Trading Update: Monday September 12, 2022

Emini pre-open market analysis

Emini daily chart

- The bulls have three consecutive bull bars, all closing near their highs. This is good for the bulls, and the market is currently Always In Long.

- The bulls want to close the August 24 breakout point low, and eventually, they want to test the August high and break above it.

- The problem the bulls have is that the overall market is in a trading range, and the bulls will probably be disappointed after a couple of legs up.

- The past three consecutive bull bars are strong enough that the bulls will probably get at least a small second leg up.

- The bulls hope to get a measured move up of the past three bull bars and a close above the August 26 high.

- While at the moment, the bulls are looking good, one must remember that the current rally may be a buy vacuum test of the August 24 low, however as I said above, the first reversal down will likely fail, which means traders will be confident of at least a second leg up.

- The bears want the current rally to lead to a lower high below the August 26 high and continue making lower highs and lows.

- It would be good for the bears if they could keep the August 24 breakout point gap open.

- The bears also want this three-bar rally to be a second leg trap; however, even if it is and the market tests the September 7 low, there will probably be buyers not far below, and the market would try and form a double bottom.

- Overall, the market may form a triangle here as the bulls want higher lows and the bears wish to lower highs.

Emini 5-minute chart and what to expect today

- Emini is up 20 points in the overnight Globex session.

- The Globex market sold off early in the overnight session and has been in a rally since the early morning.

- The bulls have three consecutive bull closes on the daily chart and will probably be disappointed today or tomorrow. This means traders should expect a trading range open and possibly a trading range day.

- As I often say, traders should be patient and not be in a rush to trade the first 6-12 bars. The market will probably go sideways, and any breakout will be minor and not go far. This means there is no rush to miss something on the open.

- Traders can also wait for a credible top or bottom, such as a double top/bottom or a wedge top/bottom.

- If today is going to be an intense trend day, there will be plenty of time to enter the trend, so there is no rush.

- Traders should also pay attention to the open of the day, especially if it is in the middle of the day’s range, because the market will likely have a hard time getting far away from it.

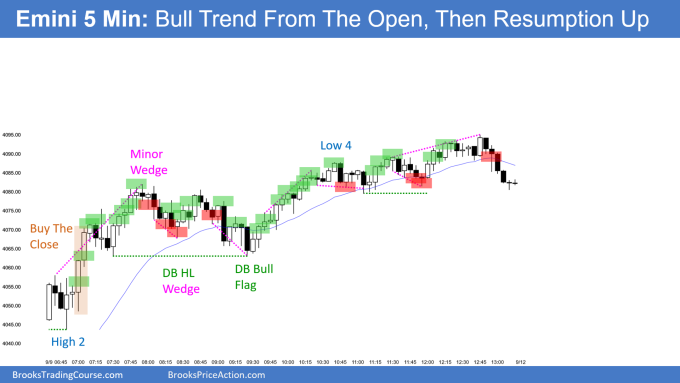

Friday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The market is testing the middle of the July – August trading range.

- The bulls have a 5-bar bull micro channel which is good; however, the bulls currently only have one bull bar closing on its high. This is trading range price action and increases the odds of it being a bull leg in a TR.

- The bulls want today to close on its high, increasing the odds of the market being Always In Long.

- The bears see the current rally as a leg up in a broad bear channel and expect a lower high.

- The overall problem with the bear case is that the market has been in a bear channel since June 2021. The odds favor a bull rally for several months starting soon.

- Also, the market is close to crucial support, the 1.000 big round number, and will probably have much trouble getting far below it.

- Ultimately, the bulls need a decisive breakout above the August 10 major lower high to convince traders that the bulls have taken over.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day video review

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com on trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Thanks again Brad for the end of day videos. I look forward to getting your perspective on the day.

from the youtube transcript for reference – added the bar numbers

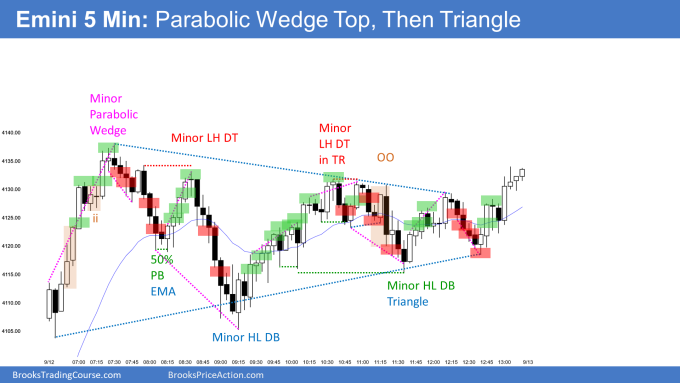

today was a parabolic wedge top that led to a triangle, here’s the parabolic wedge three pushes one two and three, and here’s the triangle these blue lines

the market gapped up and formed a trend from the open, however the trend was a parabolic wedge that led to a trading range

the first reason we’ll buy was the three consecutive bull bars 5 with the third bar closing on high here 5

bulls will buy above this they’ll buy above here 6, they’ll even buy the high one by here 9 or even the third push up after this ii which is right here 10

traders that did buy here 10, most of them would get out of longs below this bar 11 because of the wedge three pushes one two three and the risk of two legs down which we got here 20 or here 32 being the second leg

traders sell below here 12 so they can sell below this bar 13, not many would sell below 14 or 15, others would wait for the breakout pullback short break out pull back short below 17 or even this bar right here 18

traders selling here 18 have to be quick to make decisions because the market may pause at the moving average here, some bulls buy two legs down betting on trend resumption up, however tight enough bear channel that the market may have a minor reversal up in form a lower high

bulls buy here 22 they can buy above here 23 this bull bar or even this bull bar 24, however the bulls that bought here 24 would be quick to exit below this bar 25 or below the breakout pullback short here 26

bears can sell here 29 break out below these lows here 21, if they don’t sell there it’s dangerous to sell here 30 because it’s low in the range three pushes down one two three and it’s the second leg from this leg down so leg one pull back leg two

some bulls buy here 35 micro double bottom, minor high or low minor because of the sell-off, traders can buy this bar they can buy above the inside bar here 36, it’s a breakout pullback buy or they wait buy above the outside bar 38 or above this bar 39 or they can buy above here 41

the bull’s got a breakout above a bull flag and a second leg up they can buy the second leg here 48 however if they did most would get out here 50, it is a lower high with here 25, it’s also a possible low 4 low one low two low three breakout low 4, so you can call it two legs up here and here and a low four it doesn’t matter if you call it a low four or low five it’s two legs up it’s two complex bottoms one two three break out first leg second third some bulls buy here 52 but after these two bear bars most would wait and traders sell here 54 for the double top and really the market went sideways for the rest of the day three pushes down bulls come by here and really hard to do stop entries this late in the day when the range is tight

Hi Brad, thanks for your daily reports. The video review is a great addition, please continue doing them.

Glad you like the reports. You can also find more detailed End of day reviews by visiting the trading room at brookspriceaction.com. These reports are on Tuesday’s and Friday’s

I wasn’t aware of this. Nice. Repetition helps internalizing the concepts. I cannot find the detailed End of day reviews however? Do you have a deeplink to the page. Sorry for this inconvenience. Thank you.

You can sign up to view them live or access the recordings here at: https://www.brookspriceaction.com/portal.php?page=9 (this is Al’s other website).

Here is a sample of the full end of day reviews I have made in the past: https://youtu.be/neeWeTfhq68