Market Overview: Bitcoin Futures

Bitcoin futures strong bull breakout and test of 35k. The price is up 14.38% respecting last week’s close, and it is trying to do a bull breakout of a Breakout Mode Pattern. Now, there are two consecutive strong bull signal bars on the weekly chart and traders wonder if this is going to lead to a bull swing, or into a failed bull breakout and hence, lead to a bear swing. The Bulls want to break above the Head and Shoulders Bottom (HSB) Measured Move, and then trade towards the 2022 high. Bears want a bear bar closing near its low next week, and if they get that, they will bet that the price will draw a swing down to the March low.

Tuesday is the last trading day of October. So far, Bitcoin is a huge bull breakout bar.

Bitcoin futures

The Weekly chart of Bitcoin futures

Past: Support and Resistances

- The price started a Strong Bear Channel:

- Bear Flag’s Breakout Point.

- Major Lower High.

- Then, failed a Breakout Below a Bear Flag and Reversed up, forming a HSB (Head and Shoulder Bottom) pattern, that broke up:

- 2022 Low.

- 2022s Major Higher Low.

- 2023 Major Higher Low.

- HSB Breakout Point

- HSB Measured Move around $35750.

- Lately, the price has been sideways creating a Double Top and a Double Bottom, which is a Trading Range, and because the Trading Range is not wide, it is also a Breakout Mode Pattern.

- Trading Range High.

- Trading Range Low.

Present: Market Cycle

Trading Ranges tend to break when they are exhausted (by a contraction) if they are wide, and with a strong Breakout, when they are small like this one. A small Trading Range is just a Breakout Mode Pattern. The Bulls and Bears both have a 50% chance of success when there is a Breakout Mode Pattern. That means that the market is neutral.

Now, there are two strong consecutive bull bars, Traders should expect, at least, another leg sideways to up, even if this bull breakout is going to fail.

Future: Inertia

- A bull breakout of a Breakout Mode Pattern has a 50% chance of leading to a swing trade, which means that the price might go towards $47000.

- A bull breakout of a Breakout Mode Pattern has a 50% of failing and lead to a bear swing trade.

Trading

During the prior report, we have said that bulls want a relatively strong bull breakout above the Breakout Mode Pattern high. This is not high enough to think that the bull breakout has a high probability of success (60% to 70%), however, until bulls are not proven wrong, Traders should look to the upside.

- Bulls:

- Some Bulls bought above the past week’s bull signal bar.

- Others, bought above the 2023 high.

- Some traders will buy above this week’s bull bar, which is the first bull bar that closed above the Breakout Mode Pattern.

Most bulls are placing their stops below the Breakout Mode Pattern, however, placing the stop loss below this week’s low is also ok.

- Bears:

- They see a Wedge Top, and they think that there were trapped bulls at the prior resistances, where gaps were closed.

- But they would rather not sell while the price is rising, and they will either wait a bear signal bar for a failed bull breakout setup or just place a sell stop order below the Breakout Mode Pattern.

