Markets are either in trends or trading ranges, and trends can be strong or weak. When they are strong, the market is moving clearly and quickly to a new price. There are several large trend bars or a series of ordinary trend bars, and there is little overlap between adjacent bars. This is the spike phase of the trend. The market then transitions into a weaker trend, called a channel, where there is evidence of two-sided trading, sometimes evidenced by more overlap between adjacent bars, prominent tails, pullbacks and trend bars in the opposite direction. Since the market spends most of its time in this phase of the market cycle, traders need to learn how to trade trend channels.

Eventually traders in the opposite direction become strong enough to control the market, and it evolves into a trading range. This is followed by a breakout in either direction and the process begins again.

Different trading strategies work better in certain market types. When the market is in a trend, traders stand to make more money from swing trading than from scalping. When it is in a trading range, most breakout attempts fail, so scalping usually is more profitable.

Get scalped

A scalp is a strategy in which the trader intends to take a quick profit. For example, if a trader bought a pullback in a bull trend in Apple when it was around $600, the trader might use a $1 profit-taking limit order while risking $1. Many traders would do this using an order cancel order (OCO), using a protective stop $1 below the entry price and a profit-taking limit order $1 above; once one order gets filled, the other is cancelled automatically.

When scalping, traders usually do not want to see a pullback. They often will allow one pullback lasting for a single bar, but if the pullback follows a strong signal bar against their trade, they usually will exit and not wait for their stops to get hit. Because the reward is small on scalp trades — usually about the size of the risk — traders should scalp only when they are highly confident that the trade will be successful.

To be profitable as scalpers, they need a high probability of success on each trade when the reward is relatively small. Because the risk also is relatively small, most scalpers trade larger positions when they scalp than when they swing trade.

Swinging the market

Swing traders look for a profit that is at least twice as large as their risk. That usually means they will allow the market to pull back for several bars, even after the trade goes a considerable distance to their target.

Pure swing trading means that traders do not exit the position until there is a signal in the opposite direction. If one triggers, they will exit and then may reverse.

As the trend progresses, swing traders trail their protective stops. For example, in a bull trend, after the market pulls back and then makes a new high, many traders move their protective stops to just below the low of the most recent pullback. Eventually, the protective stops can be so far above their entry price that they still will have a sizable profit if they get stopped out.

During the spike (strong) phase of a trend, traders should trade only in the direction of the trend and look for any reason to enter. For example, in a bull spike, traders will buy at the market, at the close of every bull trend bar, below the low of the prior bar and on the close of any bear bar (expecting any attempt to reverse the trend to be brief and unsuccessful).

Understanding channels

During a trading range, traders scalp by buying near the bottom and selling near the top, both to initiate positions and take profits.

Channels are weak trends and can behave more like a spike or a trading range. When they are tight and steep with only small and brief pullbacks, they are spikes on higher time frame charts and should be traded like strong trends.

In a steep bear channel with only small pullbacks, traders only should look to short. When a channel is broad with large swings made of pullbacks lasting 10 or more bars, and the slope is relatively flat, it essentially is trading a range. The broader and flatter it is, the more traders will trade in both directions, looking mostly for scalps, as they do in trading ranges. The tighter and steeper it is, the more inclined traders will be to trade in the direction of the trend.

Every type of market has characteristics that make it difficult to trade. The more the market resembles a trading range, the less certain that a breakout or a reversal will hold. The steeper the trend, the higher the probability of success, but the stop usually is farther away, increasing the risk; generally it is better to swing than to scalp.

For example, in a bull trend, traders usually will trail the stop below the most recent higher-low after every new high. This usually means that the size of the risk is greater, which is typically the case when the probability is higher, as it is in strong trends. Whenever the risk is greater, traders should reduce the size of their trade so that the total dollars at risk are not greater than on any other trade.

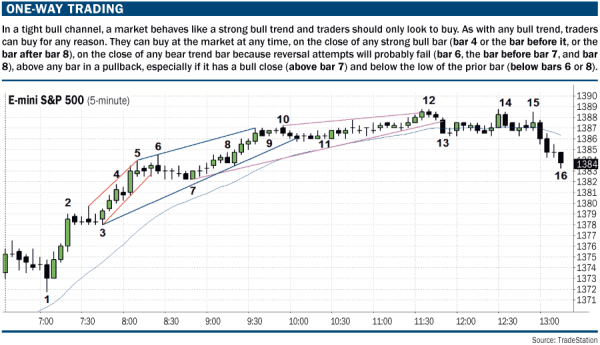

In “One-way trading” (above), the market gapped up on the open and then had three consecutive bull trend bars up to bar 2. The bars had big bodies and small tails, and there was little overlap. This bull spike was a strong trend. The market went sideways for several bars, alerting traders that a weaker bull trend (channel) was likely to follow. The three bull bars up to bar 4 had smaller bodies and the tails were more prominent. Although this was another bull spike, it was weaker; it followed a small pullback to bar 3 and its loss of momentum made it a channel. Bar 7 was another pullback, this time a small triangle (the three pushes down were the bar after bar 5, the second bar after bar 6 and the bar before bar 7).

Because the channel up from bar 3 to bar 6 was tight (no pullbacks), shorting below bar 6 probably would be a losing approach. Once bar 7 formed (a bull reversal bar after the three pushes down), and because the selling only resulted in the market falling two ticks below bar 6, the bull trend was likely to resume. The market continued higher in another tight bull channel up to bar 10. When a channel is as tight as this, usually it is simply a spike on a higher time frame chart. Traders should not be looking for shorts.

