Market Overview: EURUSD Forex

The EURUSD Forex July candlestick was a big bear bar with a long tail below. It broke below the 7-year trading range low. The long tail below indicates that the bears are not as strong as they could have been. The bears will need to create a consecutive bear bar to confirm the breakout below the 7-year trading range. The selling has been climactic. The trend channel line overshoot and wedge bottom (November 24, May 13 and July 14) increase the odds of at least a small sideways to up pullback (for a couple of weeks) before the EURUSD continue lower. The pullback may have begun in July.

EURUSD Forex market

The Monthly EURUSD Forex chart

- The July Monthly EURUSD candlestick was a big bear bar with a long tail below. It broke below the 7-year trading range low.

- Last month, we said traders will BLSH (Buy Low, Sell High) until there is a strong breakout from either direction. The bears got the breakout they wanted.

- However, the long tail below indicates that the bears are not as strong as they could have been.

- The bulls want a failed breakout from the 7-year trading range low and a reversal up from a trend channel line overshoot and parabolic wedge (November 24, May 13 and July 14).

- However, the bulls have not been able to create strong consecutive bull bars since the sell-off in 2021.

- The bulls want at least a test of the breakout point, which is the 2017 low.

- Bears want a breakout below the 7-year trading range low followed by a measured move down based on the height of the 7-year trading range which will take them to the year 2000 low.

- The sell-off since June 2021 is in a tight bear channel. That means persistent selling and strong bears.

- The bears will need to create a consecutive bear bar to confirm the breakout below the 7-year trading range.

- The selling has been climactic. The trend channel line overshoot and wedge bottom (November 24, May 13 and July 14) increase the odds of at least a small sideways to up pullback (for a couple of weeks) before the EURUSD continues lower. The pullback may have begun in July.

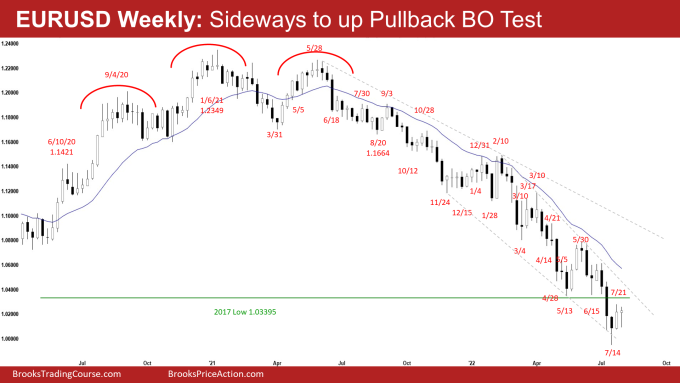

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was an inside bull doji. It closed in the upper half of the bar.

- We have said that the odds are the EURUSD is still in the two-legged sideways to up pullback phase. This remains true.

- The bears want a strong breakout below the 2017 low and a measured move down based on the height of the 7-year trading range which will take them to the year 2000 low.

- They got 2 bear bars closing below 2017 low, increasing the odds of a breakout and a measured move down.

- The move down is in a tight bear channel. That means strong bears. Odds slightly favor the EURUSD trading lower after the current pullback.

- The bulls hope that the sell-off since March was a sell vacuum test of the 7-year trading range low.

- They want a reversal higher from a wedge bottom (Mar 4, May 13 and July 14) and a trend channel line overshoot.

- The bulls hope that the recent 10-week trading range is the final flag of the move down which started in 2021.

- They want a failed breakout below the 7-year trading range and a test back into the potential 10-week final flag.

- The sell-off has been climactic and the wedge bottom and trend channel line overshoot increase the odds of at least a small sideways to up pullback before the EURUSD continue lower.

- For now, the EURUSD should still be in the two-legged sideways to up pullback phase.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Great analysis. Especially like the comment that the bears this week were not as strong as they should be.

Thanks Albert.. Have a blessed week ahead!

Best Regards,

AA