Emini and Forex Trading Update:

Friday January 31, 2020

I will update again at the end of the day.

Pre-Open market analysis

Yesterday closed near its high. It is a buy signal bar on the daily chart for a micro double bottom in a bull trend. I wrote this week that the Emini might have to test 3300 before a 2nd leg down begins. That is more likely after yesterday’s reversal up. The Emini is back to almost neutral. There is is now almost a 50% chance of a new high before there is a 5% correction.

The bulls want a double top bear flag with Wednesday’s high or a Low 2 bear flag. If instead the bulls get another one or two more bull bars, the Emini will probably test the all-time high.

The monthly candlestick closes today

I have been saying for the past week that the open of the month would be a magnet at the end of the month. Today twice reversed up strongly from below the open of the month. It now is in the middle of the month’s range.

A close below the midpoint would mean that January would be a reversal bar. But if it has a bull body, which is likely, it would be a weak sell signal bar. We already know that the context is bad for the bears on the monthly chart. The best they probably can get is a 1 – 2 month pullback.

Can it still close below the open of the month? It would then have a bear body and January would then be a sell signal bar on the monthly chart. While this is still possible, yesterday’s late strong rally make it unlikely.

Overnight Emini Globex trading

The Emini is down 13 points in the Globex session. It has been sideways for 4 days and it is now at the top of the small trading range. The range has a double bottom.

While the bulls hope that yesterday’s rally from the double bottom will continue to a new all-time high, the bears want it to fail around Wednesday’s high. They want a reversal down from a small double top and for this week’s selloff to continue down for at least 5%. Traders will find out over the next few days which outcome will be more likely.

Because yesterday’s rally was climactic, there should be some profit-taking today. Traders typically expect at least a couple hours of sideways to down trading beginning by the end of the 2nd hour. If often begins on the open. There is only a 25% chance of a strong bull trend day from the open that lasts all day.

Monthly and weekly support and resistance can be important today since today is Friday and the last day of the month. The most important magnets are the month’s open, high and midpoint.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

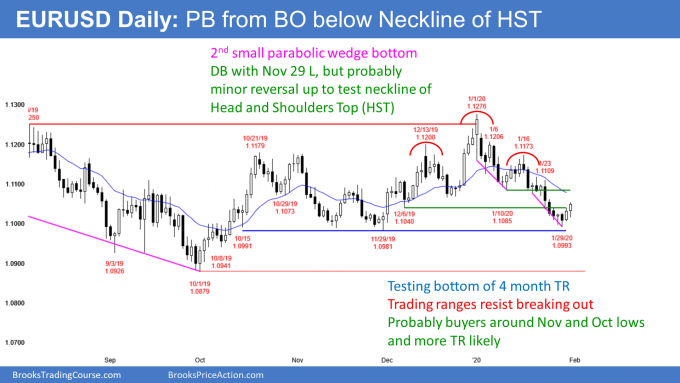

EURUSD Forex market trading strategies

The daily chart of the EURUSD Forex market is reversing up from the bottom of a 4 month trading range. There are consecutive parabolic wedge bottoms. That increases the chance of a reversal up soon.

However, the bear channel is tight. A tight bear channel typically needs at least a micro double bottom before a bull leg can begin. Consequently, this reversal will probably be minor.

It is a test of the neckline of the head and shoulders top. That means it is testing the lows that the selloff broke below. The most important is the January 10 low of 1.1085. Traders should expect the rally to end around 1.11 next week and for the bears to then get a test of this week’s lows. They see that every strong rally and selloff for 20 months reverse after a few weeks and are confident that this selloff will do the same.

Overnight EURUSD Forex trading

The 5 minute chart of the EURUSD Forex market has rallied overnight. The 1.11 area around the January 10 low is a magnet above.

Can the EURUSD reach it today? Probably not. This is because the bull trend over the past couple hours has only covered about 30 pips and most of the bars are small. That is not how a strong bull trend typically looks.

This price action increases the chance that the 5 minute chart will convert into a trading range today. But since there is a magnet above and the chart has rallied for 2 days, the odds favor sideways to higher prices.

At some point today, the bulls will probably stop buying at the market and switch to buying 20 pip pullbacks. If that happens, the bears will begin to look for scalps. Until then, it is better to only buy.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Here are several reasonable stop entry setups for today. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

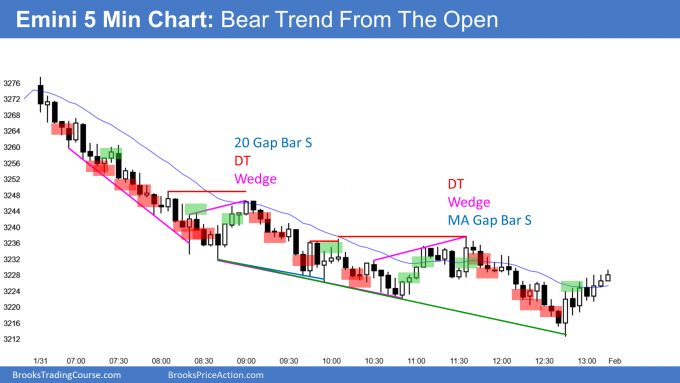

End of day summary

Yesterday was a big bull day. Today was a huge bear day. One saying on Wall Street is, “The strongest rallies come in bear trends.” While that is not true, it is a reminder that a strong rally in a bear trend, like yesterday, does not mean that the bear trend has ended. The bears got a strong reversal down today from a double top with Wednesday’s high. That shifts the probability back in favor of a 5% correction being underway.

January now closed near its low and the monthly chart is in a buy climax. The monthly sell signal will probably trigger next week. I have been saying that the minimum goal for the bears is at least a 5% pullback. Nothing has changed. The odds favor at least a little more down. The selloff might continue down to around 3000 and the top of the 2 year trading range.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.