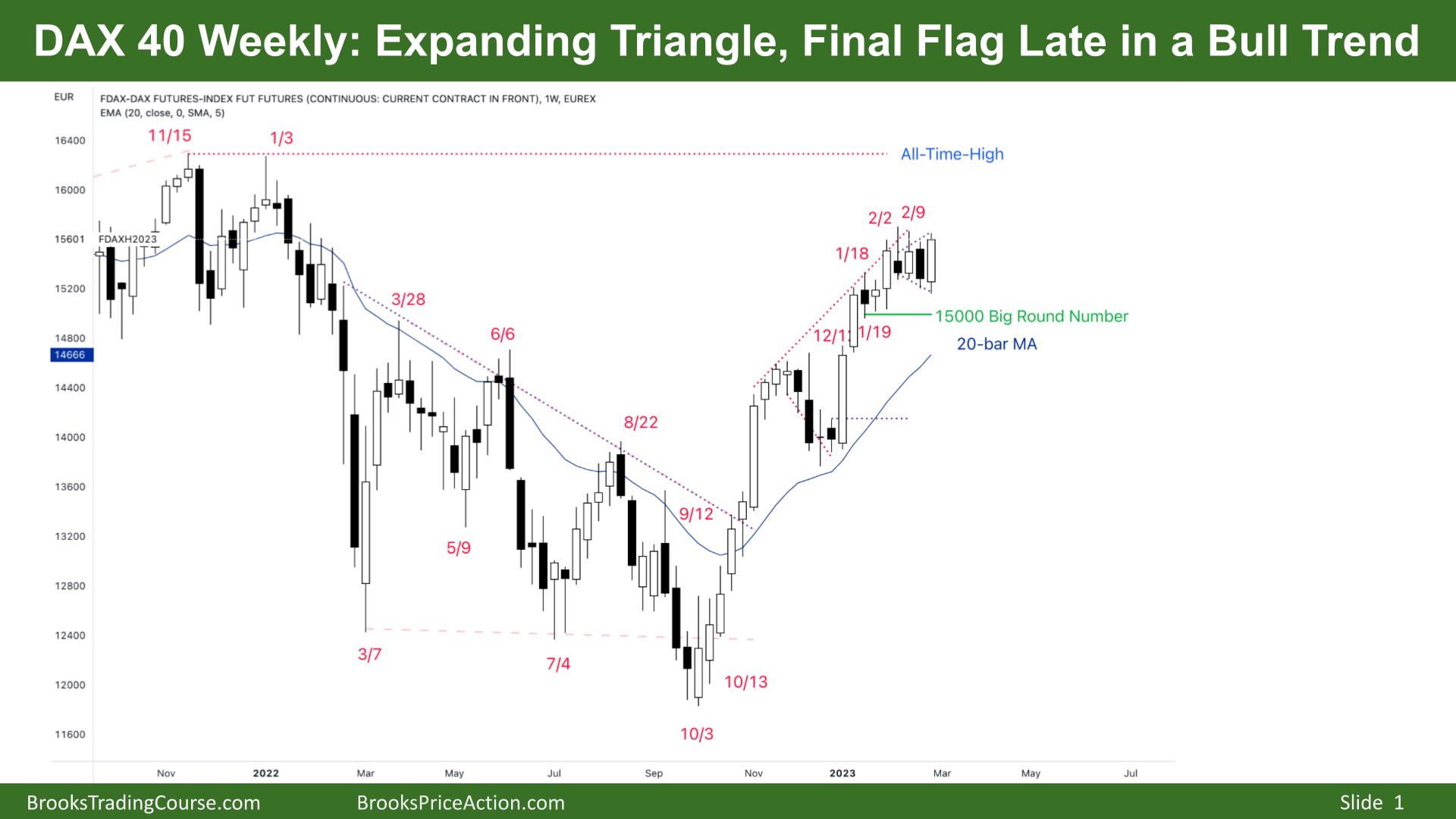

The Weekly DAX chart

- The DAX 40 futures was a bull outside bar, an expanding triangle and a possible final flag late in a bull trend.

- A lot is going on, so we can also call it a tight trading range! So it’s breakout mode and 50% each way.

- There is also a 50% chance the first breakout in either direction will fail.

- The bulls see a possible final flag for a last leg up in a tight channel.

- The bulls also see we have spent many bars above the moving average, so will likely buy the first reversal down.

- Bears see a tight trading range and high in a wider trading range from earlier last year. It was a Low 1 sell below last week, which is less reliable than a Low 2 in a tight channel.

- The bulls need a follow-through bar next week to confirm the next leg up. But most bulls don’t want to buy high and know bears will sell the micro DT and scale in higher.

- The bears want an outside down bar next week – an OO reversal. They are looking for a failed breakout and follow through for two legs back to the moving average.

- The breakout point, the prior swing high, is far below, so any pullback will likely end up being a larger bull flag. Most breakout gaps close in trading ranges, so we should expect this to do the same.

- The bulls want a break above the tight trading range to the left, but with the sideways bars the past few weeks, it might need to wait until the bulls are more confident and the risk is less.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.