Al added a few comments to report

Market Overview: S&P 500 Emini Futures

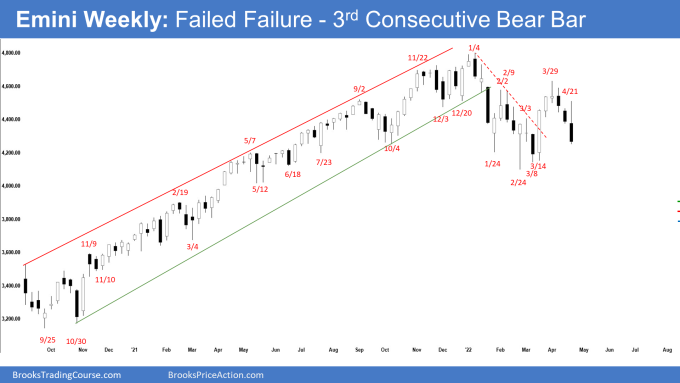

The S&P 500 Emini futures had a third consecutive bear bar and failed failure on the weekly chart. Odds slightly favor sideways to down early next week. It may even gap down on Monday. However, small gaps usually close early.

Bears want a test of the February low followed by a strong breakout and a measured move down. Bulls want next week to have a bull body, even though the Emini may trade lower first.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a big outside bear bar with a small tail below and a long tail above.

- The bears broke below last week’s low early in the week but reversed and traded above last week’s high triggering the high 1 buy entry. It then reversed lower again breaking far below last week’s low. It was a failed failure.

- There are trapped bulls above last week’s high. A failed failure increases the odds of at least slightly lower prices.

- Last week, we said odds slightly favor the Emini to trade at least slightly lower and if the bears get another bear bar especially if it is big and closes near the low, the odds will swing in favor of a test of the February low.

- Bears want the Emini to reverse lower from a double top bear flag (February 2 high and March 29). They got the 3rd consecutive bear bar this week which represents follow-through selling.

- The bears want a strong break below the February 24 low which is the neckline of the double top bear flag and a measured move down towards 3600 based on the height of the 8-month trading range.

- The bulls hope that this is simply a deep pullback and a sell vacuum to test the February low.

- However, 3 consecutive bear bars closing near the low means persistent selling. Since this week was a big bear bar closing near the low, it is a weak buy signal bar for a strong reversal up.

- The bulls will need a strong reversal bar or at least a micro double bottom before they would be willing to buy aggressively from a higher low major trend reversal pattern.

- The bulls hope that next week will be a bull reversal bar closing at the high, even if it trades lower first earlier in the week.

- Al said that the Emini has been oscillating around 4,400 for 9 months. That price might well end up being the middle of the trading range. Since the top of the range is about 400 points higher, the bottom could be 400 points lower. That is below the February low and around the 4,000 Big Round Number.

- If it gets there, traders will then wonder if the Emini might fall for a measured move down from the February/March double top. That would fill the gap above the March 2021 high on the monthly chart.

- The Emini is currently trading around the lower half of the 8-month trading range. Confusion is the hallmark of a trading range.

- Trading ranges tend to disappoint both the bulls & bears and have poor follow-through. Traders will BLSH (Buy Low Sell High) and scalp.

- Odds are, if the Emini reaches around the February low, we will see buyers around the low of the trading range.

- There has not been 4 consecutive bear bars since the Covid crash. Will next week be another bear bar? Or will the bears be disappointed with a bull bar instead?

- We have said that odds of the prior leg up from March 14 was a bull leg within a trading range, not the start of a new bull trend.

- The current leg down, even if it reaches the February low, would likely be a bear leg, and not the start of the bear trend.

- Since this week was an outside bear bar closing near the low, it is a good sell signal bar for next week.

- It may even gap down at the open. However, small gaps usually close early.

- Because it was also a failed failure, odds favor at least slightly lower prices next week.

- If the bears get another bear bar next week, especially if it is big and closes near the low, the odds of testing the February low increase significantly.

The Daily S&P 500 Emini chart

- The Emini gapped down slightly on Monday but closed as a bull doji. Tuesday reversed higher from a failed breakout below the wedge bull flag. Wednesday gapped higher, but the bulls did not get a follow-through bar.

- Thursday gapped higher once again but reversed to close as a big outside bear bar near the low. Friday continued the selloff and broke below the wedge bull flag.

