Market Overview: Nifty 50 Futures

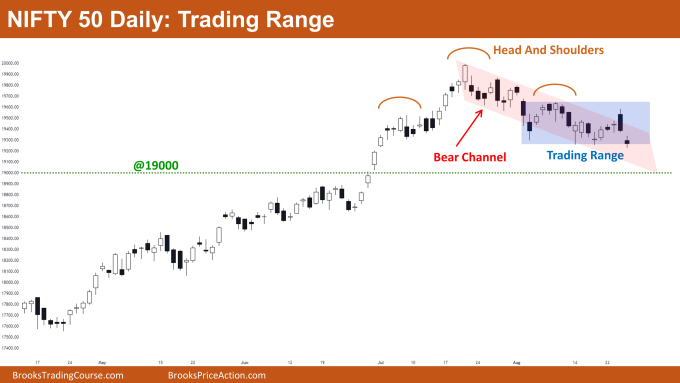

Nifty 50 Wedge on the weekly chart. The market formed the fifth consecutive bear bar on the weekly chart, which is closing close to its low. However, the bear bar has a long tail at the top, suggesting a potential trading range rather than a reversal. The likelihood of a trading range increases because the market is fluctuating between the two big round numbers. The daily chart of the Nifty 50 failed to show a bear breakout of the head and shoulders pattern. The market is currently moving within a narrow trading range.

Nifty 50 futures

The Weekly Nifty 50 chart

- General Discussion

- Bears still are unable to form consecutive bear bars, so they shouldn’t be selling the market in anticipation of a reversal.

- Bulls who missed the trend should try to buy at the top of a strong bull bar that is close to the large round number, 19000.

- Overall, traders can expect a trading range price action for the next few weeks. Consequently, traders should concentrate on buying low and selling high.

- Deeper into the price action

- The market’s most recent bull trend was very strong, which increases the likelihood that there will be a second leg up before a reversal.

- Bears haven’t been able to produce strong bear closes in the previous five bars, making this a feeble attempt at a reversal.

- Following a strong trend, a weak reversal attempt frequently results in a short-term trading range rather than a reversal.

- Patterns

- The market is forming a wedge bottom. Only 25% of bear breakouts will be successful, and since the market has a strong support level (19000), this number may drop even further.

The Daily Nifty 50 chart

- General Discussion

- The market is trading inside of a trading range on the daily chart. The ideal trading strategy is to buy low and sell high.

- Bulls can look to buy on a strong bull bar near the trading range bottom, and similarly bears can look to sell near the trading range top.

- The big round number 19000 might act as a magnet, which might result in a bear breakout of the trading range. However, the likelihood of a measured move down is slim.

- Deeper into price action

- If you pay close attention to the price movement within the trading range, you’ll notice that although bears were able to form strong bear bars, they were unsuccessful in obtaining a strong follow-through bar.

- This demonstrates the bears’ lack of interest to sell the head and shoulders pattern in anticipation of a trend reversal.

- Due to the strong support at the 19000 level, if bears are able to get a strong bear close below the trading range, the likelihood of a measured move down of the trading range is quite low.

- Patterns

- The market is trading inside a bear channel.

- The market is developing a trading range, which could eventually result in a bull breakout of the bear channel.

- The market is getting close to the large round number 19000, which will serve as a strong support for the price and reduce the likelihood that the bear channel will successfully break out to the downside.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.