The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

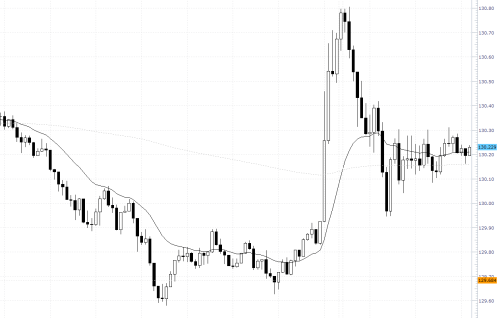

In this case, the swing up was following a classic HL MTR setup. It does not usually get this clean, at least for the markets I trade. So, the swing up was expected and somewhere in that swing up, it gave you reward many times your initial risk. Usually, when the risk at any point gets bigger than your usual trade (even on notional profits), you are expected to book at least partial profits. Near the end of the swing up, you shouldn't have been holding more than 25% of your initial position anyway.

The breakout on the buy swing was climactic, and when you have a climax late in a trend, it is usually an exhaustion move and not a breakout into an even stronger trend. Adding to that the parabolic wedge I am seeing, I would have gotten out below the second strong bear bar following the climactic breakout. Somewhere around the 4th bear bar, I would have gone shorted thinking that the market turned always in short and the second leg down that followed would have met or at least went close to the Leg 1= Leg 2 measured move down.

Big up, Big down creates confusion and trading range and that is what followed. I know, easier said than done but that's what the trades should have ideally looked like, in my humble opinion.

If you want, you can go back to the videos and refer to the Always In section. In these kinds of whipsaw movement as you call it, keeping the Always In direction concept helps very much.

Hopefully, that helps a little. Do ask follow up questions if you have any doubts. I am sure, someone would help you out, if not me. As you can see, I am still relatively a beginner and might have missed out on things the experienced traders here would not.

Thank you for your detailed answer. I was indeed talking about what to do AFTER the whipsaw and your reply about a developing trading range seems to make sense.

Difficult to trade during these days.

I was indeed talking about what to do AFTER the whipsaw and your reply about a developing trading range seems to make sense.

Big up Big down creates confusion and TR. That TR eventually evolves into some other pattern(TTR and BO mode for example). You have to trade accordingly.

Difficult to trade during these days.

If you're trading just one instrument, yes. You'll just have to wait on the sidelines until a tradable pattern appears where you can structure a reasonable trade.

Personally, I am enjoying all the phases of the market. I am constantly learning something. Once you get hooked on PA, there is no looking back it seems.