- Last week, we said the bulls wanted a reversal higher from a wedge bull flag, but there were two problems with their case: 1) The bears are starting to get big bear bars closing near the low and 2) The bull bars have weak or no follow-through buying.

- This week was a bear breakout below the wedge bull flag and a second leg down from the March 29 high.

- We said that if the bears manage to get strong consecutive bear bars trading far below the March 3 high, the odds of a test of February low increases. This remains true.

- The bears want the Emini to reverse lower from a double top bear flag (February 2 and March 29). They then want a strong break below February 24 low and a measured move down to around 3600 based on the height of the 8-month trading range.

- The bulls want the rally from March 14 low to re-test the trend extreme, followed by a breakout to a new all-time high. The bulls expected at least a small 2nd leg sideways to up. However, the pullback so far is deep with big bear bars.

- The bulls hope that this is simply a deep pullback and wants a reversal higher from a higher low major trend reversal.

- The bulls need to start creating strong consecutive bull bars and prevent a strong breakout below the February low.

- The market has been in a trading range for 8 months. Lack of clarity is the hallmark of a trading range. The trading range is more likely to continue than a strong breakout from either direction.

- We have been saying that the rally from the March 14 low to March 29 high was likely a bull leg within a trading range, and not the start of the bull trend.

- Similarly, as strong as the current pullback is, odds are it is a bear leg within the trading range, not the start of the bear trend.

- We will likely see traders BLSH (Buy Low Sell High) at the extremes of the trading range.

- Al said that the Emini has been oscillating around 4,400 for 9 months. That price might well end up being the middle of the trading range. Since the top of the range is about 400 points higher, the bottom could be 400 points lower. That is below the February low and around the 4,000 Big Round Number.

- If it gets there, traders will then wonder if the Emini might fall for a measured move down from the February/March double top. That would fill the gap above the March 2021 high on the monthly chart.

- Since Friday was a consecutive big bear bar closing near the low, odds slightly favor at least slightly lower prices on Monday. It may even gap down on Monday. Remember that small gaps usually close early.

- The bulls will need at least a strong reversal bar or a micro double bottom with follow-through buying before they would be willing to buy aggressively.

- Traders will be monitoring whether this is a sell vacuum test of the February low and buyers appear below, or if the bears continue to get strong consecutive bear bars and a breakout below February low.

Trading room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Thank you Al for your insights!

Andrew – I love your reports. TY for all of your effort. Do you think there will be buyers at the Mar 14 low? Seems like there would be bears waiting to get out breakeven at that price. Thanks again.

Dear Martin, thank you for your continuous support..

These are just my opinion, and I’m rattling them off at 5am before I go to bed..

1) I think its possible.. we have to see if we get a gap down, and then an even sharper sell off to test Feb low – which is possible.

2) If it does, will it reverse up like Jan 24th or Feb 24th into a bull reversal bar?

3) If it does, bulls will have a reversal bar.

4) If bulls get that, and there are good follow through buying with good buying pressure, and the selling stalls, odds are good that bears who sold the double top bear flag (March 29) will take profits, and traders buy the TR low.

5) Does it mean it will go straight up to the high? Maybe not.

6) It may bounce, maybe make a lower high, or even near March 29 high and we will then have a wedge bear flag.

7) Sellers will then return again if the buying stalls around those levels.

Take note that Macron won, and that may mean a positive European market? Not sure.. remains to be seen.. monitor day to day and see how it plays out.

Follow on the day to day market update from Brad.

Alright, off to bed soon for me. Have a blessed week ahead Martin!

Best Regards,

Andrew

Hi Andrew and Al !

Thank you for your analysis! I trade options and would like to know your opinion about time duration for Buying Put for SPY – if expiration in 2 weeks is enough time for bears to test February 24 low? And thinking about low probability market fall – is it ok to buy a Put with expiration in 2 months (or 3 months)? What delta would be better?

Best regards,

Murat

Dear Murat,

A good day to you.. thanks for going through the report.

Unfortunately I do not make trade recommendations here nor anywhere on the website..

Furthermore, I trade futures, and not options so I would not be the right person to ask this question anyway.. 🙂

Hope you find the answers you are looking for.

Best Regards,

Andrew

Andrew wrote a great report. I have some additional thoughts. The bulls made 3 exceptionally strong attempts to resume the bull trend (1/24/2/24/3/14). When the market tries hard to go one way and fails, it often goes the other way.

The past 2 days formed a big enough surprise for traders to expect at least a small 2nd leg sideways to down. The Emini might go sideways until the May 4 FOMC meeting and then decide on the next move.

