Market Overview: Weekend Market Update

There are only 7 trading days left in the decade for the Emini. The bulls want the month, the year, and the decade to close on the high. The Emini will probably be sideways to up through yearend.

The bond market is in an early bear trend on the monthly chart, but it is at support. The nested wedge bottom on the daily chart could lead to a bounce for a week or two.

The EURUSD Forex market has been sideways for 5 months. There is no sign that the trading range is about to end. Since it is stalling at the bear trend line and the October high, it will probably be sideways to down for a week or two.

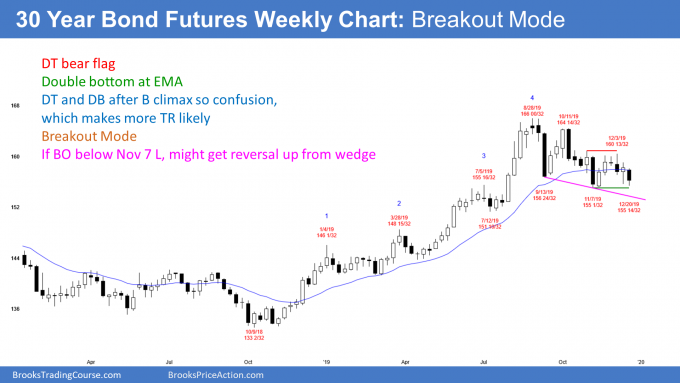

30 year Treasury bond Futures market:

Nested wedge bottom so bounce soon

The 30 year Treasury bond futures is having a 3rd push down since the August top on the weekly chart. The bulls want either a double bottom with the November 7 low or a failed breakout below that low. A reversal up from below would be a wedge bull flag where September 13 was the 1st leg down.

If the bulls get a reversal up, it will probably be minor. The monthly chart (not shown) has been creating a major top over the past several years. Even if the bulls get a new all-time high, it will probably be brief. Traders should expect the bonds to work lower over the next decade.

That means interest rates will start to go up. I have said many times that the American public will not allow zero interest rates. They would see that as an unacceptable failure.

Americans are proud and see themselves as the world leaders in capitalism. If their country cannot afford to pay interest on the money it borrows, and in fact charges money to people lending it money (people who buy bonds), that would be offensive. It therefore will not happen. That is a fundamental reason why the bonds will not rally much from here. The technical picture of a nested wedge on the monthly chart is a strong reason as well.

Where do bonds go from here?

The monthly chart is creating its 4th consecutive bar bar. This is coming after a parabolic wedge top and a failed breakout above a nested wedge top. Bonds will go lower on the monthly chart.

When there is a reversal down from a buy climax, the first targets are the 20 month EMA and the bottom of the most recent buy climax. That is the August low on the monthly chart. Traders should therefore look for lower prices over the next several months. This is true even if there is a bounce early in 2020.

After 3 or 4 bear bars down from a buy climax, traders expect at least a small 2nd leg down. Consequently, any rally over the next several months should be minor. It could last 1 – 3 bars. Since this is a monthly chart, that means a few months. But it will form a lower high and lead to at least a small 2nd leg down.

It is important to note that a 2nd leg down means that the 1st leg down will end at some point. There will soon be a bounce. Furthermore, 5 or 6 consecutive bear bars would be unusual. Traders should expect a bull bar in January or February.

Wedge bottom on daily and weekly charts

The December selloff on the daily chart (not shown) has 3 legs down. Thursday and Friday formed small bull reversal bars. Traders see this as a wedge bottom and a double bottom with the November low. They therefore expect a couple legs up within a few weeks. It might begin next week.

The wedge selloff on the daily chart is the 3rd leg down in a possible wedge bottom on the weekly chart. Therefore, the daily wedge is nested within a bigger weekly wedge. A nested wedge bottom has a higher probability of leading to a rally with at least a couple legs up.

The bulls might even get a rally to the 166 top of the 2 month trading range over the next couple months. However, the odds still favor any rally to form a lower high. Traders should assume that the bond market will work lower for many years. There will be many strong rallies, but each will be followed by a new low in the developing bear trend on the monthly chart.

EURUSD weekly Forex chart:

Trading range might continue for all of 2020

The EURUSD weekly Forex chart in October had the strongest rally in its 2 year bear trend. Traders expected a 2nd leg up to resistance. Last week satisfied that minimum objective. The rally broke above the October high and the 15 month bear trend line.

