Emini and Forex Trading Update:

Tuesday March 17, 2020

I will update again at the end of the day.

Pre-Open market analysis

The Emini opened limit down yesterday and sold off to within a fraction of a point of -13%. That is the 2nd circuit breaker level. Instead of hitting the limit, it reversed up strongly.

The selloff was also a test of the December 2018 low. There is a parabolic wedge down to that low on the daily chart. The bulls wanted a reversal up from the double bottom and the parabolic wedge selloff.

Yesterday’s bear body makes yesterday a weak buy signal bar for today. However, a short covering rally will probably begin at some point this week.

Possible rally, but still in bear trend

It is important to remember that yesterday’s low was 31% below the all-time high. Once the S&P cash index enters a bear market (closes down -20%), the final low is usually about a year later.

There is typically not a new all-time high until a couple years after that. Consequently, even if there is a rally that lasts many months, traders should still expect a test of yesterday’s low before there is a new all-time high.

Can this selloff lead to a crash far below the December 2018 low?

What happens if the Emini breaks strongly below the December 2018 low? Traders would see this selloff as comparable to the 1987 Crash. It could accelerate down in a series of big bear days.

That is unlikely. The selloff is hesitating at support. There is a parabolic wedge sell climax. That typically leads to profit taking.

Also, the American public is now clearer about the future. While it is depressing, it is less frightening and uncertain. They accept that the infection will be with us for the rest of the year and millions will get infected. It will continue to spread until there is a vaccine next year.

In addition, they now understand that the goal is to slow down the spread of coronavirus so that hospitals will not get overwhelmed. They have made the changes in their behavior.

Finally, the government is trying to stabilize the economy and support business and individuals. All of this will reduce the panic. Everyone will adjust to the new normal. That should soon lead to a trading range on the daily chart.

Overnight Emini Globex trading

The Emini was 5% limit up in the Globex session, but could not hold that level. It is now up less than 1%.

Yesterday was a reversal day. That is a type of a trading day. It was also the 3rd mostly sideways day. The Emini so far are holding the support of the December 2018 low.

If the bears continue to fail to break below that major support, they will take profits. Once traders decide that short covering is underway, the bears will buy back their shorts aggressively and the bulls will buy. This could result in a strong rally that could last a couple weeks and possibly a couple months. Therefore, there is an increased chance of big bull days beginning soon.

The bears have not given up yet. Therefore, there is still a 50% chance of a break below that December low within the next week. The bears might get a couple legs down, but probably not a protracted selloff below that support. It is important to note that a break below major support has a 50% chance of quickly reversing up.

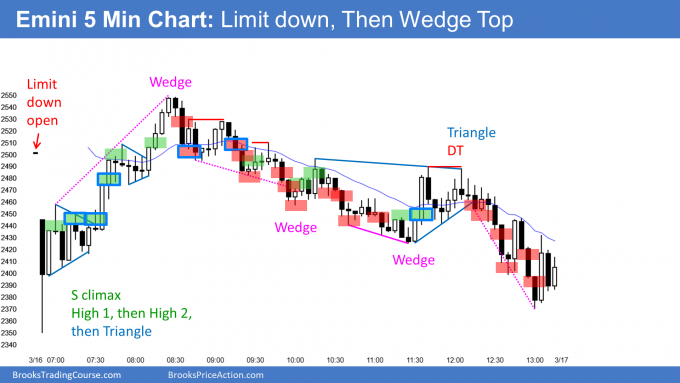

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

The daily chart of the EURUSD Forex market has sold off strongly for 6 days after an even stronger rally. Big Up, Big Down creates Big Confusion. This typically results in a trading range. Consequently, there will probably be a bounce within a few days.

At the high, I said that the rally was either the start of a bull trend or a big bull leg in a big trading range. I said that a trading range was more likely.

Because of the parabolic wedge buy climax, traders expected a 2 legged pullback below support. This is that pullback.

The bears hope it is a resumption of the 2 year bear trend. It is more likely a deep minor reversal and a leg in the 8 month trading range.

Traders will find out this week. If this is simply a leg in a trading range, the bears will be disappointed by a lack of follow-through after today’s bear breakout. There should then be a 1 – 2 week bounce and more sideways trading.

Less likely, this is a resumption of the 2 year bear trend. If so, this selling will continue to below the February low without more than a 2 – 3 day bounce.

Overnight EURUSD Forex trading

The 5 minute chart of the EURUSD Forex market has been in a free-fall for the past 6 hours. This is climactic. It is a sign of strong bears. Traders have only been selling.

The 20 minute pause around 4 am PST was the end of the 1st leg down in the sell climax. There is now a 2nd leg down. That typically results in exhausted bears.

When bears get exhausted, they take profits and wait for at least a couple legs up to the EMA before looking to sell again. That bounce usually takes 10 or more bars.

Once it occurs, traders expect a trading range or a bear channel. The bears sell rallies and take profits at a new low.

Also, the bulls will finally begin to buy. They look for reversals up from below the most recent low.

The legs and bars are big enough for 20 – 40 pip scalps. But they will shrink as the day goes on.

Day traders should expect the sell climax to end within an hour or so. They then will look for either a trading range or a bear channel for the rest of the day.

However, the bear trend has been very strong. It will be easier to make money selling rallies than buying new lows unless there is a surprisingly strong reversal up. That is unlikely today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

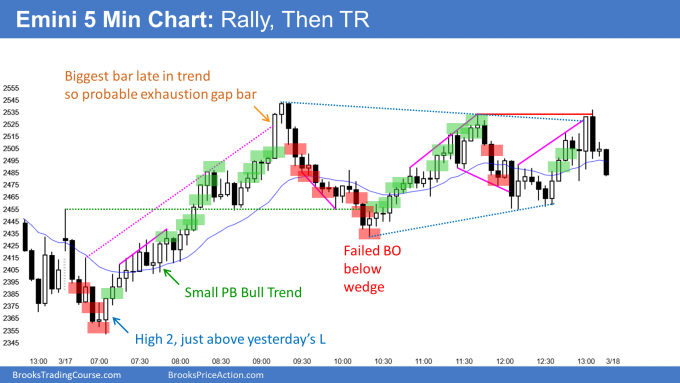

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

End of day summary

Today was an inside day. It sold off on the open, but reversed up from a High 2 bottom just above yesterday’s low. After rallying for 2 hours, the bulls failed to break above yesterday’s high. The Emini sold off from an exhaustive buy climax. It then went sideways for the rest of the day,

Today was a trading range day. The Emini oscillated around the open of the week. That might be a magnet for the rest of the week.

Because it is an inside day, it is both a buy and sell signal bar for tomorrow. A strong short covering rally will probably begin within a week. But there might 1st be a break below the December 2018 low.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Hi Al: What time do you update Pre-Open market analysis.

I’m on the EST time zone. It appears your pre-open market analysis does not get the update before market open at 9.30 am EST?

Or I’m somehow not seeing the update ? I did check few times with refresh page option this morning before market opened.

Thank You,

In my experience, normally it is released five to ten minutes before open.