Market Overview: FTSE 100 Futures The FTSE futures market moved down last week with a small bear bar in a bear leg. We are pausing between the two MAs. Bulls want to buy on the moving average (MA), get another leg up, and close strongly above the prior All-time High (ATH). Bears are selling above bars […]

Bitcoin consecutive bear bars

Market Overview: Bitcoin Futures Bitcoin consecutive bear bars. This week, the price decreased by -9.67% of its value. A leg down started after entering the sell zone a couple of weeks ago. Traders expect trading range price action for the upcoming months instead of a bear trend resumption. Bitcoin futures The Weekly logarithmic chart of Bitcoin futures […]

EURUSD Pullback to the 20-Week EMA

Market Overview: EURUSD Forex The EURUSD Forex weekly chart bears got a pullback to the 20-week EMA (exponential moving average). The bears want a continuation down to the January 6 low or the November 21 low which was the start of the bull channel. The bulls want a reversal higher from a double bottom with […]

EURUSD Consecutive Bear Bar

Market Overview: EURUSD Forex EURUSD consecutive bear bar on the weekly chart. It is the start of the pullback. The first targets for the bears are the 20-week exponential moving average and the January 6 low. The bulls want any pullback to be sideways and not deep. They want weak bear bars with long tails […]

Nifty 50 Consecutive Bear Bars

Market Overview: Nifty 50 Futures Three Nifty 50 consecutive bear bars formed on the weekly chart, with all 3 bear bars closing near their lows, but the market is still trading inside the bull channel on the weekly chart. On the daily chart, Nifty 50 has reached the measured move down of the cup and […]

DAX 40 Consecutive Bars, Bear Surprise

Market Overview: DAX 40 Futures DAX futures this week was consecutive bars, a bear surprise after such a tight bull channel. Although it is outside down, the bulls will expect a second leg up, so it might be a bear trap. The bears will probably get a second leg sideways to down to the breakout […]

DAX 40 Consecutive Bear Bars Closing on Lows

Market Overview: DAX 40 Futures DAX futures continued down this month with consecutive bear bars closing on lows. The bulls see a bull flag in a longer-term bull trend and expected the second leg to get back to near the breakout of the trading range. The bears see a tight bear channel, but with overlap […]

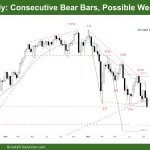

DAX 40 Consecutive Bear Bars and Possible Wedge Bottom

Market Overview: DAX 40 Futures DAX futures moved down again last week with DAX 40 consecutive bear bars and setting up a possible wedge bottom. The bears got a break below the March lows, but we have been going sideways for many weeks, it might form a tighter trading range here. Bears want a follow-through […]

EURUSD Consecutive Bear Bars below 7-Year Trading Range

The EURUSD Forex monthly candlestick was a consecutive bear bar below the 7-year trading range low. The long tails below July and August candlesticks indicate that the bears are not as strong as they could have been. Bears want a breakout below the 7-year trading range low followed by a measured move down based on the height of the 7-year trading range which will take them to the year 2000 low. The bulls want a reversal up from a trend channel line overshoot and parabolic wedge (November 24, May 13 and August 23).

FTSE 100 consecutive bear bars low in trading range

Market Overview: FTSE 100 Futures The FTSE futures market moved lower again last week with FTSE 100 consecutive bear bars low in a trading range. We are back at the October 2021 breakout point and it makes you wonder if this is a failed breakout above the high. With bulls unwilling to buy they might need […]