However, this week formed a bear bar that closed near its low. It is therefore a Low 2 sell signal bar for next week. The Low 1 (end of the 1st leg up) ended on October 21. This increases the chance of a test of the November 29 low next week.

Has the 2 year bear trend ended?

Traders are deciding if the 2 year bear trend has ended. The 3 month rally is good for the bulls, but not good enough to convince traders that a bull trend is underway.

The chart has been sideways for 5 months. It is therefore in a trading range. Every trading range always has both reasonable buy and sell setups. But neither is high probability.

Markets have inertia. They resist change. Traders should expect breakout attempts to fail and for the trading range to continue. Eventually there will be a successful breakout up or down. But the current rally has not yet been strong enough to make traders believe that the bulls will finally get their breakout.

The bears have sold every rally for 2 years. They sold this one as well. Each selloff eventually resulted in a new low. But the bears quickly took profits and the bulls confidently bought every new low. That will probably happen again if the bears break below the October low.

The lack of momentum up and down and the reversals every 2 – 3 weeks make a continuation of the trading range most likely. There is no evidence that a a strong trend up or down is about to begin.

Just as the bulls were disappointed by this week, the bears will probably be disappointed with the next couple weeks. Traders should not expect this week’s sell signal to quickly lead to a new 2 year low. There should be at least a 2 – 3 week pause around the November 29 low. The bulls would then try to get a reversal up from a double bottom.

Nothing has changed. This is trading range price action. Traders should expect reversals and disappointing follow-through after buy and sell signals.

What about next year?

The EURUSD has been in a tight bear channel on the monthly chart for 2 years. The first breakout above is typically minor. That means, once it comes, it probably will not last more than a few months.

Also, the 2 year bear trend is a Spike and Channel trend. Traders expect an eventual rally to the beginning of the channel. That is the September 2018 high around 1.18.

They then expect a trading range. Since a trading range is at least 10 – 20 bars and I am talking about the monthly chart, the EURUSD market will probably be sideways for the next year. The bottom will be around the October 2019 low of 1.0879 or slightly lower, like down to 1.08. And, the top might reach around 1.18.

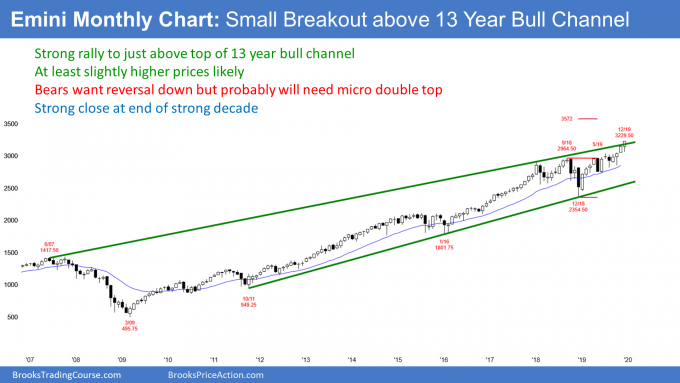

Monthly S&P500 Emini futures chart:

End of strong year and decade

The monthly S&P500 Emini futures chart is forming its 4th consecutive bull bar in December. It is in a strong bull trend.

The year opened on its low and it is now near its high. The bulls want the year to close near its high. That would give traders confidence going into next month. It would increase the chance of higher prices over the next few months.

After 4 bull bars, the 1st reversal down will probably be minor. That means the best the bears can probably get over next few months is a 1 – 2 bar (month) pullback.

End of a very strong decade

Not only is the Emini at the end of a strong month and year, it is also at the end of a strong decade. Look back over the past 10 years. The decade opened in 2010 near its low and it is now closing near its high. That is a sign of strong bulls. It increases the chance of at least slightly higher prices over the next year or two.

I am not showing a yearly chart (where each bar is 1 year). However, the decade had several big bars followed by smaller bars. That means that the 10 year rally is in a parabolic wedge buy climax.

A climax eventually attracts profit-takers. Once it does, the chart typically enters a trading range, often for 10 or more bars (years, since I am talking about a yearly chart). That is why I have been saying that the Emini will probably enter a trading range within a few years that could last for a decade. This is what happened in the 1970’s and after 2000.

While there is no top yet, the 5 – 10 year trading range will probably begin within 3 years. As hard as it might be to believe after an 11 year bull trend, traders should expect at least one 40 – 60% correction in the next decade.

