Market Overview: NASDAQ 100 Emini Futures

The Nasdaq Emini futures is in a strong bear leg. This is the 5th consecutive bear bar and successive weekly bear close below the prior March low. At the same time, bulls who bought the low of March made money selling near the monthly exponential moving average (EMA).

The week started by going below last week’s low and reversed. There were 3 bull days making it go near last week’s high and the monthly EMA on Wednesday. At this point, both bulls and bears sold and reversed all the bullishness. Friday was a trading range day that ended up with a bear body.

As was mentioned last week, this bear leg down is stronger than the bull leg up in March. The market also reached one of the targets mentioned last week on the weekly chart – 12635.5. It is still valid that there will likely be a 2nd leg down, to the other targets shown in Weekly chart below.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- This week’s NASDAQ candlestick is a bear bar with a big tail on top and a tail at the bottom closing below last week’s low. Also, bulls who bought the low of March made money selling at the high of last week/monthly EMA.

- The downward slope of the weekly EMA is quickly getting steeper. The bulls need to soon start creating successive equal-sized bull bars that are not too big (to not attract profit takers). This will start flattening the weekly EMA as it gets closer to monthly EMA.

- It is still likely that there will be a second leg down, even if there are one or two pause weeks in the next couple of weeks. One of the places where the 1st leg might end is after piercing the trend channel line in the next week or two.

- Some of the lower targets shown on the Weekly Chart are:

- March 2021 open at 12635.5 – was met this week

- November 2020 open at 11948.75

- Leg 1 Leg 2 move at 11720

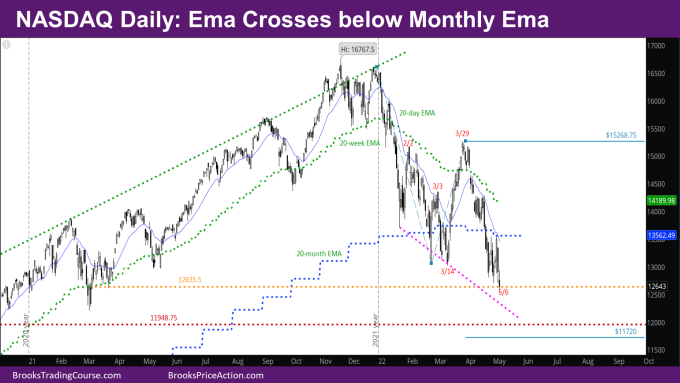

The Daily NASDAQ chart

- Friday’s NASDAQ candlestick is a bear doji bar with a close below the low of other days of the week.

- The past two weeks have been tight trading range days where bulls make money buying the close of bear days and bears make money selling the close of bull days.

- The daily EMA also just crossed below the monthly EMA. The last time the daily EMA spent significant time below the monthly EMA happened in 2018 and 2015. It took about 21 days for the daily EMA to cross back over the monthly EMA – and many of those days had to be bull days.

- The bulls will soon have to create a series of bull days like they did back in March to accomplish getting the daily EMA cross back up.

- The bulls also want the month to close above the monthly EMA to avoid consecutive close below the monthly EMA, so this is another reason for the bulls to show up in the next 3 weeks.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Thank you Rajesh for your nice work. The NQ hit the mar 5 2021 low today as well. Almost a full year for these levels now. I trade the NQ and would like to follow your work.

Hi Rajesh!

Thank you for the very interesting analysis. How do you think if one can consider the 2-legged pulback to EMA20 on Daily chart as a final flag (last 10 days) or it is not likely a FF and we will see some bigger FF?

kind regards,

Murat