The bear inside bar at bar 12 was after about 20 sideways bars and at the top of a trading range. Because the market had evolved into a trading range, traders would look to sell high.

When buying in a strong bull channel, traders should shoot for a profit target at least twice as large as their initial risk, until the trend likely has ended and the market looks to be transitioning into a trading range. The market went sideways for about 15 bars after bar 10 and was therefore in a trading range. Many traders would have exited their longs below bar 12 because it was a bear bar at the top of a developing range. At that point, traders switched to trading-range trading. Some would have shorted below bar 12.

When swing trading in a bull trend, traders should consider putting their protective stops below the most recent higher-low. Because this often results in a bigger risk, traders need to reduce the size of the trade to make sure that the dollars at risk are no greater than on any other trade.

For example, for any long between bar 4 and bar 7 on “One-way trading,” the stop should be below bar 3. Once the market moved above the bar 6 high, traders would tighten their stops to below bar 7, the most recent higher-low. Some traders prefer to use a fixed number of ticks, such as two points, for their protective stops. However, the tighter the stop, the lower the probability of success. In strong trends, usually it is better to use a price action stop (below the most recent higher-low), even though the greater risk means that a trader would trade a smaller position.

Trends tend to weaken as they unfold. Traders can redraw the channel after each pullback and each reversal from a new high. The new channels tend to be flatter (with a shallower slope) and broader (with deeper pullbacks). Eventually, the pullbacks are deep enough that the channel has evolved into a trading range. Once there is a pullback below a bull trend line, lasting at least five to 10 bars, and reaches the moving average, traders begin to look for a major trend reversal. They want to see a test of the bull high and a reversal from there. As we can see in the chart, there was a lower-high major trend reversal below the bar 14 two-bar reversal. There then was a second entry short below the bar 15 double top for a swing down.

Changing priorities

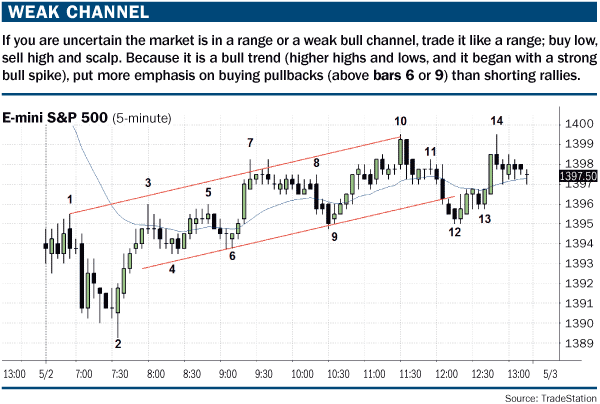

In “Weak channel” (below), there was a strong bull spike up to bar 3, but then the market went sideways to bar 6. At that point, traders were uncertain whether the market was still in a weak, broad bull channel, forming higher highs and lows or in a trading range. It does not matter because traders should trade broad channels and trading ranges the same, looking to buy low, sell high and scalp.

Because there was a strong bull spike up to bar 3, the market was likely to have follow-through buying for many bars, probably in the form of a bull channel. Because a bull channel is still a bull trend, traders should pay particular attention to pullbacks and then look for longs. In weak bull channels and trading ranges, buy signal bars around the bottom of the channel often appear weak.

As we can see in the chart, buying above bar 6 was a relatively easy long, but buying above bars 9 or 12 was less certain. Many traders would not have bought above bar 12, even though it was around the bottom of the channel, because it had a bear body and followed three strong bear bars. They might instead have waited for a second entry, especially one with a bull signal bar. Many would have bought above bar 13.

When scalping in a trading range or broad bull channel, traders should use a profit target that is about twice the size of their stop. However, if the setup looks strong enough to be confident that it will work, they can use a risk that is as large as their reward and still make money over time.

For example, a trader might use a two-point profit target and a two-point protective stop on all strong setups. Alternatively, a price-action stop may be used. If the trader bought above bar 9, the risk might be one tick below bar 9. The risk would be six ticks below the entry price. The trader might try to hold long for a reward that is twice as large as the risk, or about three points (12 ticks). As we can see in the chart, the market turned down at the bar 10 high, which was exactly 14 ticks above bar 9, and that is exactly where it had to go for traders to scalp out of their longs with 12 ticks of profit. This means that many traders did exactly that.

Shorting was more difficult in this channel. Some bears would have shorted below the bear reversal bar that formed three bars after bar 7, believing that the market was in a trading range and, therefore, that most breakout attempts would fail. (It was a reversal down from a high 2-buy setup and, therefore, a final flag reversal.) It was the third push up (bars 1 and 3 were the first two) and the market already had pullbacks lasting about five bars (bars 4 and 6).

The two-bar reversal at bar 10 was outside down, so traders were hesitant to short below its low. They might have been willing to look for shorts because it was around the top of the channel, and also it was a small wedge top with the two minor pushes up in the prior seven bars. Other traders would have waited for a second signal, such as shorting below the bear bar after bar 11. Some would have shorted on a limit order during bar 11 as it went above the high of the prior bar, expecting the market to form a second leg down from the wedge top, especially after the two strong bear bars down from bar 10.

Price-action trading remains one of the most direct forms of price analysis. Once you’ve become familiar with the various states of the market, it is a powerful and simple technique for exploiting moves in trends and channels.

This is based on an article from the September 01, 2012 issue of Futures magazine.