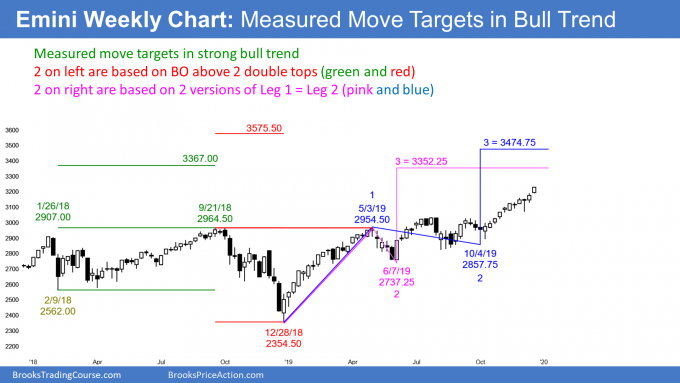

Weekly S&P500 Emini futures chart:

Parabolic wedge rally, but no top yet

The weekly S&P500 Emini futures chart gapped up this week and rallied. It has been in a particularly strong bull trend for 3 months and there is no top.

Every strong trend eventually attracts profit-takers. When the bull channel is tight, like this one, the initial profit-taking is usually brief. There might be a 1 – 3 week pullback at any time. The bears will probably need at least a micro double top before they can get a bigger pullback.

There was a big doji bar 2 weeks ago. That is often the 1st sign that the bulls are starting to take profits. When the bull trend resumes, as it did last week, the resumption often stalls within a few weeks from additional profit-taking. But the downside risk is small for at least a few weeks.

Measured Move Targets based on the height of trading ranges

There are several ways to calculate measured move targets. No one knows in advance how many institutions will take profits at any of the targets. Traders will evaluate the strength of any rally to a target and then watch how the markets acts when it is near the target. Will it stall and enter a trading range? Will it reverse strongly? Will it break strongly above and quickly race up to the next target?

The simplest measured move projection is based on the height of the trading range. However, there are usually several possible highs and lows that one can use. Also, there are frequently smaller ranges within a trading range, and they also can lead to reliable targets. Sometimes there are obvious points that everyone will use. That is not the case here.

There was a double top in January and September 2018. After a failed breakout below in December 2018, the Emini broke above. A measured up from the February 2018 neckline to the double top is 3367.00

There was another double top using that September 2018 high and the May 2019 high. The measured move up from the December 2018 neckline to the September 2018 high (which was about the same as the May 2019 high) is 3575.50

Leg 1 = Leg 2 measured move targets

There are 2 ways to draw a Leg 1 = Leg 2 measured move where Leg 1 is the rally from the December 2018 low (point 1, which is the start of Leg 1) to the May 2019 high (point 2, which is the end of Leg 1). Some traders will say that the Leg 2 up began in June 2019. Their projection is 3352.25 (the end of Leg 2).

But the Emini went sideways for many months and the bull trend did not clearly resume up until October 2019. I prefer using that low as the start of the 2nd leg up. That measured move target is 3474.75.

These 4 targets are between about 3350 and 3575. It is reasonable to assume that the Emini will be about 10% above this December’s close at some point in 2019. If so, it could reach all of the targets. Additional targets will become obvious as pullbacks come over the next many months.

Traders should try to find as many reasonable targets (also called magnets or resistance) as they can because targets often lead to profit-taking. Because they are magnets, the bulls will buy pullbacks, expecting the Emini to get drawn to that resistance. Once at a magnet, there is often a reasonable short trade.

Daily S&P500 Emini futures chart:

Possible Final Bull Flag

The daily S&P500 Emini futures chart gapped up on Monday, but then went sideways for 3 days. The bulls got a breakout on Thursday. There are now 3 legs up in the tight bull channel from the December 3 low.

The rally is therefore a parabolic wedge buy climax. Will the bulls take profits and will the bears get a reversal down from here?

When the channel is tight like this, the 1st reversal down is typically minor. Furthermore, the bulls want the Emini to close near the high of the month, the year, and the decade as a sign of strength. They have been in control on all of those time frames and are unlikely to give up with so little time left. That reduces the downside risk through yearend.

Measured move target above

There was a double top with the November 27 and December 6 highs. When a rally breaks above a double top, it often continues up for a measured move. The neckline was the December 3 low. A measured move up from the December 3 low to the December 6 high is 3235. That is a reasonable near-term target for the current rally.

If the rally gets there, there will probably be some profit-taking. If it goes above, traders might instead be using the July 26 high for the measured move projection. The target from there is 3243. There are other targets on the weekly chart (see above).

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.