There are consecutive big bear bars closing near their lows and the 2nd bar has a body completely below that EMA. There is a 60% chance of some kind of a measured move down, which means a test of the March 24 low.

The bulls will try to get a double bottom higher low there. They will try hard to prevent the market from breaking below the February 24 low, where most bulls will give up.

It is important to note that a break below a bottom generally has a 50% chance of failing and reversing up again. Here, the probability of at least a couple legs down would be 60%, given the 3 strong reversals up.

A break below that low will probably lead to a break below 4,000 and a test of the gap below the April 2021 low on the monthly chart, which would close a monthly gap.

The Emini has been oscillating around 4,000 for 9 months. It therefore could end up as the middle of the trading range. Since the high of the 9-month range is 500 points above, the bottom could be 500 points below, which would be around 3,900.

On the monthly chart, I mentioned several times that February low did not quite reach the 20-month EMA. I said that many traders would conclude that the average was not yet tested. I said that it increased the chance of the Emini going sideways to down until there is a low at least minimally below that average. That is one of the forces behind the current selloff.

Can the selloff on the weekly chart from the head and shoulders top lead to a bear trend? It might on the daily chart, and the selloff might test the bottom of the bull channel on the weekly chart (a parallel from the 2/19/20 high and the 1/4/21, anchored at the 3/23/20 low is around 3800), but it would probably not go much lower.

The bull trend on the monthly chart has been so strong to make a bear trend on the monthly chart unlikely. This selloff should be a minor reversal on the monthly chart, which means the selloff will probably not go much below 3800, if it gets that far.

The bears would have a better chance of a bear trend on the monthly chart after a test of the all-time high. Remember, I have said many times that the Emini should enter a trading range for about a decade within the next few years, but picking the exact high is impossible. It is always better to bet on at least one more new high. The trading will probably have at least a couple 30 – 50% corrections, like the trading ranges in the 2000’s and in the 1970’s.

Selloffs often get drawn to certain percentages down. For example, many traders with cash like to wait for a 10 or 20% correction before buying. A selloff to 4,000 would be a 20% correction and a test of a Big Round Number. Therefore, that is additional support around 4,000.

At the moment, the odds favor a test of that gap below the April 2021 low before there is a new high. But another strong reversal up would flip the odds in favor of a new high.

Trading ranges always are most bearish near the low and most bullish near the high. Yet, smart traders are always looking to buy low and sell high until there is a strong break in either direction.

Last week was a strong breakout. The odds favor a test of the next support, which is at the March and February lows. A couple consecutive closes below the February low should lead to a test below 4,000.

Many stocks have already fallen below their pre-pandemic highs. The bears want the major averages to do that over the next couple months. While the current selloff should trade below the February low, the odds are against it continuing down to the February 2020 pre-pandemic high.

Dear Al, thank you very much for the insight..

Take care and wishing you and your family a blessed week ahead!

Best Regards,

Andrew

When there is a dramatic move, option prices go up. There is an increased risk of the option sellers losing money, and they therefore charge a greatly inflated premium. A bear therefore would not buy puts immediately after a big selloff. He would either buy put spreads or wait for a bounce and then buy put spreads.

After a huge move, option premiums typically remain high for at least a couple weeks. Therefore, anyone trading options should be selling premium. If someone buys puts, he should also sell puts. The easiest structure is a buying a put spread.

It is probably better to wait for at least a 50 – 100 point bounce first. Option premiums will also be high going into the 5/4/22 FOMC meeting. The Fed might do something it has not done in years (raise rates 1/2%), which greatly increases the uncertainty of the market’s reaction.

Whenever something is uncertain, always assume that there is a 50% chance that the outcome was more than totally discounted ahead of the announcement. Therefore, news event that appears bearish could lead to a sharp rally.

You can see that balance by looking at the option’s delta. It is basically the probability of the option expiring at or in the money. The delta of the ATM put and call for any expiration is usually close to 50%. For example, the SPY is around 426, and the delta for both the May 22 426 put and the call are near 0.50, which means there is about a 50% chance that the SPY will be above or below that price on expiration.

The theta of both is high. That is the time decay, and it reflects the increased uncertainty and greater risk that the option sellers are taking by selling options. It means options are expensive, and option traders should be short some options in any option position that they take. The easiest structure is a spread, where you buy one option and sell an out of the money option, which offsets a lot of the risk of time decay and volatility.