Market Overview: EURUSD Forex

The EURUSD Forex November candlestick was a EURUSD strong bull breakout above an inside bar. It closed back above the 7-year trading range low. The bulls need to break far above the major bear trend line and 20-month exponential moving average to convince traders that a reversal higher is underway. The bears want a reversal lower from a lower high around the major bear trend line or the 20-month exponential moving average.

EURUSD Forex market

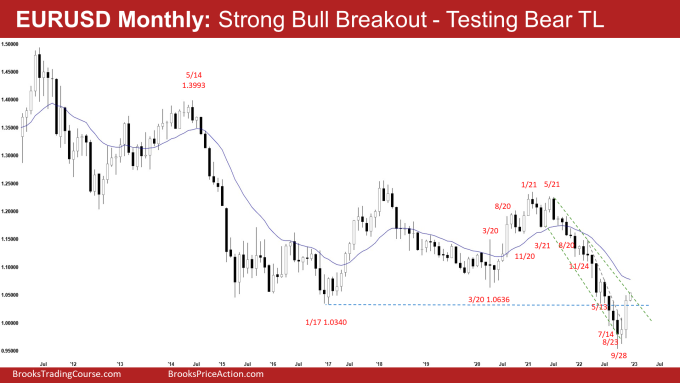

The Monthly EURUSD Forex chart

- The November monthly EURUSD candlestick was a big bull bar closing near its high.

- Last month, we said that the trend channel line overshoot (September) and parabolic wedge bottom (Nov 24, May 13 and Sept 28) increase the odds of at least a small sideways to up pullback lasting a few months. It may have already started in October.

- November candlestick broke far above the minor bear trend line and the bull inside bar. It closed above the high of the prior 3 candlesticks.

- The bulls want a failed breakout below the 7-year trading range. They got a reversal up from a trend channel line overshoot, parabolic wedge (Nov 24, May 13 and Sept 28) and micro wedge (July, Aug, September).

- November was the first consecutive bull bar since May 2021 and closed back above the 7-year trading range low.

- Because of the strong bull breakout, odds slightly favor the EURUSD to trade at least a little higher, which it has done so far.

- The next target for the bulls is the 20-month exponential moving average which is around the May/June high.

- The bulls need to break far above the major bear trend line and 20-month exponential moving average to convince traders that a reversal higher is underway.

- The bears want a reversal lower from a lower high around the major bear trend line, or the 20-month exponential moving average.

- They want a retest of the September low followed by a breakout and a measured move down based on the height of the 7-year trading range, which will take them to the year 2000 low.

- While the selloff since June 2021 was very strong, it has also lasted a long time and is climactic.

- The trend channel line overshoot (September) and parabolic wedge bottom (Nov 24, May 13 and Sept 28), increase the odds of at least a small sideways to up pullback lasting a few months. The pullback started in October.

- For now, odds slightly favor the EURUSD to trade at least slightly higher. Traders will see if the bulls can create a decent follow-through bull bar in December.

- December is the last month of the year. Its close will affect the yearly candlestick. Bulls want a close above the middle of the bar around 1.0515 while bears want a close below it.

- The midpoint of the year may be a magnet at the end of the month.

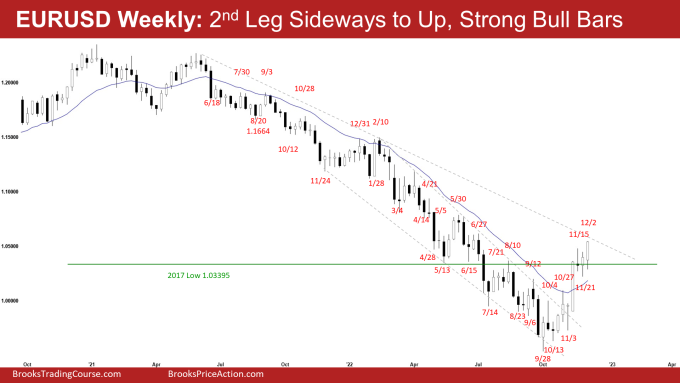

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bull bar closing near its high.

- Last week, we said that odds continue to slightly favor the EURUSD to trade at least a little higher.

- The bulls got a follow-through bull bar closing above the prior two candlesticks.

- They hope that the 10-week trading range (July to Sept) is the final flag of the selloff.

- Bulls got a reversal higher from a wedge bottom (May 13, July 14 and Sept 28) and a trend channel line overshoot.

- They want a failed breakout below the 7-year trading range. This week was a consecutive close above the 7-year trading range low.

- Since the September low, the bulls have created bigger bull bodies with closes near their highs with follow-through buying, while the bear bars are weak with no follow-through selling.

- The move-up is in a tight bull channel. Odds slightly favor a larger second leg sideways to up after a pullback.

- The bulls hope that the market is now Always In Long.

- They need to break far above the major bear trend line to increase the odds that the selloff has ended.

- The bears want a reversal lower from a lower high around the major bear trend line or around the May high.

- They then want a retest of the September low followed by a strong breakout and a measured move down based on the height of the 7-year trading range. This will take them to the year 2000 low.

- The bears hope the EURUSD is forming a parabolic wedge bear flag (Oct 4, Nov 15, and Dec 2).

- If next week trades higher, they want the EURUSD to reverse lower from a double top bear flag (with Jun 27 or May 30 high) or around the major bear trend line.

- Because of the strong move-up, the bears will need a strong reversal bar, or at least a micro double top before they would be willing to sell more aggressively.

- Since this week was a bull bar closing near its high, it is a good buy signal bar for next week. It is a weak sell signal bar.

- For now, odds continue to slightly favor the EURUSD to trade at least a little higher.

- Next week, traders will see if the bulls get a consecutive bull bar breaking far above the major bear trend line or if the EURUSD trades higher but reverses into a bear bar or has a long tail above.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.