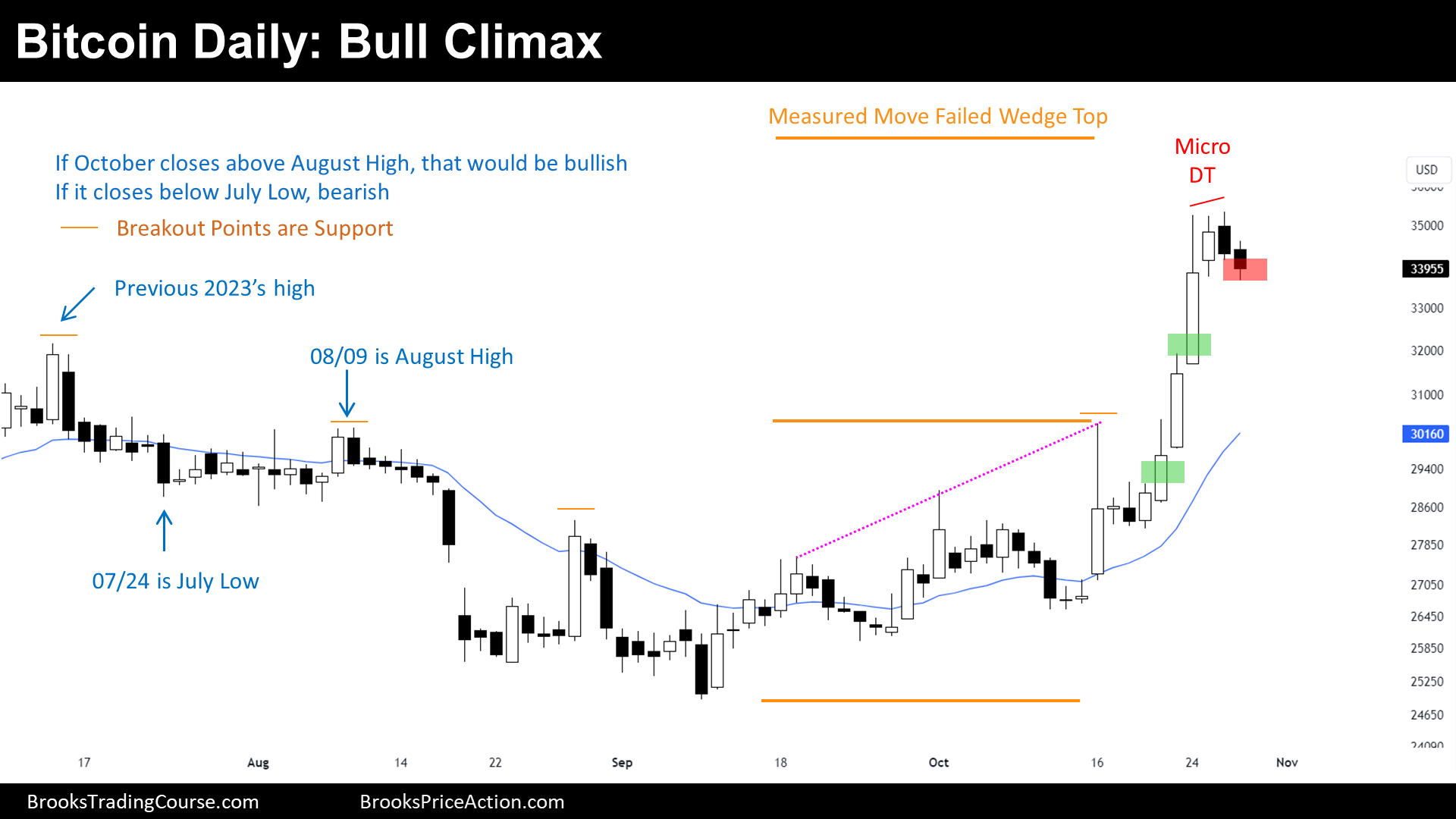

The Daily chart of Bitcoin futures

Past: Support and Resistances

- There was a bear breakout of a Tight Trading Range:

- 2023 high.

- August High.

- Then, the price entered a Trading Range:

- Trading Range High.

- Trading Range Low.

- During the Trading Range, did three legs up, forming a Wedge Top:

- Wedge Top High.

- Finally, the price started a Strong Bull Breakout and now, all levels mentioned above, are support.

Present: Market Cycle

- The price is in a strong bull breakout.

- Every bull breakout, it is also a bull climax.

- After a large 5 bull micro channel, the price did a micro double top, followed by a bear signal bar.

- The price is far from the 20 exponential moving average.

Future: Inertia

A strong bull spike is usually followed by a bull channel. But we do know the context on the weekly chart: A Breakout Mode Pattern has only a 50% chance of success, and moreover, there is a Wedge Top.

Trading

Traders will look to buy an intraday pullback on Tuesday, that is when is often forms the low or higher low of the week during bull cycles. If by the end of Tuesday, the intraday Price Action is bearish, then Traders will expect more downside to come.

- Bulls:

- They probably took profits, at least partial, below the micro double top.

- Most should wait to enter, or reenter, until it is proved that bears are weak and until the price is nearer the 20 Exponential Moving Average.

- Buying far from the 20 Exponential Moving Average is risky, and Traders doing that are Trading with a tiny position size, expecting to scale in lower.

- Bears:

- They sold below the micro double top and bear signal bar. They think that this is a bull climax and that their chances of success are above 40%, and the potential reward is twice their risk.

Market analysis reports archive

You can access all the weekend reports on the Market Analysis page.

I have a question: Why is the HSB MM at 44k? The MM is twice as much as the bottom of head to top of neck, right? My measurement is 35k.

Hola Elijah! You are right, my fault. I measured the HSB directly from the Powerpoint template, forgetting that it was a logarithmic chart.

I will update during the day.

Wedge Top at a Measured Move target, first breakout of a Breakout Mode Pattern… sounds like a good Price Action Cocktail.

But if october closes above August high, I expect supports will work on the daily chart.

Thank you Elijah wishing you a great week ahead